Why Analyst Predicts XRP Price Could Hit $95 Soon?

Highlights

- Crypto analyst predicts that the XRP price will reach $95 soon.

- He explained that this will happen based on the similarity between XRP price's movement and that of Netflix's NFLX stock.

- The analyst advised the XRP community not to worry about external factors like the Ripple SEC appeal.

Crypto analyst Egrag Crypto has predicted that the XRP price can reach $95 soon. This prediction has raised eyebrows considering the crypto’s current price. However, the analyst explained why he is confident that XRP can reach this price target.

Why XRP Price Can Reach $95 Soon

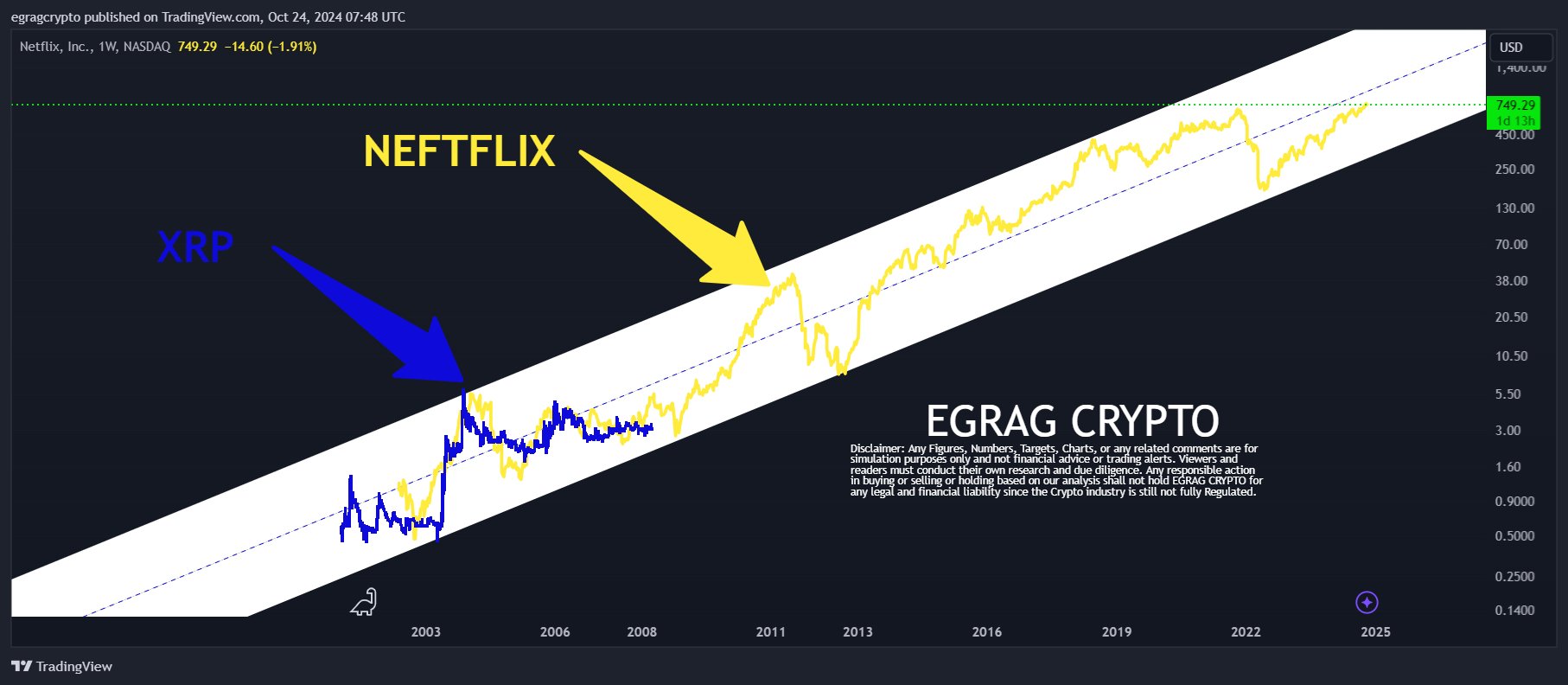

Egrag Crypto predicted in an X post that the crypto could reach $95 based on his comparison with the crypto to Netflix’s NFLX stock. He suggested that the XRP price could follow a similar trajectory as NFLX and experience exponential growth. NFLX is currently trading at $754, meaning this is a price level that XRP could reach at some point.

The analyst shared an accompanying chart in which he tracked XRP’s price movement with the time when Netflix’s stock began trading. The chart showed some similarities between the price surge NFLX enjoyed between 2002 and 2004 and the one the XRP price recorded between 2017 and 2018.

Based on the similarities between their price movements, the crypto is at the point where it could enjoy a price breakout to as high as $95, similar to the parabolic rally that the stock recorded between 2008 and 2011.

Egrag Crypto indicated that patience is key while waiting for XRP’s exponential growth. He alluded to the fact that many crypto participants look to be caught up in day-trading meme coins and chasing quick profits However, the analyst believes that is not a “winning long-term strategy.”

According to him, the “real play” is to buy and hold the crypto and then let the exponential growth do its thing. He again cited the Netflix stock as an explanation of why patience is key, adding that the same principles apply to the coin.

Holders Need To Stop Worrying About External Factors

Egarg advised XRP holders to “stay steady” and stop stressing over XRP price swings, regulations, the US SEC, or even the US presidential race between Kamala Harris and Donald Trump. The analyst remarked that none of these factors will “stop the evolution of money that XRP represents.”

Ripple’s long-running legal battle against the US SEC is one of the major factors that the XRP community continues to believe is holding the XRP price from experiencing this exponential growth.

If so, then the coin’s price could continue to remain stagnant in the meantime amid the Ripple SEC appeal. Based on the timeline provided by the Ripple CLO Stuart Alderoty, the appeal could last until 2026. However, a CoinGape market analysis predicts that the XRP price could hit $100 within the next 1 to 5 years.

At the time of writing, the XRP price is trading at around $0.51, down over 1% in the last 24 hours. Trading volume is up almost 20%, with $1.14 billion traded during this period.

- Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga

- Arthur Hayes Issues Advice To ZEC Holders Amid Push For Crypto Privacy

- Market Structure Bill: Senate Ag Committee Targets Early December Markup

- Breaking: U.S. SEC Unveils ‘Token Taxonomy’ To Help Classify Crypto Assets

- Winklevoss Twins Unveil Zcash Treasury Company Cypherpunk, Eyes 5% ZEC Supply

- Sui Price Set for a $5 After Launch of USDsui Native Stablecoin

- Ethereum Price Holds Above $3,400: Can Bulls Defend This Key Support?

- After a 108,000% Burn Spike, Will Shiba Inu Price Hit $0.000016 Next?

- Bitcoin Price Eyes Fresh Rally as U.S Government Reopening Sparks Risk-On Mood

- Pi Network Price Eyes Rally to $0.5 as Top Whale Holdings Nears 375M Tokens

- When Will Solana Price Reach $300: Prediction and Analysis