Nvidia Soars, Bolstering Bitcoin’s Potential to Hit $100K Soon

Highlights

- Nvidia entering the $3 trillion club has implications for BTC price to hit $100K.

- Markus Thielen predicts a move to new all-time high and even $100K after a breakout.

- On-chain data hints at potential rally in near-term.

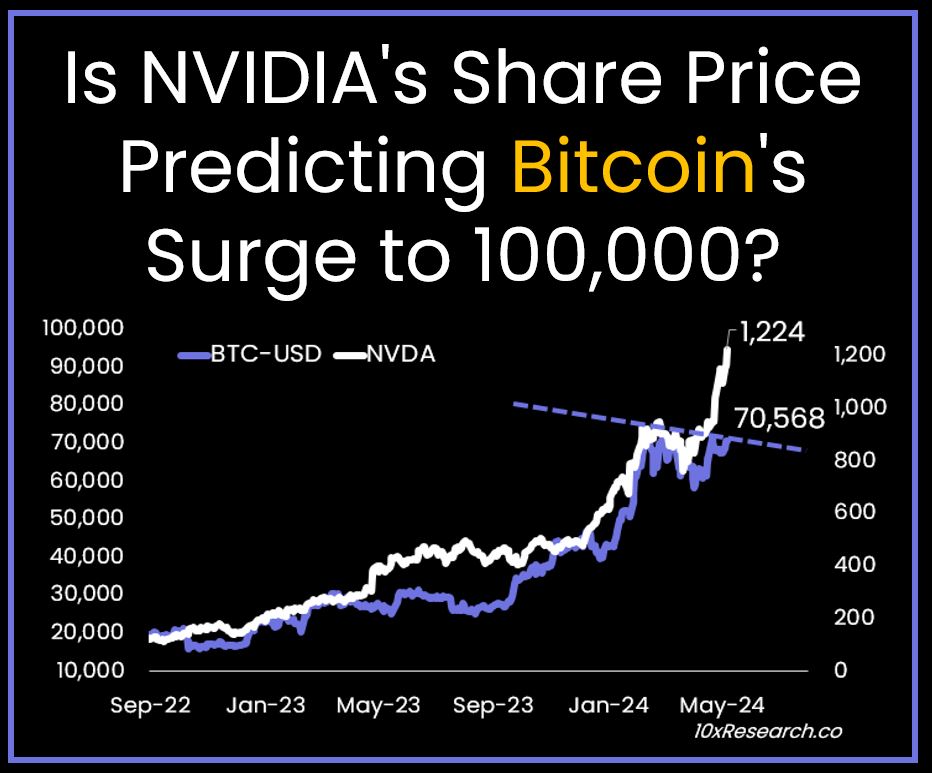

Nvidia has joined the $3 trillion club as the third company to reach this milestone, surpassing Apple to become the second-largest company listed on a U.S. stock exchange. Nvidia’s (NVDA) share price reached a record high of 1,224.50, sparking bullish trends for technology stocks and cryptocurrencies like Bitcoin and AI coins. This significant achievement by Nvidia increases the likelihood of Bitcoin’s rally to $100,000.

Analyst Says Nvidia Rally Strengthened Bitcoin $100K Move

Markus Thielen, CEO of 10XResearch, on June 6 said a massive surge in Nvidia share price hints at high odds of Bitcoin price hitting $100K. He further bolstered his earlier prediction that BTC price is expected to hit a new all-time high by next week.

Since a rise in the correlation between Bitcoin and US markets due to ongoing mainstream adoption, Nvidia and BTC prices have moved almost similarly. Markus Thielen believes a breakout of $70,568 has set Bitcoin on a path to hit $100K.

NVDA price trading at 1,237.21, up 1.05% in a pre-market rally on Thursday. The price soared over 32% in a month and 154% year to date. Analysts at Bank of America raised their price for Nvidia stock to $1,500 from the previous NVDA price target of $1,320.

This shift underscores the growing investor enthusiasm for companies at the forefront of the artificial intelligence (AI) revolution.

Also Read: Cardano, Shiba Inu, Jasmy Grabs Interest Of Big Whales, Trigger Buy Signal

Multiple Factors Confirms BTC Price Rally

BTC price is trading sideways today, with the price currently trading at $70,915. The 24-hour low and high are $70,390 and $71,735, respectively. Furthermore, the trading volume has decreased by 27% in the last 24 hours, indicating a decline in interest among traders.

CryptoQuant data reveals institutional investors have shifted towards reaccumulation over the past two weeks, NVT golden cross hints local bottom, and Bitcoin Volatility Index (SMA-30d) and Adjusted MVRV (30DMA/365DMA) metrics highlight slowdown in price swings.

Analyst Willy Woo predicted a $1.5 billion Bitcoin short liquidation if BTC price hits $72,000 and set to a rally towards $75,000.

Also Read: Cathie Woods Ark Invest Has Strong AI Exposure Despite Trimming Nvidia

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k