Waller Signals December Fed Rate Cut Despite Powell’s “No More Cuts” Stance

Highlights

- Federal Reserve Governor Christopher Waller called for another rate cut in December.

- This comes as Fed Chair Jerome Powell insists the easing cycle may be over.

- Hawks like Lorie Logan and Beth Hammack also urge caution on further cuts.

Governor Christopher Waller has called for another Fed rate cut in December. This comes as Chair Jerome Powell insists the cycle of monetary easing may have reached its end.

Waller Pushes for December Policy Easing

According to Reuters, Federal Reserve Governor Christopher Waller has called for one last cut by December, emphasizing the need to act swiftly to protect the job market.

“The biggest concern we have right now is the labor market,” Waller said in an interview. “We know inflation is coming down, and that’s why I continue to support a policy rate cut in December, because all the data are pointing that way.”

His remarks suggest that Waller believes inflation is cooling fast enough to justify easing. This comes as Powell maintains that rates should stay elevated to avoid reigniting price pressures.

Powell admitted after the October FOMC meeting that although inflation is still “somewhat elevated,” the U.S. labour market has started to improve. However, he maintained that the overall state of the economy hasn’t changed enough to warrant another cut just yet.

Powell added that new tariffs and rising input costs make price stability more challenging. This highlights the necessity for the Fed to carefully strike a balance between controlling inflation and protecting jobs.

Recent CPI data also supports the case for another Fed rate cut. The Bureau of Labor Statistics reported a 3% year-on-year increase in consumer prices for September, slightly below the 3.1% forecast. Monthly inflation rose 0.3%, also undershooting expectations.

Fed Divided on the Next Rate Cut Move

While the Fed typically lowers interest rates to spur lending and job growth, it faces a delicate situation. Powell hinted that inflation pressures, outside of tariff impacts, are easing toward the Fed’s 2% target.

Meanwhile, several Fed officials remain hesitant. Dallas Fed President Lorie Logan said she saw “no clear need” for another cut unless inflation falls faster than projected or the job market weakens significantly. Cleveland Fed President Beth Hammack echoed this view, stressing the need to maintain some level of restriction to keep inflation anchored.

In contrast, Waller and other dovish members argue that waiting too long could risk deeper damage to the labor market, which has already shown signs of strain.

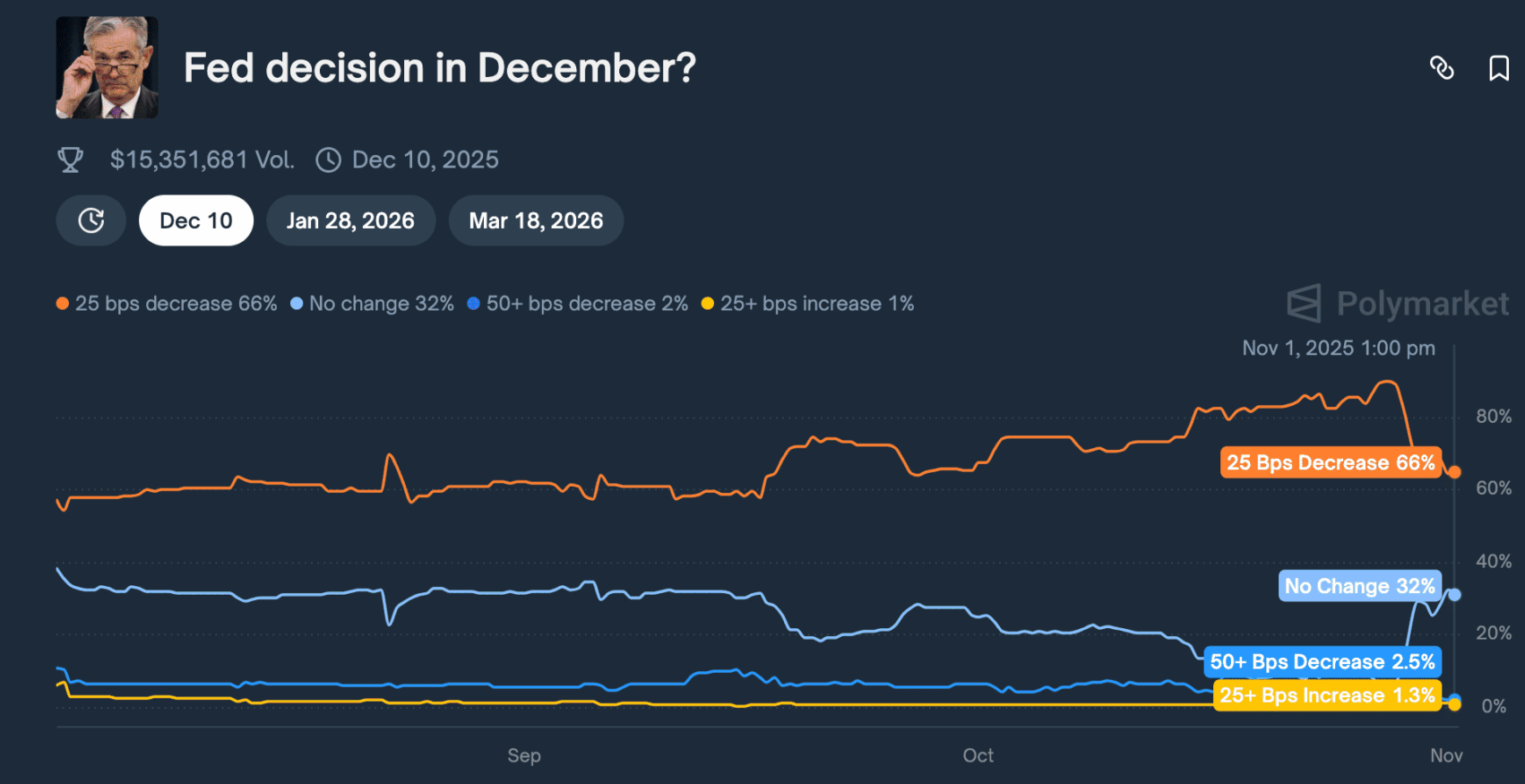

The FOMC committee voted 10–2 this week to lower rates to the 3.75%–4.00% range. Powell made it clear that another move in December was “not a foregone conclusion.” His warning trimmed near-certain market expectations of another cut.

Meanwhile, traders still price in roughly 66% odds of one, according to Polymarket data.

Atlanta Fed President Raphael Bostic supported Powell’s caution, saying the chair’s remarks accurately reflected the deep divide within the committee. “It’s important that the public understands how wide the range of views actually is,” Bostic noted.

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise