Vitalik Buterin Outlines Helios’s Role In Multi-Chain Ethereum Scaling

Highlights

- Vitalik Buterin highlights Helios for Ethereum scalability, aiming for universal light client integration.

- Ethereum's Helios project targets efficient rollup interoperability across Layer 2 platforms like Optimism.

- Ethereum plans gas fee optimization to increase TPS by 1.5x, competing with faster blockchains.

Ethereum co-founder Vitalik Buterin has outlined key steps for Ethereum’s scaling, emphasizing the role of Helios, a multichain light client.

Following ETH’s path toward scalability and decentralization, Vitalik Buterin noted that implementing Helios and similar solutions to mobile and desktop wallets is crucial for light client verification on Ethereum’s Layer 1 and Layer 2 networks.

Vitalik Buterin Outlines Helios’s Role

In his recent posts on X (formerly Twitter), Buterin emphasized the need to add Helios or other light clients into user wallets. This integration would allow users to check the validity of transactions without running full nodes, which is important given that Ethereum has plans for an ecosystem with thousands of rollups. A productive, verifiable light client is deemed essential for the sustainability of the ecosystem and users’ security.

Noah Citron, a developer associated with Helios, elaborated on the project’s goals of building a multichain light client. Citron pointed out that rollup operators currently require a full node for every chain they are engaged with, which is a problem when the number of chains increases.

To this end, Helios plans to optimize this process by offering a highly effective light client for ETH’s Layer 2 solutions which include Optimism, Base, Unichain and other platforms that are built on OP Stack.

Rollup Interoperability & Cross-Chain Communication

Rollup interoperability is a major focus for ETH as it scales. Some current proposals such as Optimism’s Superchain and zkSync’s Elastic Chain have suggested that rollups can be interconnected. According to Citron, these solutions will rely on secure light clients via which rollup operators will be able to validate cross-chain messages.

Helios’s current support for the OP Stack is a step in that direction. Through signed sequencer pre-confirmations, Helios can co-ordinate the data across the different rollups in the Superchain ecosystem, thereby easing the burden on rollup operators.

Citron added that Helios will be implemented on other platforms, so users can manage different Layer 2 solutions without setting up complex full-node wallets.

Vitalik Buterin’s Proposal to Optimize Gas Fees

Ethereum co-founder Vitalik Buterin also revealed that there are ongoing works to enhance the gas fee system of Ethereum to enhance the speed of transactions. This upgrade would increase Ethereum’s TPS by 1.5, which could be useful in helping the network to go up against faster blockchains like Solana.

As highlighted by Buterin, this change would not threaten the security of ETH hence making it a suitable platform for developers and users.

This emphasis on transaction speed is in line with ETH’s objective of reducing fees for users whilst preserving decentralisation and security. If those changes are to be adopted, it could help make ETH more approachable and efficient.

ETH Price Trend

The focus on scaling has contributed to varied sentiment in the Ethereum market. Analyst Mando CT recently described Ethereum as being in a “buy zone” from a long-term investment perspective, citing Ethereum’s historical influence on the wider cryptocurrency market.

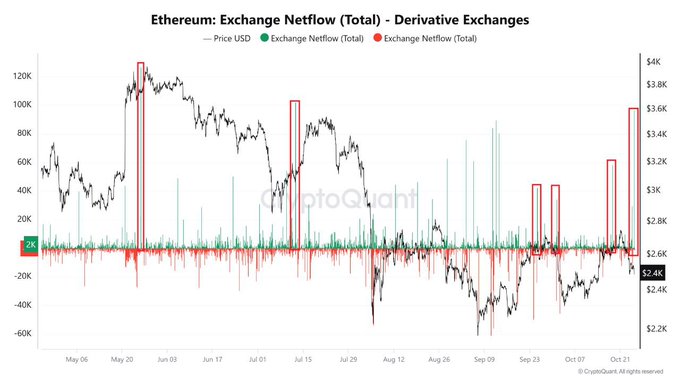

Meanwhile, technical analyst Kyledoops observed a 96,000 ETH inflow into derivatives exchanges on October 24, a move that could trigger increased market activity. Such inflows are often seen as indicators of potential price volatility, though the current ETH price remains stable around $2,550.

Source: X

Additionally, Ethereum whales have continued to offload large quantities of ETH, with one early ICO participant recently transferring 3,000 ETH to Kraken. This trend, coupled with the exchange inflows, has led analysts to speculate on possible price corrections or significant shifts in the ETH market. Despite this, Buterin’s outlined steps to scale Ethereum could reassure investors about the network’s long-term growth potential.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs