Why Bitcoin Price Could Revisit $63k Before A New ATH

Highlights

- Analyst Justin Bennett predicts that the Bitcoin price could retrace to $63,000 to wipe out last week's leveraged buyers.

- Crypto analyst CrediBULL Crypto also warned that Bitcoin's open interest has reached the same level which preceded its last drop from $70,000 to $49,000.

- Crypto analyst Crypto Con advised market participants to position themselves for what could be the last leg of the bull run.

Crypto analyst Justin Bennett has predicted that the Bitcoin price could retrace to $63,000 following the recent market rally. This prediction comes as the flagship crypto targets a new all-time high (ATH) following a weekly high of around $69,000, its highest level since late July.

Why Bitcoin Price Could Retrace $63,000

Bennett stated in an X post that he wouldn’t be surprised to see BTC wipe out this week’s leveraged buyers with the restest of the month open at around $63,000. He made this statement while highlighting a potential rising wedge developing alongside a bearish divergence. His accompanying chart showed that BTC could drop to around $63,276.

The analyst also noted that this week’s Bitcoin price rally was primarily driven by the perpetual market, which he claimed is not “conducive” for a sustainable breakout, especially with the open interest (OI) near its late July highs.

Crypto analyst CrediBULL Crypto also warned about the spike in open interest and suggested that a price correction was imminent. He noted that the OI has officially surpassed the level it was at before the last BTC price drop from $70,ooo to $49,000.

Like Bennett, CredibBULL Crypto had earlier in the week warned that a price correction was imminent based on his claims that the derivatives market is what is driving the recent market rally. The analyst suggested there could still be a Bitcoin price crash to $50,000 before it surpasses its current ATH of $73,000.

However, amid these bearish predictions, market experts have provided a bullish outlook for BTC. As to short-term targets, Bitwise CIO Matt Hougan predicted that BTC could reach a new ATH before the US election. Standard Chartered also predicted that the flagship crypto will surpass $73,000 before the November 5 US presidential elections.

The Bull Run Is About To Kick Into Full Gear

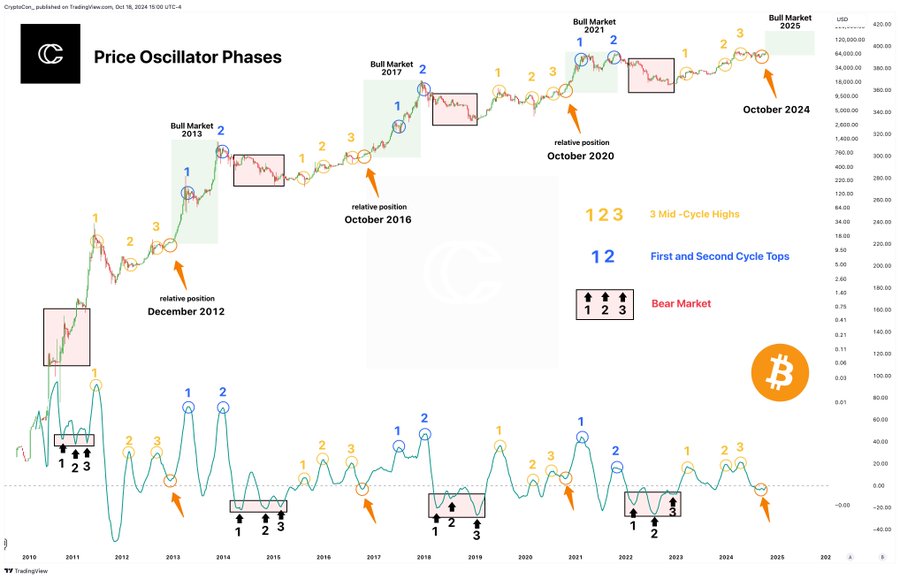

Crypto analyst CryptoCon indicated in a recent X post that the Bitcoin bull is about to kick into full gear. The analyst also suggested that the Bitcoin price will unlikely retrace to as low as $40,000 again, as some might expect. He also explained that the bull run means new ATHs and a “year of great price action for all crypto.”

CryptoCon is confident that the Bitcoin bull run is almost here because of the Price Oscillator, which he said confirms that BTC has completed all of the local highs of the mid-cycle. In line with this, he reaffirmed that up next is the bull market and the “first and final cycle tops.” His accompanying chart showed that the BTC price could reach a market top of $120,000 sometime next year.

Real Vision’s Chief crypto analyst Jamie Coutts predicted that the Bitcoin price could reach $110,000 between April 2025 and July 2025. He claimed this will happen as the global money supply rises to $500 trillion.

Matt Hougan is also confident that the BTC price will reach six figures. He cited factors like the US election, Spot Bitcoin ETFs, rate cuts, and increased demand for the flagship crypto among whales as what will drive this price surge.

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch