Bitcoin (BTC) Is At A Major Downside Risk If the Equity Market Corrects Predicts Analyst

The world’s largest cryptocurrency Bitcoin (BTC) continues to trade sideways after failing to hold above $40,000 levels. At press time, Bitcoin (BTC) is down 7.5% trading at $35,274 with a market cap of $658 billion.

The Bitcoin indicators and on-chain metrics are dodgy at this point giving a tough time for analysts. Popular Bitcoin analyst Willy Woo looks at the macroeconomic situation in order to analyze the situation at hand. Woo predicts that there will be selling pressure on Bitcoin rather than any bullish momentum over the next week.

He notes that there’s a lot of money currently flowing into the U.S. Dollar Index (USD) which means that money has been moving to safety. Thus, Woo points out that if the equity market corrects further, Bitcoin (BTC) will also enter a strong price correction. In his recent analysis, Woo wrote:

“My only concern for downside risk is if we get a major correction in equities which will pull BTC price downwards no matter what the on-chain fundamentals may suggest. Noticing USD strength on the DXY, which suggest some investors moving to safety in the USD”.

We Are Not In the Bear Market

The recent price action in BTC has made investors anxious with some noting that this is the beginning of the new bear market cycle. Woo denies any such situation citing the healthy growth of new users joining the Bitcoin network.

Woo also points out that money has started flowing from stablecoin back into Bitcoin (BTC). He also notes that Bitcoins have been moving from the weak hands to the strong hands. As we reported earlier, short-term-holders (STHs) – who entered the market in the last 1-6 months – have been booking losses but whales and long-term users have been accumulating at every stage.

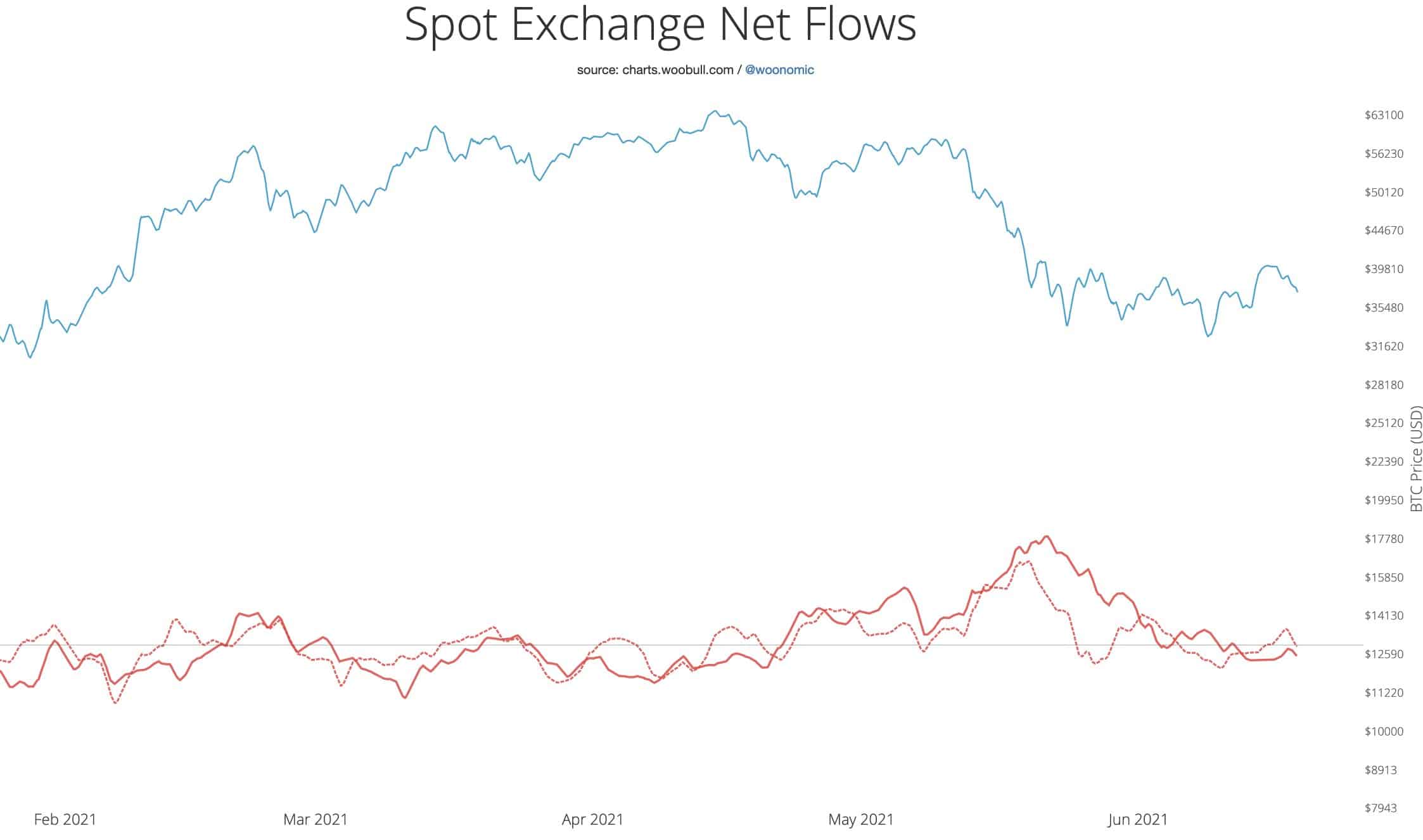

In the below chart Woo also points out that exchange flow over the last month has started flowing in, however, it’s not. happening at an “exaggerated” pace.

Woo suggests that some time needs to be burn, just as CoinGape reported that analysts are looking for a “wait and watch” approach.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs