Why Bitcoin Price Is Below $65k Today?

Highlights

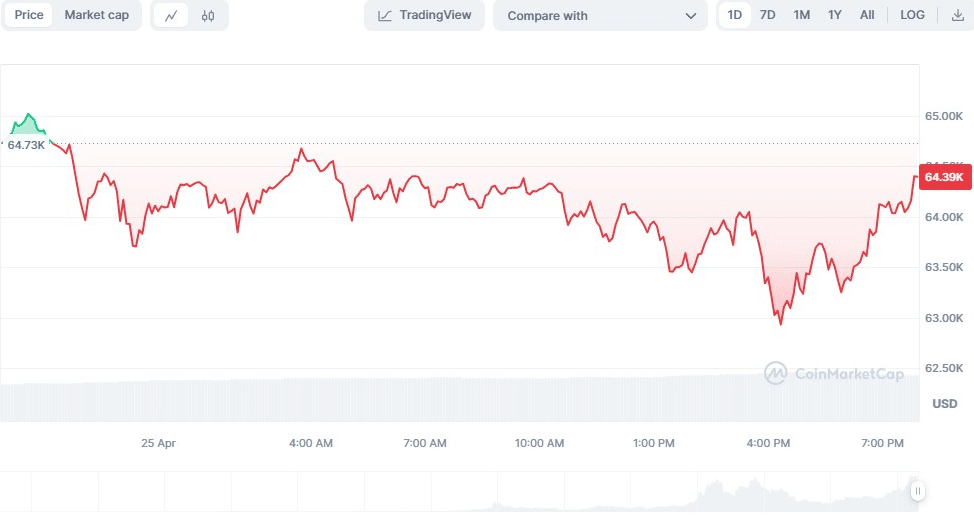

- Bitcoin drops to $64,500, down 4% from the intra-day high.

- Over 40M long positions liquidated in a major sell-off in an hour, with over $22 million liquidated in 24 hrs.

- Post-halving, Bitcoin's funding rate turns negative.

- $9.4B in crypto options set to expire, raising volatility.

As Bitcoin struggles to maintain its upward momentum, the cryptocurrency market is witnessing a significant sell-off, with over 40 million long positions being liquidated in just an hour. A total of over 208 million in crypto were liquidated in the last 24 hours.

This massive sell-off has increased anxiety among investors and analysts, leading to a deeper look into the reasons for Bitcoin’s current price drop. By press time, the price of BTC was trading at $64,427, a decrease of over 0.45 % from the intra-day high of $65,083. BTC’s market capitalization dipped by 0.42% to $1,268,251,647,682 while its 24 hour trading volume surged by 24% to $33,093,026,191. This surge in the trading volume suggest traders are taking advantage of the dip to buy.

BTC/USD 1-day price chart

The recent sell-off comes amidst persistent resistance faced by Bitcoin, despite its attempts to consolidate above the $66,000 mark. Moreover, technical indicators like the TD Sequential have flashed warning signals suggesting a possible Bitcoin price trajectory change.

However, analysts caution that if BTC fails to hold above its critical support level of $65,000, which it has, then it may see further selling pressure and may facilitate a more profound decline in price.

Bitcoin Funding Rate Turns Negative Post-Halving

Adding to the downward pressure on BTC is the funding rate turning negative for the first time this year, just before the recent halving event. The negative funding rate indicates that the market’s sentiment has changed towards a bearish mood when the short positions outweigh the long positions.

This occurrence is essential as it portrays the effect of the halving event on Bitcoin’s network dynamics and investor psychology. The halving of the Bitcoin block reward has already started to affect market dynamics as indicated by derivatives data which signifies a turn toward bearish positions.

Regardless of Bitcoin’s current downswing, there are certain indicators that the market is looking upward again. After two days of negative funding rates, Bitcoin has experienced a bounce in its funding rate subsequent to the halving event. Moreover, aggregate open interest has surged, suggesting a rise in the bullish sentiment among market players.

The rebound of the BTC Long/Short Ratio also confirms the optimistic bias, which signals that investors are now more bullish than bearish on Bitcoin.

In addition, more recent studies suggest that the last Bitcoin halving had a more positive impact on the Bitcoin price than the previous halving, which indicates a potential prolongation of the bullish trend in the long term.

Crypto Options Expiry Adds to Market Volatility

As BTC grapples with selling pressure and negative indicators, the upcoming expiry of crypto options adds another layer of volatility to the market. Over $9.4 billion worth of crypto options, including Bitcoin and Ethereum, are set to expire, potentially exacerbating price fluctuations in the short term.

The expiry date is a closely watched factor by the market participants, as it may give additional direction to the BTC prices. The expiration of options contracts typically results in an upsurge in trading activity and escalated volatility as investors reposition their holdings.

Moreover, Arthur Hayes has weighed in on the current market trend, expressing confidence in Bitcoin’s long-term trajectory. Hayes emphasizes Bitcoin’s role as “the hardest money ever created,” citing ongoing fiat inflation as a catalyst for Bitcoin’s continued growth. He predicts a bullish outlook for Bitcoin, urging investors to capitalize on opportunities presented by market dips.

According to Coinglass, CME Bitcoin futures open interest has dropped 4% in the past 24 hours adding pressure on the selling seen in Bitcoin, triggering a selloff in crypto market.

Read Also: Peter Schiff Predicts #Bitcoin (BTC) $60K Support Won’t Hold

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)