Why The Falling Wedge Is Undeniably Bullish for Bitcoin Price?

Bitcoin price briefly renewed the bullish outlook above $29,000 and teased a breakout above $30,000 following the Federal Open Market Committee (FOMC) interest rate hike decision.

According to a CNBC report, the 25-basis point increase to a target range of 5.25 – 5.5% propelled the cost of borrowing in the US to the highest level in more than 22 years.

Remarks by the Fed Chair, Jerome Powell indicated that inflation had eased since mid-last year but insisted on the need to achieve its 2% goal, implying that the country “has a long way to go.”

In other words, there is a possibility of another data-driven decision that would lead to a hike, especially in September “if the data warranted.”

Investors in risk assets like Bitcoin have faulted the Fed for its hawkish approach to policy making with Powell saying the bank may “choose to hold steady and we’re going to be making careful assessments…, meeting by meeting.”

Bitcoin Price Holds Under $30k – Where To Next?

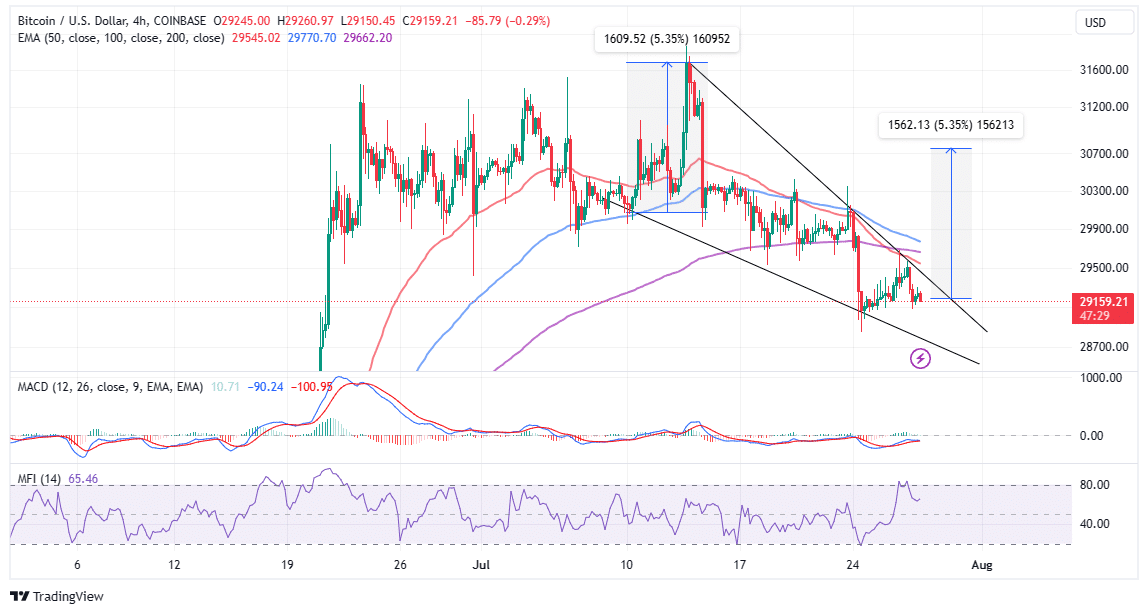

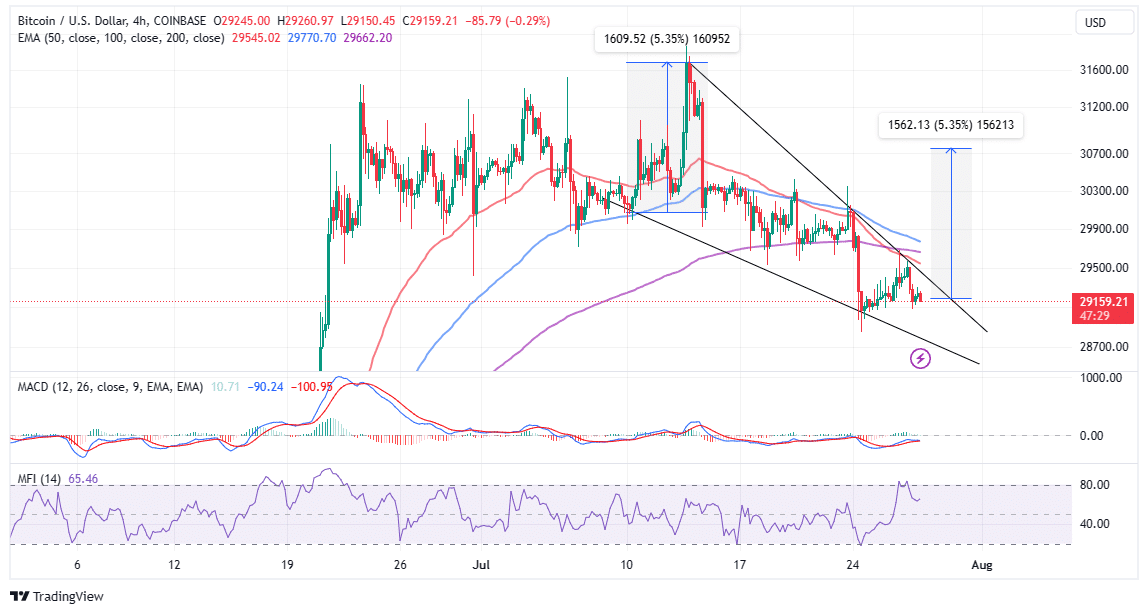

Market watchers expected Bitcoin price to resume its uptrend above $30,000, but both gains and losses were contained in a tight range, with support at $29,000 holding steady.

The Money Flow Index (MFI), however, rolled back from the overbought region into the neutral zone, suggesting that some investors sold in favor of less volatile assets. Based on the daily chart, their impact remains limited, as the MFI shows fund inflows starting to increase again.

The same chart shows the formation of a falling wedge pattern, teasing a 5.35% breakout to $30,753 if validated.

This is a bullish chart formation that signals a potential reversal or continuation of a downtrend. It is formed when the price makes lower highs and lower lows within a narrowing range, creating a wedge-like shape.

The pattern confirmed when the price breaks above the upper trendline of the wedge, indicates that sellers in the Bitcoin market are losing strength and that buyers are taking over.

Traders can use the falling wedge pattern to enter a long position at the breakout point or wait for a retest of the upper trendline as support, depending on their risk tolerance.

The price target for the trade can be estimated by measuring the height of the wedge at its widest point (5.35%) and projecting it from the breakout point ($29,191) – hence the forecasted move to $30,753.

What’s Holding Bitcoin Price Breakout

The horizontal movement in the Moving Average Convergence Divergence (MACD) below the mean line shows that Bitcoin lacks the momentum to trigger a breakout or sustain one.

Moreover, the 50-day Exponential Moving Average (EMA) (red) has recently validated a death cross pattern by crossing below the 200-day EMA (purple).

If this technical picture holds, a recovery would remain a pipe dream until Bitcoin price sweeps liquidity at lower levels, for example, $28,000 or $25,000, thus tapping fresh momentum for a rally above $30,000.

Related Articles

- Ethereum Price Rally Awaits This Bullish Pattern Confirmation

- Crypto Legislation Surges Forward: Clarity For Payments Stablecoin Bill Clears Hurdle

- FTX And Genesis Settle Disputes In Bankruptcy Cases, Good News for Gemini?

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?