Why Is Bitcoin Price Falling Suddenly Today?

Highlights

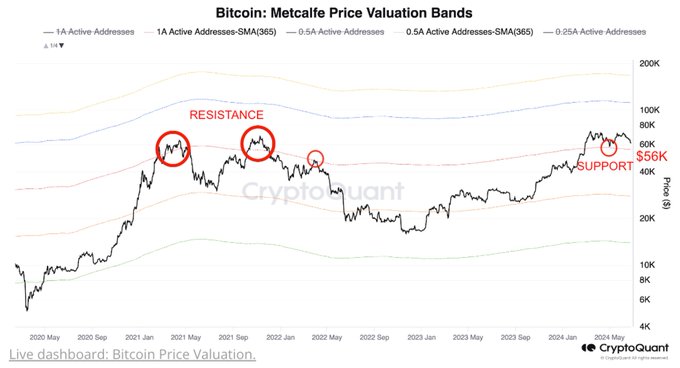

- BTC's price falls below $61K; risks drop to $54K if $56K support fails.

- May's core PCE growth slowest since March 2021, Bitcoin still unstable.

- Bitcoin trading volume down 12.84%, signaling reduced market interest.

Bitcoin’s (BTC) price is falling sharply below the $61K level after failing to maintain its support above $60,000. This decline has raised concerns among analysts about a potential major correction if Bitcoin cannot hold its ultimate support level of $56,000.

Bitcoin Struggles Amid Cooling PCE Data

Bitcoin’s price action has not displayed much of a response to the recent U.S. macroeconomic figures. The core Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s preferred inflation measure, rose at an annual rate of 2.6% in May, the lowest since March 2021.

On a monthly basis, the core PCE increased at a rather slow pace of only 0.1%, the slowest rise since November 2023. However, even with these somewhat low inflation numbers, Bitcoin has not been impacted much and continues to trade in the $60,000 range.

Econ Friday

PCE data expectedly came in coolerPersonal income slightly higher than expected but cooling personal spending

Pretty good reports tbh https://t.co/7erMdACddr pic.twitter.com/4GhTcxmtOd

— Skew Δ (@52kskew) June 28, 2024

Concurrently, recent activities by the U.S. government have also added to market uncertainties. A U.S. government-associated address shifted 11.84 BTC, valued at approximately $726,000, to a new address. Although relatively small, this transaction is speculated to be a precursor to larger moves. Such government actions can cause unease among investors, contributing to speculative fears about potential large-scale sell-offs, which can exert downward pressure on Bitcoin prices.

Analysts Warn of Thin Support Below $60,000

Market analysts are worried that support for Bitcoin is weakening below the $60,000 mark. If the price fails to hold this level, a massive bearish momentum may follow, and the price may drop to $54,000.

CryptoQuant shows that the critical level of support that Bitcoin has is at $56k. If this support level is not sustained in the future, then there is a risk of a sharp price decline.

Analyst Willy Woo has described the recent price retests at $58,000 to be due to liquidations of leveraged positions as well as selling pressure from miners, which indicates that the market has not fully recovered from the downtrend without liquidating these positions.

Decreasing Demand, Trading Volume, and Open Interest

Another factor contributing to Bitcoin’s price decline is the decreasing demand from long-term holders and U.S. investors. Long-term BTC holders have been reducing their holdings throughout 2024, with significant sell-offs observed in May and June. According to IntoTheBlock data, May saw approximately 160,000 BTC sold, worth around $10 billion, while June witnessed an additional 40,000 BTC leaving long-term holders’ wallets. This steady decrease in holdings has correlated with fluctuations in Bitcoin’s market price.

Furthermore, trading volume has seen a significant decrease of 12.84%, settling at $39.92 billion. This drop may indicate low market turnover and traders’ interest which may result in low liquidity and high volatility.

Open interest, which is the total number of derivative contracts outstanding, also declined by 1. 94% to $31. 74 billion, which implies that there are fewer contracts being held or opened. However, options open interest has gone up by 2. 18% to $10. 24 billion, this might mean that although there are fewer new options being traded, more traders are holding on to their options, possibly due to uncertainty in the market.

Read Also: Bitcoin ETF, Nvidia, & AI Hype Usher $400 Billion Investment in ETFs

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k