Wintermute Addresses US SEC on Tokenized Securities as Coinbase, Kraken Seek License

Highlights

- Wintermute share recommendations to the U.S. SEC Crypto Task Force on tokenized securities regulation.

- SEC needs to share guidance on tokenized securities trading, lending on DeFi, and clarify network tokens are not securities.

- Coinbase, Kraken, and other seeks broker-dealer license for offering tokenized stock trading.

Algorithmic crypto trading and market-making firm Wintermute Trading submitted comments to the U.S. Securities and Exchange Commission (SEC) Crypto Task Force regarding the need for tokenized securities regulation. This comes as the SEC seeks to regulate tokenization while companies such as Coinbase, Kraken, and others eye approval for a broker-dealer license.

The SEC calls for industry-wide comments as the regulatory body prepares for tokenization guidance before Dinari and other crypto exchanges start offering related services in the United States.

Wintermute Weighs in on Tokenized Securities with SEC

Wintermute submitted feedback to the SEC‘s Crypto Task Force on tokenized securities, recommending three areas critical for liquidity providers to support the adoption of tokenized securities. The comments came in response to the SEC’s “There Must Be Some Way Out of Here” in support of increased regulatory support for crypto.

The firm asks the SEC to share guidance and rules for crypto brokers and dealers on tokenized securities trading from their accounts. Also, self-custody them with key management and wallet software, and settle tokenized securities on-chain, including with stablecoins and other non-security assets.

Wintermute recommended that the SEC should encourage trading tokenized securities on DeFi, adding tokenized securities to liquidity pools to boost liquidity, and lending tokenized securities directly on DeFi. The firm claimed these activities should not require broker-dealer registration or trigger U.S. jurisdiction.

The firm requested the SEC to clarify that network tokens such as Bitcoin, Ethereum, Solana, XRP, and others are not securities under the Howey Test. As they are critical to decentralized protocols, despite initially distributed in fundraising transactions or traded speculatively.

The firm believes that clear guidance and rules on these will boost RWA tokenization, including tokenized stocks, ETFs, and other traditional financial products.

RWA Tokenization Boost Under Crypto-Friendly SEC

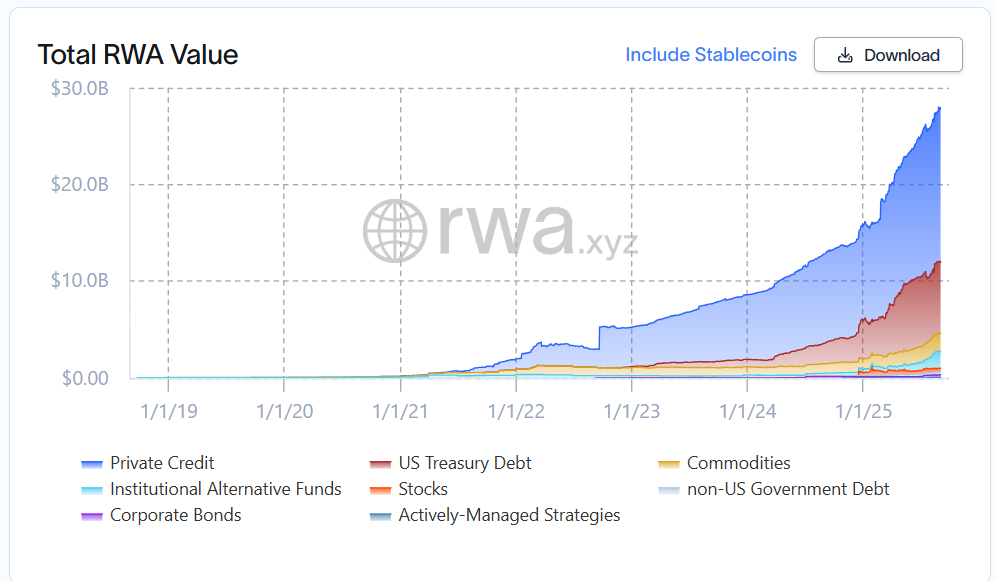

RWA tokenization in the U.S. saw a major boost under the crypto-friendly Trump Administration. The total tokenized RWA market value globally has reached nearly $28 billion, with more than 191.18 million stablecoin holders.

Recently, tokenized stock trading platform Dinari became the first firm to secure a broker-dealer license to offer tokenized securities. Also, Kraken and Coinbase are seeking a broker-dealer license from regulators to offer tokenized securities in the United States.

On September 3, Galaxy Digital became the first company to enable tokenization of its SEC-registered GLXY shares on Solana.

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Putin Signs Law to Confiscate Bitcoin Amid Russia’s Crypto Crackdown, Pavel Durov Probe

- Michael Saylor’s Strategy Moves $83M in Bitcoin as $9B Paper Losses Raises Pressure

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card