XRP Lawyer Backs Judge Torres Deeming Ex-SEC Official’s Statement ‘Incorrect’

Highlights

- XRP lawyer disputes ex-SEC official's claim on Judge Torres' ruling, emphasizing interpretation differences.

- Ripple and Coinbase face implications as court rulings play key roles in the regulatory landscape.

- The debate over the application of the Howey test to cryptocurrency transactions intensifies amid legal battles.

In the ongoing legal saga between Ripple and the U.S. Securities and Exchange Commission (SEC), a recent statement by ex-SEC official John Reed Stark regarding XRP secondary market sales sparked controversy. Notably, pro-XRP lawyer Bill Morgan swiftly countered Stark’s assertion, igniting further debate in the crypto community.

Meanwhile, as regulatory clarity remains a key concern for investors, the nuances of court rulings hold significant weight in shaping the future of cryptocurrencies.

XRP Lawyer Challenges Ex-SEC Official’s Comment

Amid the Ripple vs. SEC legal battle, pro-XRP lawyer Bill Morgan has disputed a recent statement made by ex-SEC official John Reed Stark. As reported by CoinGape Media earlier, the ex-SEC official claimed that Judge Torres’ ruling implied secondary sales of XRP couldn’t be considered investment contracts. However, the XRP lawyer Bill Morgan argues that Stark’s interpretation is “incorrect”.

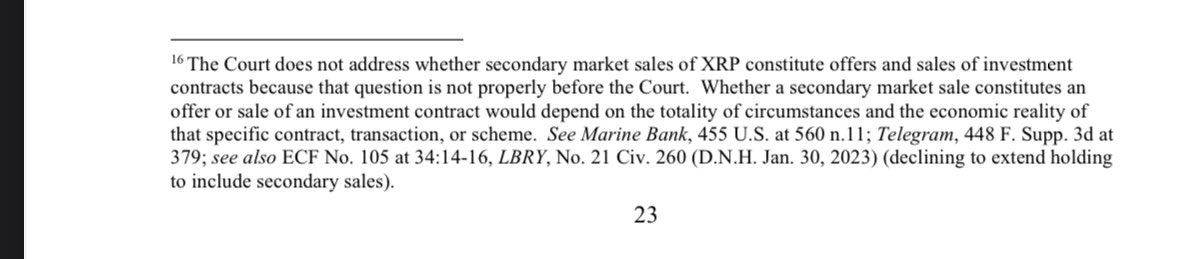

Meanwhile, Morgan clarified in a social media post that Judge Torres did not make any conclusive findings regarding the nature of secondary market sales of XRP. Rather, the court explicitly stated that this issue wasn’t properly before it.

In addition, he has also shared a court document to support his claims. Notably, the court order emphasized that determining whether such XRP sales constitute investment contracts depends on the specific circumstances and economic reality of each transaction.

Meanwhile, Morgan’s statement, in response to Stark’s assertion that Judge Torres’ logic in the Ripple case, has gained notable attention from the crypto market enthusiasts. For context, in an X post, John Reed Stark contended that Judge Torres’ ruling suggested secondary sales couldn’t be investment contracts because buyers might not know the seller’s identity.

Also Read: Ethereum Co-Founder Vitalik Buterin Criticizes Ongoing Meme Coin Frenzy

Crypto Market Seeks Regulatory Clarity From Ripple & Coinbase Case

The dispute over the interpretation of Judge Torres’ ruling holds significant implications for Ripple and Coinbase as they navigate the regulatory landscape. While the SEC seeks hefty penalties against Ripple, the court rulings play a crucial role in determining the legal status of cryptocurrencies like XRP and the operations of platforms like Coinbase.

Meanwhile, Judge Failla’s rejection of Judge Torres’ reasoning, as suggested by the ex-SEC official, underscores the complexity of applying the Howey test to cryptocurrency transactions. As the legal battle continues, both Ripple and Coinbase will rely on strategic legal arguments to defend their positions and address the SEC’s allegations of securities law violations.

On the other hand, the recent remarks from the XRP lawyer have also sparked discussions in the crypto market. Notably, the XRP price has added over 1.05% over the last 24 hours and traded at $0.6286 during writing.

Also Read: Prisma Finance Hacker Moves Funds to Tornado Cash

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- US Strike on Iran Possible Within Hours: Crypto Market on High Alert

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?