Here’s Why Crypto Market Is Down Today, Short-Term Bitcoin ETF Impact Largely Over

The crypto market saw massive retracement after the spot Bitcoin ETFs listings, with market cap tumbling back to $1.66 trillion from $1.82 trillion. Altcoins such as Ethereum rebounded amid Bitcoin dominance slipping below 50%.

Bitcoin price has traded sideways near $42,500 throughout the week and traders look to accumulate below $40,000, but experts predict the days of the short-term impact of Bitcoin ETF approval are largely over.

Why Crypto Market Is Down Today

The trading volumes across cryptocurrencies took a hit due to factors including volatility, earnings season, and macro. Strong US dollar causing selling pressure on Bitcoin. The US dollar index (DXY) reverses back above 103.50 from 101 in early January.

However, Coinglass data and latest macro data indicate that Bitcoin selling pressure is easing gradually. In the last 24 hours, the crypto market saw over $100 million in total liquidation, with 75% longs and 25% shorts liquidated. Bitcoin recorded $22 million liquidation and Ethereum saw $20 million liquidation. However, the trend is changing as short liquidation is rising in the last 12 hours.

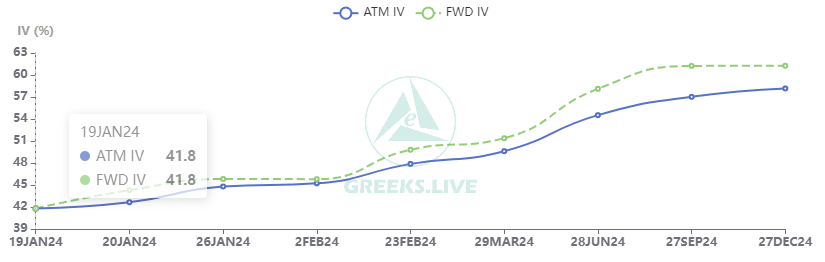

BTC’s volatility level dropped to a new low in the past month, with both major terms RV and IV showing significant declines, and short-term IV plummeting to below 45%.

According to futures and options data, the short-term impact of the spot Bitcoin ETF is largely over. The funding rate looks attractive to traders and a buying will start soon. BTC futures and options open interests (OI) both are rising again in the last 4 hours. BTC OI across exchanges including CME, Binance, and Coinbase are recovering, with a 0.35% jump to $18.31 billion of total BTC futures open interest.

In contrast, Ethereum open interest (OI) fell over 2% in the last 24 hours, with a total ETH OI of $8.85 billion. However, Solana and XRP OI are rising again and prices could make a comeback soon.

Also Read: GBTC Outflows Make Way Into Spot Bitcoin ETFs, Bitwise Records $68 Million Inflows

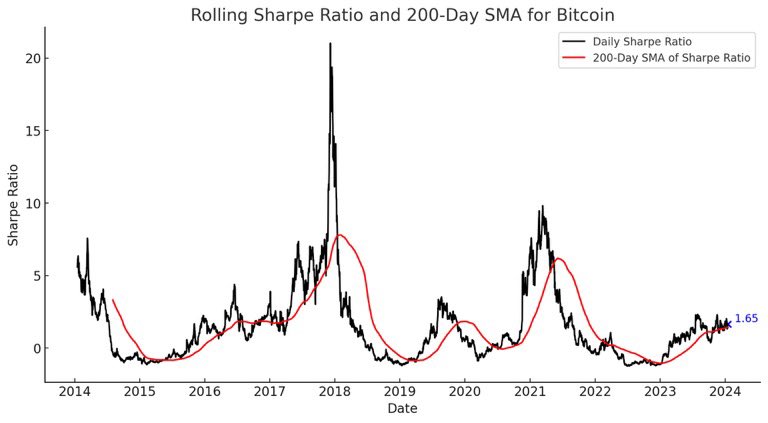

Bitcoin and Crypto Looks Promising

Popular analyst Crypto Birb said the cyclical nature of risk-adjusted returns of Bitcoin looks promising for the next 12-18 months. He predicts that if historical patterns come into effect, holding BTC after the 4th halving and until 2026 is super bullish.

Top analyst and trader Michael van de Poppe said “People are bearish on Bitcoin and have a negative outlook. Don’t be like that. Buy the dip and hold.”

The ETFs on #Bitcoin have a net inflow of $782 million over the first three days.

That's more than 50% higher than ALL ETFs combined have done in 2023 in terms of volume.

People are bearish on #Bitcoin and have a negative outlook.

Don't be like that. Buy the dip and hold.

— Michaël van de Poppe (@CryptoMichNL) January 17, 2024

BTC price is currently trading at $42,745. The 24-hour low and high are $42,189 and $42,880, respectively. The trading volume remains low ahead of Friday’s expiry. Bitcoin gaining upside momentum will bring a pullback across altcoins, with the first hint of Ethereum open interest falling.

Also Read: Bitcoin Miners On A Aggressive Selling Spree, BTC Hashrate Tanks 34%

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs