Why Is The Solana Price Dropping Today?

Highlights

- The Solana price is down almost 5% today.

- This has occurred partly thanks to Solana whales offloading their coins.

- Solana's DEX volume has also declined by over 24% in the last seven days.

- The LIBRA meme coin saga has also dampened investors' confidence.

The Solana price is down 9% today and has lost the $170 support level. This price decline has occurred due to various factors, including a drop in Solana’s network activity, which presents a bearish outlook for the crypto.

Why The Solana Price Is Dropping

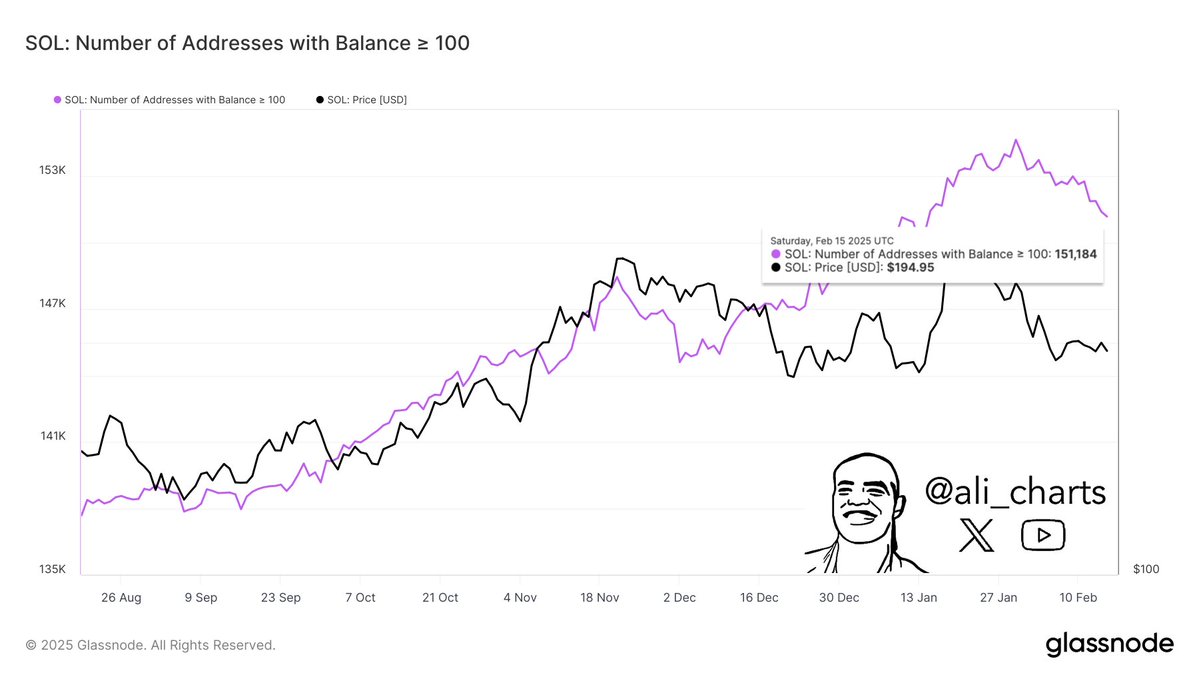

CoinMarketCap data shows that the Solana price is down 9% today and has dropped below the $170 price level. Crypto analyst Ali Martinez revealed one possible reason for this price decline in an X post. The analyst stated that the number of wallets holding more than 100 SOL has declined by 2.24% over the past two weeks, dropping from 154,653 to 151,184.

This indicates that some Solana whales have been offloading their coins, contributing to Solana’s price decline. As CoinGape reported, the meme coin launchpad Pump.fun recently offloaded 148,759 SOL, worth just over $28 million at the time.

The Solana price has also dropped due to a decrease in decentralized exchange (DEX) activity on the network. DeFiLlama data shows that there has been a 24% decline in DEX volume on Solana. This is likely a result of the rotation of capital from Solana to the BSC network, whose meme coin ecosystem again looks to be thriving. For context, further data from DeFiLlama shows that DEX volume on BSC has surged by almost 50% in the last seven days.

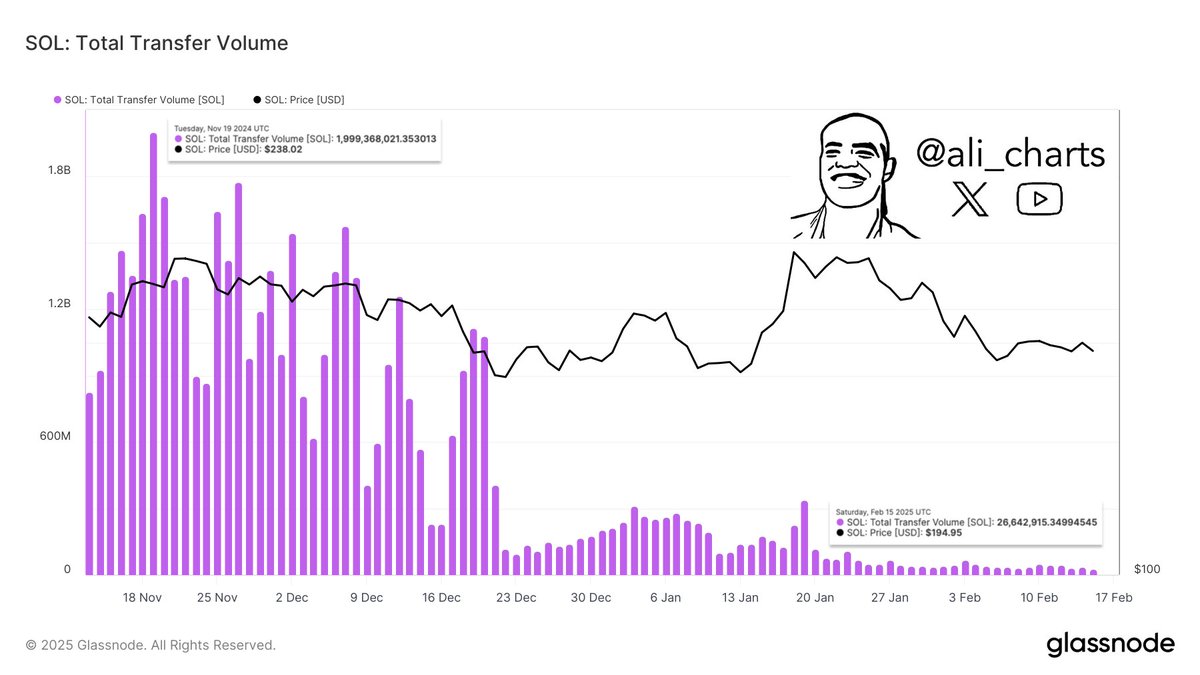

Martinez also provided some insights into the volume decline on Solana, stating that the total volume transferred on the network has dropped from $2 billion in November to just $26 million as of February 17th.

Libra Meme Coin’s Role In This Price Decline

The LIBRA meme coin saga also looks to have contributed to the Solana price decline. Argentina’s President Javier Milei had last week promoted a SOL meme coin, LIBRA, on his meme coin on his X account. This coin eventually turned out to be a rug pull as it crashed over 94% in hours.

According to the Solana Post, 74,698 traders lost over $286 million on this token, which Milei promoted. On the other hand, insiders are reported to have cashed out over $100 million.

🚨 $LIBRA wiped out traders.

74,698 traders lost $286M+ on the token promoted by Argentina’s President @JMilei.

71,369 lost up to $10K

2,409 lost $10K–$50K

438 lost $50K–$100K

318 lost $100K–$250K

87 lost $250K+

52 lost $500K+

25 lost $1M+

Total carnage. pic.twitter.com/8QByngPhGu

— The Solana Post (@thesolanapost) February 17, 2025

This development has brought about a lot of fear, uncertainty, and doubt (FUD) in the Solana ecosystem, with the network labeled as one filled with many bad actors in its meme coin ecosystem. Consequently, meme coin traders on the network look to be rotating their capital to other networks, especially with Solana’s once-bubbling meme coin ecosystem on the decline.

This also explains the decline in Solana’s DEX volume, as its meme coin ecosystem had attracted a lot of liquidity to these exchanges and the network in general.

Amid this development, the Solana price is still at risk of suffering a further crash. As CoinGape reported, SOL could face significant selling pressure from the $2.06 billion tokens that will be unlocked in early March. These coins form part of the proceeds from FTX’s bankruptcy estate, which firms like Pantera Capital bought through an auction.

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15