Why Bitcoin Price Is Down Today?

Highlights

- Bitcoin price failed to recovered from a pullback after reports of Mt. Gox's massive BTC move.

- Whales sold BTC and didn't purchased considering US PCE inflation data and crypto market expiry due May 31.

- BTC recorded $25 million in long positions liquidation.

- BTC price currently trades at $68,381.

Bitcoin price saw a pullback today after reports of Mt. Gox’s massive BTC move to an unknown wallet address triggered a broader market selloff. Mt Gox later denied claims of selling $10 billion worth of Bitcoin and Bitcoin Cash reserves for making repayments to creditors. However, the crypto market failed to rebound despite denial by a former executive.

Why Bitcoin Price Is Going Down Today

Mark Karpeles, former CEO of Mt. Gox, said “Everything is fine with MtGox. The trustee is moving coins to a different wallet in preparation of the distribution that will likely happen this year, there is no imminent sale of bitcoins happening.”

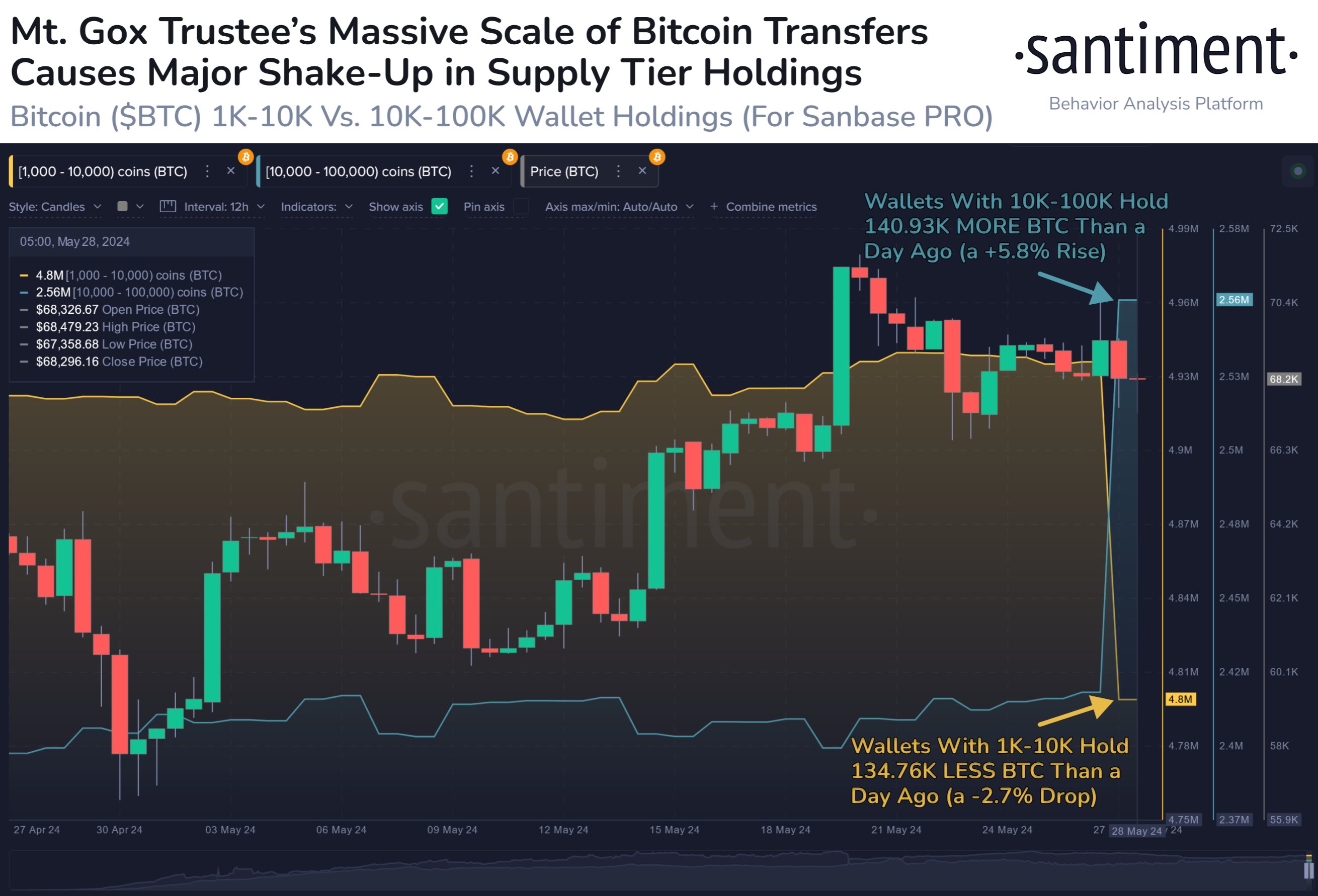

However, large amounts of Bitcoin have been moved causing a net drop of BTC held by 1K-10K and 10K-1ooK BTC wallet addresses. This caused sentiment to remain down as traders considered other factors.

Bitcoin still holds firm above key support level at $66K, but headwinds such as US PCE inflation data and crypto market expiry on May 31 are likely factors traders considered staying away from the market.

CoinGape reported that over 68,383 BTC options of a notional value of $4.66 billion are set to expire, with a put-call ratio of 0.57. The max pain point is $65,000, indicating high odds of Bitcoin selloff after days of low trading volumes. Implied volatility (IV) witnessing significant declines across all major terms, which means volatile price movements can likely cause a further pullback in BTC price.

Crypto Liquidations

Crypto market saw $170 million liquidated in the last 24 hours, as per CoinGlass data. Ethereum (ETH) outpaced Bitcoin in liquidation, with BTC recording $25 million in long positions liquidation. The largest single liquidation order happened on crypto exchange Binance as someone traded ETHUSDT valued at $4.92 million.

BTC price fell over 3% in the past 24 hours, with the price currently trading near $68,243. The 24-hour low and high are $67,227 and $70,479, respectively. Trading volumes rise over 25%, indicating interest among traders but with caution.

The US dollar index (DXY) rose above 104.54 after the recent drop in dollar index. Meanwhile, the US 10-year Treasury yield also climbed to 4.54% after poor results of the 5-year and the 2-year auctions triggered a selloff. In addition, Minneapolis Federal Reserve President Neel Kashkari noted that the current policy stance is restrictive but emphasized that officials haven’t entirely ruled out additional rate hikes.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs