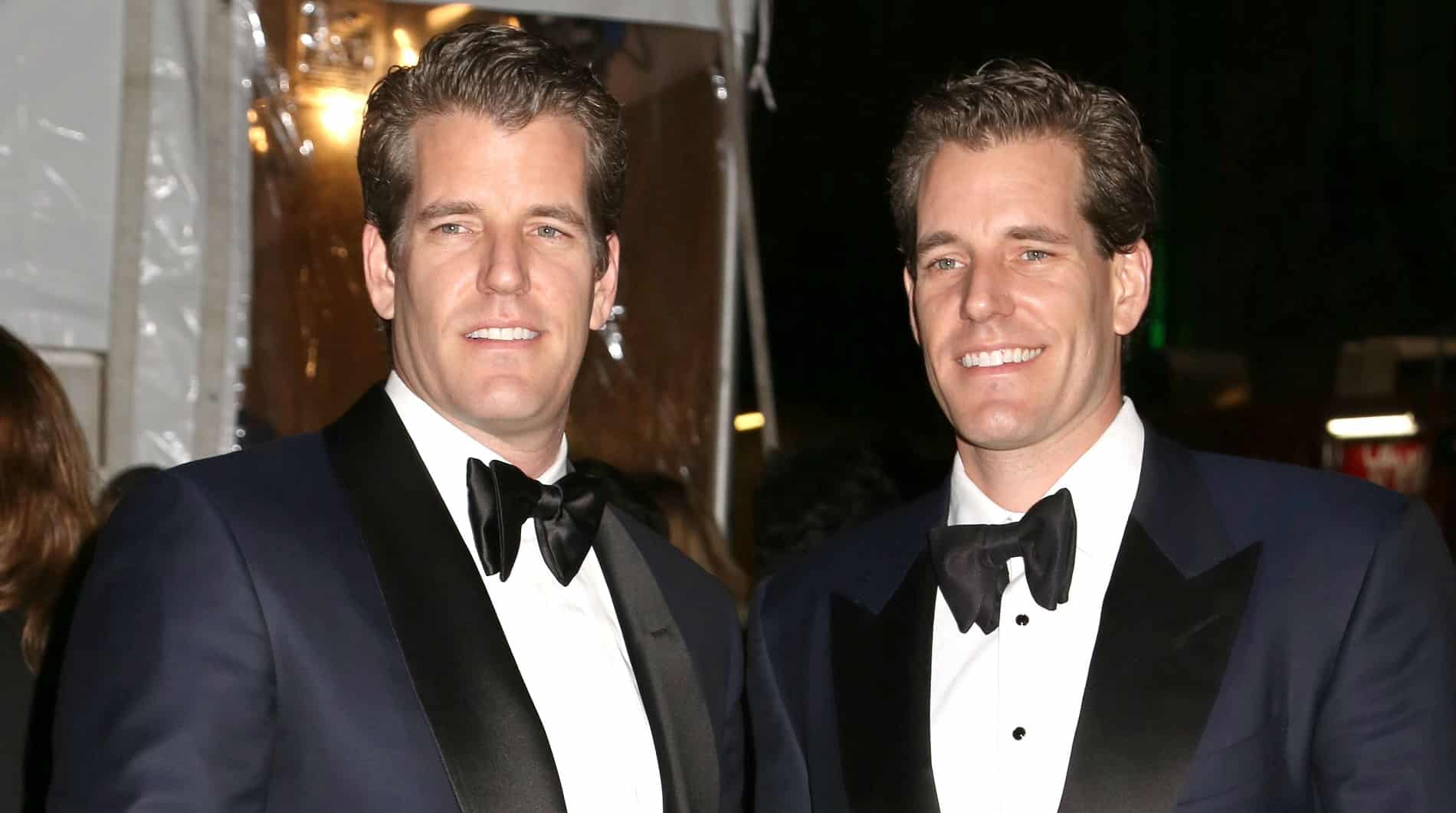

Winklevoss Twins Fight To Resurrect Gemini, Lends $100 Mn Of Personal Funds: Report

Users of the Gemini crypto exchange finally see some glimmer of hope as billionaire founders Tyler and Cameron Winklevoss, who happen to be the founders of Gemini Trust Co., have delved into their own resources to support the failing exchange. Gemini faces numerous setbacks and regulatory challenges as it became a victim of the yearlong bear market for cryptocurrencies.

Winklevoss Twins Lend $100 Million

The twins, who gained mainstream fame from the infamous Facebook lawsuit, recently provided Gemini with a loan of $100 million according to a report by Bloomberg, citing unnamed sources. Gemini had allegedly approached outside investors throughout the preceding months, albeit informally, in an effort to secure capital funds. However, the exchange’s multiple attempts went futile as it failed to reach any kind of agreement with the parties.

Read More: FTX Founder SBF Lost Track Of $50 Million, Then “Joked Internally” About It

Despite the fact that Gemini has been reeling under pressure, the crypto exchange recently announced its plans to launch an international crypto derivatives exchange that will specifically offer perpetual futures. This type of derivative is banned in the U.S. for retail customers as it doesn’t have an expiration date and can be traded with significant leverage, which results in a high-risk investment instrument.

In fact, it’s the users of Gemini Earn — a yield-generating product of the exchange — who have been severely affected by the gruesome aftermath of the FTX collapse. The FTX implosion led to a chain reaction that affected number of prominent crypto businesses in the industry, one of it being Genesis Global.

Gemini’s Tussle With Genesis

Genesis Global had been Gemini’s only partner for its Earn lending program. However, the long-standing partnership turned bitter when Genesis froze customer withdrawals in November in wake of the FTX crisis. This in turn compelled Gemini to halt redemptions on all of their Earn accounts, leaving customers distraught.

In light of this decision, about $900 million in customer funds were left unaccounted for, which provoked a heated argument between the Winklevoss twins and Barry Silbert, the chief executive officer of DGC, the parent company of Genesis. The two sides finally settled their issue in February after months of negotiations.

Additionally, the U.S. SEC filed a lawsuit against Gemini and Genesis on the grounds that the Earn program violated regulations pertaining to the sale of securities. Furthermore, Gemini is being sued by the Commodities Futures Trading Commission (CFTC), which asserts that the exchange lied to the derivatives regulator in an effort to create the first Bitcoin futures contract that is regulated by the United States government.

Also Read: Will U.S. Inflation Data & FOMC’s Minutes Propel Bitcoin’s Price Above 30K?

Recent Posts

- Crypto News

Breaking: U.S. Senate Delays CLARITY Act again, Crypto Market Structure Vote Slips to Early 2026

The CLARITY Act is no longer expected to pass the U.S. Senate this year. Lawmakers…

- Crypto News

Breaking: Bitwise Files S-1 For SUI ETF With U.S. SEC

Crypto ETF issuer Bitwise is looking to add a SUI ETF to its growing list…

- Crypto News

Crypto Hacks 2025: North Korean Hackers Steal over $2B in ETH and SOL This Year

In 2025, crypto hacks increased significantly. The cybercriminals associated with the North Korean government stole…

- Crypto News

Universal Exchange Bitget Removes Barriers to Traditional Markets, Offers Forex and Gold Trading to Crypto Users

The number one universal exchange Bitget is removing barriers between crypto and traditional finance. It…

- Crypto News

Breaking: U.S. CPI Inflation Falls To 2.7% YoY, Bitcoin Price Climbs

The U.S. CPI inflation came in well below expectations, providing a bullish outlook for Bitcoin…

- Crypto News

Crypto Market Brace for Volatility Ahead of Today’s U.S. CPI Data Release – What to Expect

The crypto market could see some price fluctuations ahead of the release of the major…