XRP Bulls Aim Another Rally With $1 XRP Price Post Lawsuit Incoming

XRP price is delicately balancing on the line that could determine if bulls get a breakout or a sell-off ensues. The sixth-largest crypto boasting $25 billion in market capitalization with $544 in trading volume, is up 0.1% to $0.4759.

Its peers, the likes of Bitcoin and Ethereum, are up 0.5% and 0.3%, respectively, on the day the U.S. Consumer Price Index (CPI) data comes out. The Federal Reserve depends on the CPI and other economic indicators to gauge the level of inflation and adjust monetary policy accordingly.

If the CPI drops to the expected 3% range, risk assets like BTC, ETH, XRP, and stocks may finally acquire enough momentum to resume paused rallies as investors’ risk appetite increases.

The situation could be slightly more worrying for XRP price, especially after LBRY lost the lawsuit against the Securities and Exchange Commission (SEC).

Is An XRP Price Breakout In The Offing?

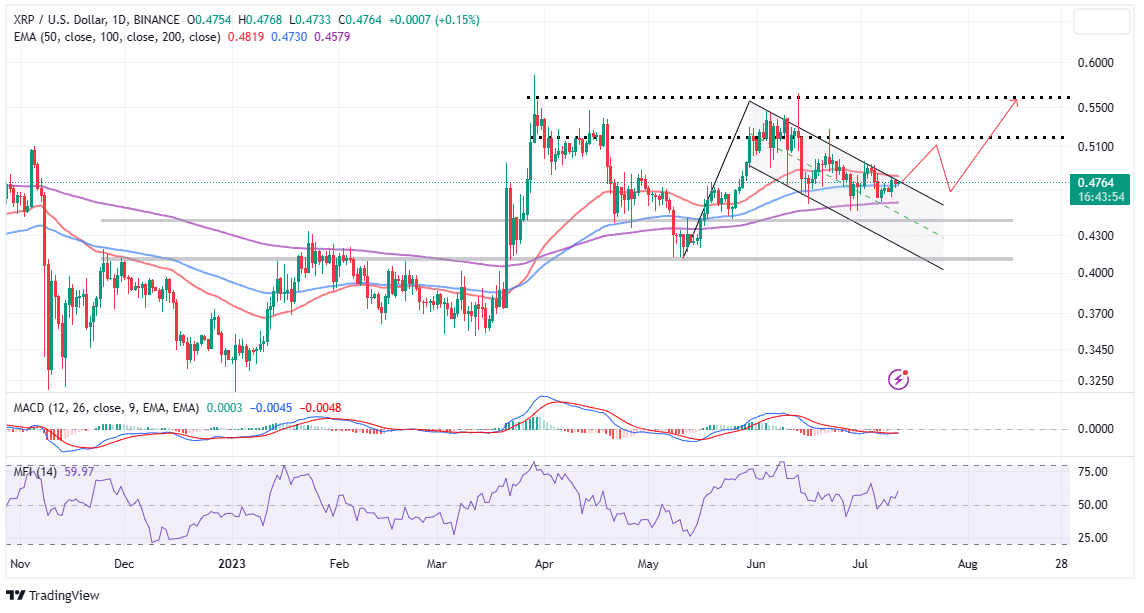

XRP is on the verge of a bullish breakout targeting highs around $0.55 in the short term. The presence of a bull flag pattern on the daily chart implies that with a minor push above the short-term hurdle at $0.48, XRP price could validate the uptick.

The 100-day Exponential Moving upholds XRP’s current position by providing support at $0.4730. On the upside, weakening the flag’s resistance at $0.48 would propel the price above $0.50, thus bringing the target at $0.55 within reach.

Reinforcing the bullish outlook in XRP is the soon-to-be-confirmed buy signal from the Moving Average Convergence Divergence (MACD) indicator. Traders may want to confirm that the MACD makes a bullish cross before triggering their buy orders.

The Money Flow Index (MFI) shows that more funds are starting to flow in XRP markets. In other words, as inflow volume increase, momentum builds, paving the way for a recovery.

How LBRY Losing Case Against the SEC Could Complicate Matters for XRP

In a ruling made by US District Judge Paul J Barbadoro, LBRY, a cryptocurrency company, was found to have disregarded the Securities Act. Instead of providing precedence, crypto enthusiasts fear the LBRY lawsuit could further complicate the situation for Ripple.

Judge Barbadoro ruled that LBRY will no longer offer or participate in the sale of unregistered token securities in addition to a $111,614k civil penalty. According to Jeremy Hogan, a Partner at Hogan & Hogan, it is possible to see a similar outcome in the Ripple case.

“The final ruling is out in the SEC v. LBRY case,” Hogan said via a Twitter post. “The Judge did not rule on secondary sales (or, not surprisingly, the Major Questions Doctrine). He enjoined further violations and issued a penalty.”

Hogan argues that while such an outcome is possible, “the Court would have to find that there is not enough to the Fair Notice Defense to have a trial on the issue.” On top of this, “the Court would have to find that past AND present sales of XRP are investment contracts in order to provide injunctive relief.”

https://twitter.com/attorneyjeremy1/status/1678879301825970176?ref_src=twsrc%5Etfw” rel=”nofollow

An injunctive relief would be bad news for Ripple as it “would enjoin sales from escrow.”

Related Articles

- Convenience Store Giant 7-Eleven Introduces Slurpee NFTs on Polygon Network

- Crypto Bull Cathie Wood’s Ark Invest Offloads Coinbase (COIN) Shares Worth Millions

- Bitcoin Price Upholds $30k Support With BTC Accumulation On The Rise: Bull Cycle Confirmation?

Recent Posts

- Crypto News

Breaking: Bitwise Files S-1 For SUI ETF With U.S. SEC

Crypto ETF issuer Bitwise is looking to add a SUI ETF to its growing list…

- Crypto News

Crypto Hacks 2025: North Korean Hackers Steal over $2B in ETH and SOL This Year

In 2025, crypto hacks increased significantly. The cybercriminals associated with the North Korean government stole…

- Crypto News

Universal Exchange Bitget Removes Barriers to Traditional Markets, Offers Forex and Gold Trading to Crypto Users

The number one universal exchange Bitget is removing barriers between crypto and traditional finance. It…

- Crypto News

Breaking: U.S. CPI Inflation Falls To 2.7% YoY, Bitcoin Price Climbs

The U.S. CPI inflation came in well below expectations, providing a bullish outlook for Bitcoin…

- Crypto News

Crypto Market Brace for Volatility Ahead of Today’s U.S. CPI Data Release – What to Expect

The crypto market could see some price fluctuations ahead of the release of the major…

- Crypto News

Breaking: Canary Capital Files S-1 for its Staked INJ ETF

Canary Capital amended its staked INJ ETF application with the U.S. Securities and Exchange Commission…