XRP Price Analysis Shows $1.4 Crash Imminent, But There’s A Catch

Highlights

- XRP price has recorded marginal gains today and held the $2 support.

- A top expert predicts a potential XRP price dip to $1.4.

- Despite short-term concerns, analysts remain optimistic on the future performance of Ripple's coin.

XRP price has shown signs of recovery today as the broader crypto market stayed in the green. But experts are not convinced about a full recovery yet. In fact, popular analysts warn that XRP could still dip sharply to $1.4 or even $1.3 before rallying toward higher price targets, potentially hitting double digits in the coming days.

XRP Price Soars But Analyst Warns Another Dip Ahead

XRP price was up over 1% today and traded at $2.09 along with its trading volume falling 6% to $3 billion. The crypto has touched a 24-hour high and low of $2.12 and $2.06, respectively, while its Futures Open Interest rose 0.5% to $3.09 billion.

However, the market pundits might not be convinced yet of a continuing rally ahead. Instead, they predicted that the crypto could slip to $1.4 or even lower before a strong rebound. Besides, with recent developments in the Ripple Vs SEC case, investors are also keeping close track of the crypto.

Analyst Warns Dip Ahead

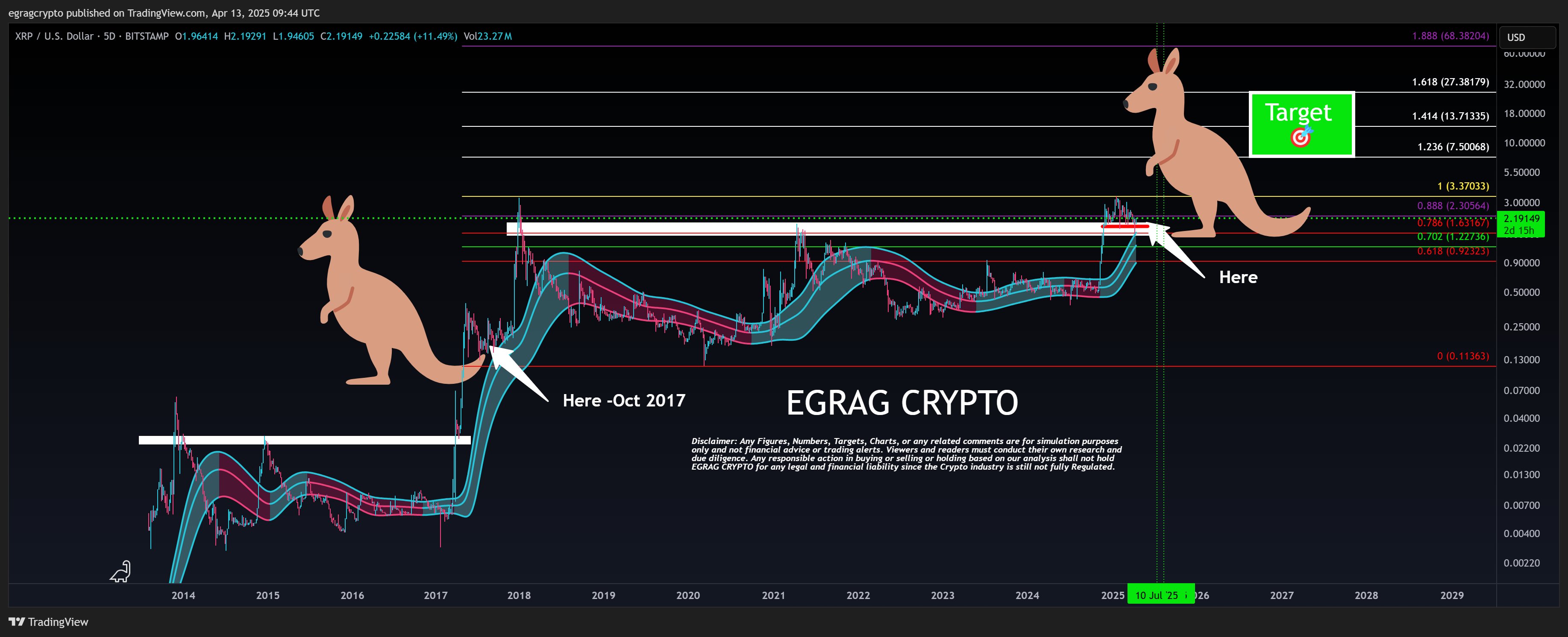

Despite recent optimism, crypto analyst EGRAG CRYPTO suggests that Ripple’s native crypto may not be out of the woods and said “The XRP Kangaroo is Clucking”. In a recent post on X, he noted that unless XRP closes above $2.30–$2.50 on the 5-day chart, a retest of $1.85 remains likely. More alarmingly, he hinted at a possible liquidation event that could cause a temporary “wick” to $1.4.

Meanwhile, he added that such sharp moves often come with surprise headlines. These narratives, he believes, are often orchestrated by market makers to trigger volatility. Drawing parallels with past events, the analyst highlighted how government policies like China’s mining bans or tariff announcements have been used to manipulate market sentiment.

EGRAG clarified that he isn’t trading actively right now. He’s neither shorting nor longing for the asset. Instead, he’s simply holding his position and accumulating more XRP at pre-defined levels. Despite the near-term risk, he remains confident in long-term targets at $7.50, $13, and even $27.

XRP Analyst Sees Liquidation Event As Market Tactic

EGRAG’s perspective suggests that the XRP price is vulnerable to quick, news-driven price swings. For context, the first XRP ETF goes live in the US successfully, fueling market sentiment recently. Besides, experts have said that Ripple price could hit a high of $15, citing JPMorgan’s prediction of ETF inflow.

Notably, these swings, according to him, aren’t always about fundamentals. Instead, they’re often tactics used by large players to shake out weak hands. He emphasized, “Tariffs on? The market dumps. Tariffs off? The market pumps.” This approach reflects how non-technical events are increasingly becoming tools for engineered volatility in crypto markets.

XRP Price Might Dip To $1.29 Before Rally

Adding to this cautious outlook, analyst Ali Martinez shared a similar bearish signal. He cited technical patterns that show XRP might fall to $1.29 before bouncing back. Martinez referenced renowned chart expert Thomas Bulkowski, stating that such a dip is not unusual.

“This pullback happens just to make trading interesting,” Martinez explained, referring to classic market behavior that aims to keep traders on edge. So, while a drop to the $1.4–$1.29 range looks possible, both analysts maintain a bullish long-term view.

Considering that, the analysts have advised us to stay calm, avoid panic selling, and watch the charts. In other words, despite short-term woes, the experts are still optimistic about the long-term trajectory of the XRP price.

- Ethereum Treasury BitMine Acquires 41,788 ETH as Tom Lee Predicts Crypto Market Bottom

- Breaking: Michael Saylor’s Strategy Adds 855 BTC Amid Bitcoin’s Crash Below Its Average Buy Price

- XRP News: Ripple Secures Full EU-Wide Electronic Money Institution License

- Ethereum Slips Below $2,200 Amid Broader Crypto Market Crash

- Crypto Market Crash: Why Are BTC, XRP, ETH, and DOGE Prices Falling Today?

- Here’s Why Pi Network Price Just Hit an All-Time Low

- Crypto Events to Watch This Week: Will the Market Recover or Crash More?

- XRP and BTC Price Prediction if Michael Saylor Dumps Bitcoin Following Crypto Market Crash

- Here’s Why MSTR Stock Price Could Explode in February 2026

- Bitcoin and XRP Price Prediction After U.S. Government Shuts Down

- Ethereum Price Prediction As Vitalik Withdraws ETH Worth $44M- Is a Crash to $2k ahead?