Will XRP Price Gains Come Undone As Federal Court Rejects Ripple Ruling?

The position of XRP in the market as a cryptocurrency and not a security token is once again in question following a recent ruling made by SDNY District Judge Jed Rakoff, which allows the Securities and Exchange Commission (SEC) to carry on with the lawsuit against Terraform Labs and its founder D Kwon.

Legal representatives of Terraform and Kwon had filed a motion to dismiss the SEC’s case, citing the ruling made in the Ripple vs SEC lawsuit.

Judge Rakoff did not give any regard to the early July ruling, delivered by Judge Analisa Torres, which distinguished between institutional XRP sales and public sales, such as those on third-party exchanges like Coinbase and Binance.

The judge asserted that the regulator has jurisdiction to proceed with the case which would determine if Kwon and his company Terraform violated security laws.

Meanwhile, XRP down 2.4% in the last 24 hours, is trading at $0.6881. The turbulence in the market cuts across the board with Bitcoin price falling by 1.6% to 28,932 while Ethereum is holding firmly to support at $1,830 following a 1.7% drop.

How Far Can XRP Price Tumble?

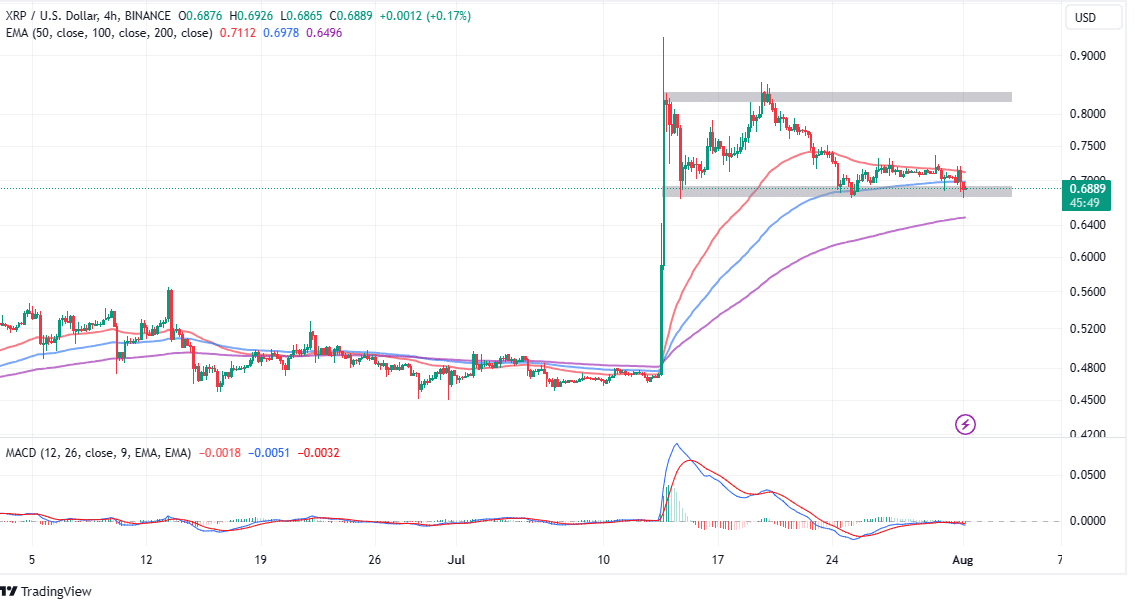

Attempts to push XRP price to $1 have been futile despite the Ripple ruling, which deemed XRP not a security token but particularly for sales made via exchanges. While the token rallied substantively to trade highs of $0.93, it has generally wobbled within the range stretching from $0.68 and $0.85.

XRP price has in the last few weeks been confined in the lower range of the channel, thus putting a lot of pressure on support at $0.68. It is essential for bulls to keep this support intact, otherwise, sellers could tap sell the signal from the Moving Average Convergence Divergence (MACD) indicator.

Such a bearish call compels traders to close their long positions and open short positions and is characterized by the MACD line in blue flipping below the signal line in red. The bearish outlook in XRP becomes more apparent with the momentum indicator sliding toward the mean line (0.00) of further below it.

While recovery from the range resistance at $0.68 cannot be ruled out, traders need to be cautious keeping in mind the support turned hurdle at the 100-day Exponential Moving Average (EMA) (blue) at $0.6977.

A sustained break above $0.7 would mean that the range support is sturdy enough to arrest potential declines, possibly averting an impending sell-off, with the Ripple ruling seemingly in trouble.

Traders who may be eyeing new exposure to XRP longs should be on the lookout for gains above $0.7 – the resistance level at the 100-day EMA. A sharp spike in volume may follow, which is crucial for the climb to $0.75 as well as the range high of $0.85.

Declines below the immediate $0.68 support might extend to revisit the 200-day EMA and if push comes to shove due to investors selling in panic, XRP price could sweep the liquidity at $0.6 before resuming the uptrend to $1.

Related Articles

- Bitcoin Price Stuck Under $30k: 10% Bullish Wave Incoming?

- Binance Breaks New Ground with Japan Launch, BNB Token to Take Center Stage

- FTX 2.0 Plans Complete Cash Payment to Creditors, Wipeout FTT Token

Recent Posts

- Altcoin News

Arthur Hayes Moves Another 682 ETH To Binance: A Major Sell-Off Ahead?

Arthur Hayes, a legendary trader and BitMEX co-founder, has made a bold move, sparking a…

- Altcoin News

Is XRP Selling Pressure Easing? Here’s What On-Chain Data, ETF Flows Signal

XRP price has remained in a downtrend for nearly 6 months amid massive selling pressure…

- Altcoin News

Crypto Bill: Spain Pushes Ahead with MiCA and DAC8 As US Trails Behind

Spain is making a major step in cryptocurrency regulation, implementing major crypto bills like the…

- Crypto News

Breaking: Grayscale Files Updated S-1 for its Avalanche ETF with the US SEC

Crypto asset manager Grayscale has filed an updated S-1 for its Avalanche ETF with the…

- Bitcoin News

Bitcoin Price Will Never Rise: Peter Schiff

Peter Schiff, a gold advocate and Bitcoin critic, has once again made headlines with his…

- Crypto News

Trump Calls for Rate Cuts as Fed Chair Favorite Hassett Says U.S. Lags on Lowering Rates

Fed chair expectations moved into focus after President Donald Trump called for lower interest rates…