Will DeFi’s Superior Yields Weaken Ethereum’s Security?

In a new race for better yields, it appears as if Ethereum would open itself up for more trouble once they shift from the rather secure Proof of Work consensus algorithm to a Proof of Stake system, where node operators have to stake a minimum of 32 ETHs and earn yields in return for securing the network.

The rise and rise of DeFi, analysts elaborate, presents a risk to the security of PoS systems thanks to superior yields offered by DeFi applications. Analyzed, DeFi dapps, operating at full throttle and competing with staking systems, will be perilous and a security risk for Ethereum and similar blockchains with a deflationary model.

The Role of DeFi

DeFi, short for Decentralized Finance, is an emerging finance style that takes advantage of the distribution of Ethereum–and other smart contract based platforms, to issue out loans to coin stakes in exchange of loans. According to proponents, DeFi sidelines centralized authorities, including banks notorious for fractional reserving deposits and issuing out loans recklessly via an opaque system where policies are often passed without consideration of the bank account holder.

With DeFi, the lending sphere is completely democratized and open for everyone desirous of operating without a central authority. Better still, it is a grand opportunity for HODLers to lend out their stash instead of staking them on-chain for superior yields at sprouting smart contracts controlled firms such as Compound or MakerDAO.

What DeFi and Staking Yield Competition Will Mean for Ethereum

For borrowers, they receive stable coins with ETH as collateral. But here lies the catch. For economically rational investors who are incentivized to stake their coins and secure the network, it won’t make sense to lock their prized coins on-chain if yields are attractive in competing lending DeFi dapps.

comparing staking coins returns vs defi interests on lending is fucking retarded btw

what he said about staking coins is absolutely right about risk in the coins dropping (HUGE risk btw), but there is zero context to justify injecting that comment

— 찌 G 跻 じ ⚡️ ? (@DegenSpartan) July 29, 2019

In this case, analysts explain, it would make perfect sense to unlock and move coins to a DeFi app. For this, the demand for ETH would consequently decrease, weakening the network’s security as a result.

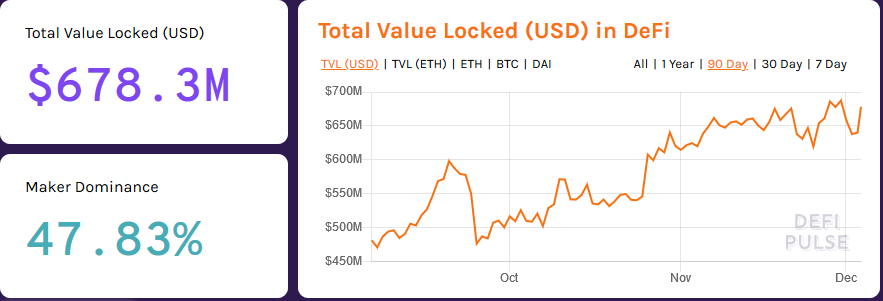

At the time of writing, there are $678.3 million worth of ETH locked up in DeFi dapps. Combined Compound and MakerDAO lock over $420 million with an average daily yield of 0.7%.

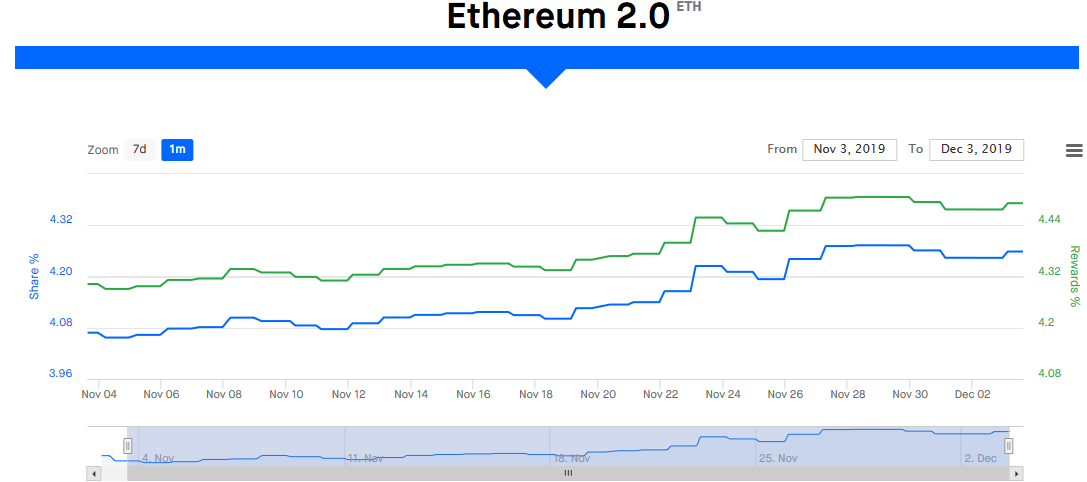

Compared, staking yields in Ethereum 2.0-that is when the network would have shifted to a Proof of Stake system, would yield a dismal 4.26% in compensation for the 180-day lock up period if 32 ETHs are staked.

As it is, only time will tell whether the tension between staking and lending platforms will diffuse with time.

- Fed’s Chris Waller Says Labor Market Is ‘Very Soft,’ Signaling Support for More Rate Cuts

- DeepSnitchAI Raising funds to Build AI Intelligence for Investors

- LINK Vs. XRP: Crypto Founder Lark Davis Reveals Who Will Win in the Next Decade

- Bitcoin Proxy Metaplanet Gets Support from World’s Largest Sovereign Wealth Fund

- Bitcoin Adoption Hits New Levels as Bhutan Commits $1B BTC to Develop Its Economic City

- Bitcoin Price Prediction as Capriole Founder Warns of a Drop Below $50K by 2028

- XRP Price Rare Pattern Points to a Surge to $3 as ETFs Cross $1B Milestone

- DOGE Whales Add 138M Coins in 24 Hours: Will Dogecoin Price Rebound Above $0.15?

- Ethereum Price Outlook Hinges on Whale Moves: Dump Below $2,800 or Reclaim Above $3K Next?

- Solana Price Outlook After Charles Schwab Adds SOL Futures — What Next?

- Pi Network Stares at a 20% Crash as Whale Buying Pauses and Demand Dries