XRP Institutional Buying Soars 266% Before Key Filing in Ripple SEC Lawsuit

Highlights

- XRP saw a 266% rise in buying activity from instititional investors.

- Ripple awaits Form C and Form D appeals filing by the US SEC this week.

- Ripple CEO Brad Garlinghouse claims to end to the regulation-by-enforcement agenda by the SEC

- XRP price soars more than 1%.

XRP saw massive buying by institutional investors as the U.S. Securities and Exchange Commission and Ripple agreed to continue the legal fight in the Second Circuit Court of Appeals. With Ripple’s recent SEC lawsuit win in a district court and an upper hand in the circuit court, investors seemed more upbeat about a huge upcoming rally in XRP price.

Institutional Investors Buying XRP Heavily

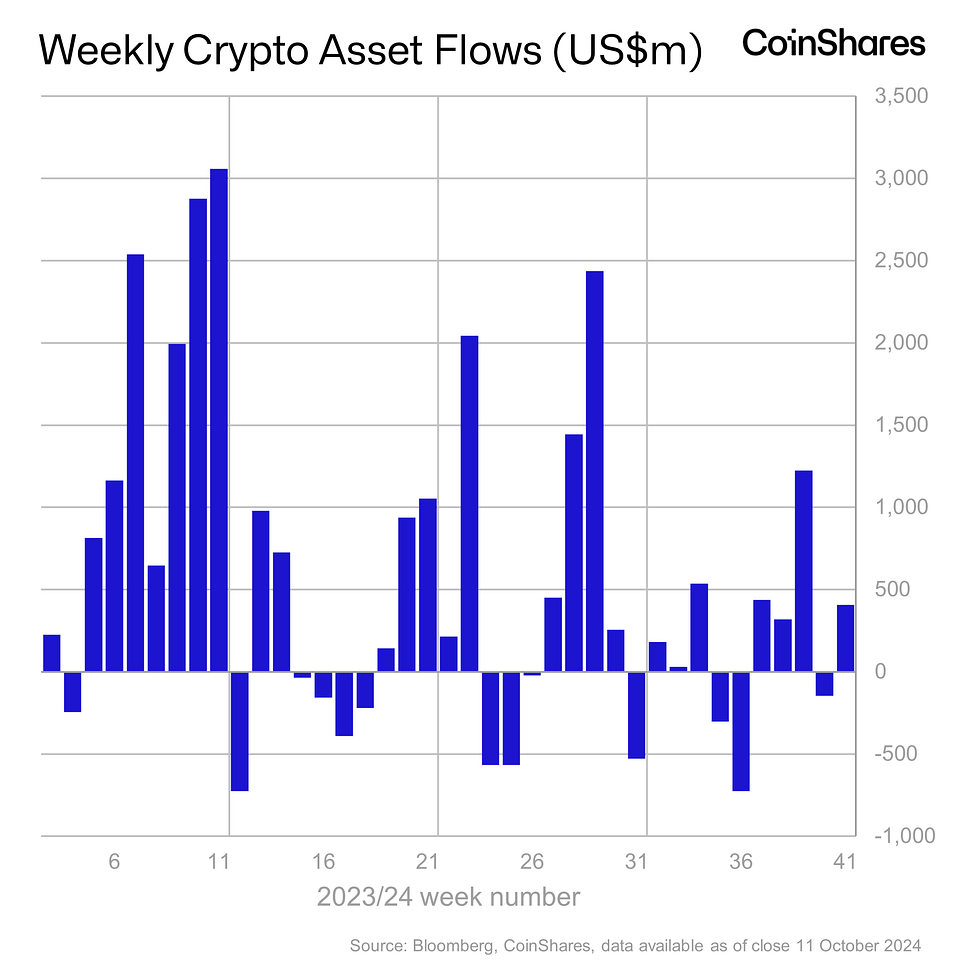

XRP saw $1.1 million in buying from institutional investors last week as compared to $0.3 million in the earlier week, as per CoinShares report on October 14. Thus, a 266% rise in buying activity was recorded week-over-week as Ripple and the US SEC prepared for appeals in the circuit court.

Digital asset investment products witnessed $407 million in net inflows in a week as investors remained bullish on an ‘uptober’ rally, coinciding with upcoming US elections. Investors ignored the rise in CPI and PPI inflation in the U.S. to continue buying the dips.

Amid the major XRP news, total XRP futures open interest also climbed over 6% in the last 24 hours. The futures OI has reached 1.39 billion worth $766 million.

Ripple Vs SEC Lawsuit Moved to Second Circuit Court

US SEC appealed against Judge Torres’ $125 million penalty decision in the remedies phase, instead of almost $2 billion in fines solicited by the agency. Form C and Form D filings with complete details on the appeal are due this week. The crypto community has slammed the SEC for appealing and stretching the long-running case.

Meanwhile, Ripple filed a notice of cross-appeal clearing its intention to oppose the SEC’s irrational appeal of Judge Torres’ ruling. Ripple CEO Brad Garlinghouse added that the cross appeal will seal the SEC’s fate and finally put an end to the regulation-by-enforcement agenda by the agency under Chair Gary Gensler.

Former SEC lawyers such as Marc Fagel and James Farrell believe the SEC will challenge programmatic sales, as well as secondary sales. US SEC has started suing and probing crypto-related companies for secondary market sales, which Judge Torres did not address in her landmark summary judgment last year.

Also, Bitnomial sued the U.S. SEC over the agency’s claim that XRP is a security despite clarity from the court. Moreover, lawyer Bill Morgan questioned the SEC’s rationale behind treating the futures as security futures contracts. He slammed the inconsistency in regulatory enforcement, especially when comparing XRP to similar cases with Ethereum (ETH), where the SEC had previously shown no objections to the futures contracts.

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?