XRP Price Dips To $2.2, Here’s The Key Support Level To Watch

Highlights

- XRP price has recently slipped below the $2.2 level, sparking market concerns.

- Top experts revealed key support levels for Ripple's native crypto ahead.

- Despite short-term pullback concerns, experts remained optimistic on XRP's run towards $3 ahead.

XRP price has dipped to the $2.2 mark recently, amid a selloff noted in the broader market. The investors are appearing to be taking a cautious stance amid the recent pressure, which has fueled discussions among investors over further dip ahead for the crypto. However, amid this, a top expert has sparked speculations by highlighting the key support levels for Ripple’s native crypto ahead.

XRP Price Dip Fuels Market Speculations

The recent crypto market crash has fueled discussions in the market, especially as XRP price recorded a sharp decline today. Notably, Ripple’s native crypto was one of the top-performing altcoins in the recent days as market optimism soared due to the RLUSD launch, XRP ETF anticipation, and other positive market trends.

In addition, the crypto issued by US firms has gained notable traction amid Donald Trump’s support for the digital assets space. Despite that, the recent dip in XRP has fueled discussions among investors, with many seeking clarity on the potential future path for the crypto.

However, despite the dip, market experts remained confident in the asset due to the positive developments in the Ripple market. For context, a prominent figure in the market, The BitBoy recently lauded Ripple’s stablecoin launch and said that “RLUSD will drive billions of dollars in liquidity through XRP Ledger”.

In a separate post, he said explained why RLUSD is “so important” for Ripple’s native crypto. Meanwhile, he noted that “Stablecoins are the backbone” of the crypto market and “liquidity is king” in the digital assets space. Considering that, RLUSD is likely to boost liquidity, which in turn could provide a boost to the XRP price ahead.

Key Levels To Watch For Ripple’s Native Crypto

XRP price today slipped around 4% to $2.28 during writing, while its trading volume slumped 7% to $21 billion. Over the last 24 hours, the crypto has touched a low of $2.17, indicating strong selling pressure in the market. Furthermore, CoinGlass data showed that XRP Futures Open Interest declined 11% recently, reflecting the gloomy sentiment hovering in the market.

Amid this, top experts have revealed crucial levels for XRP to watch ahead. In a recent X post, EGRAG Crypto said that XRP has a key support level of $2.3. Once this level is crossed, the crypto will target $2.62 ahead and $3.28 in its next run.

Echoing a similar sentiment, another top expert Dark Defender said that XRP can dip to as much as $2.17. He noted that the crypto would continue to trade between $2.17 and $2.18 before another rally. However, despite the short-term concern, he remained optimistic about XRP’s run toward the $3 level ahead.

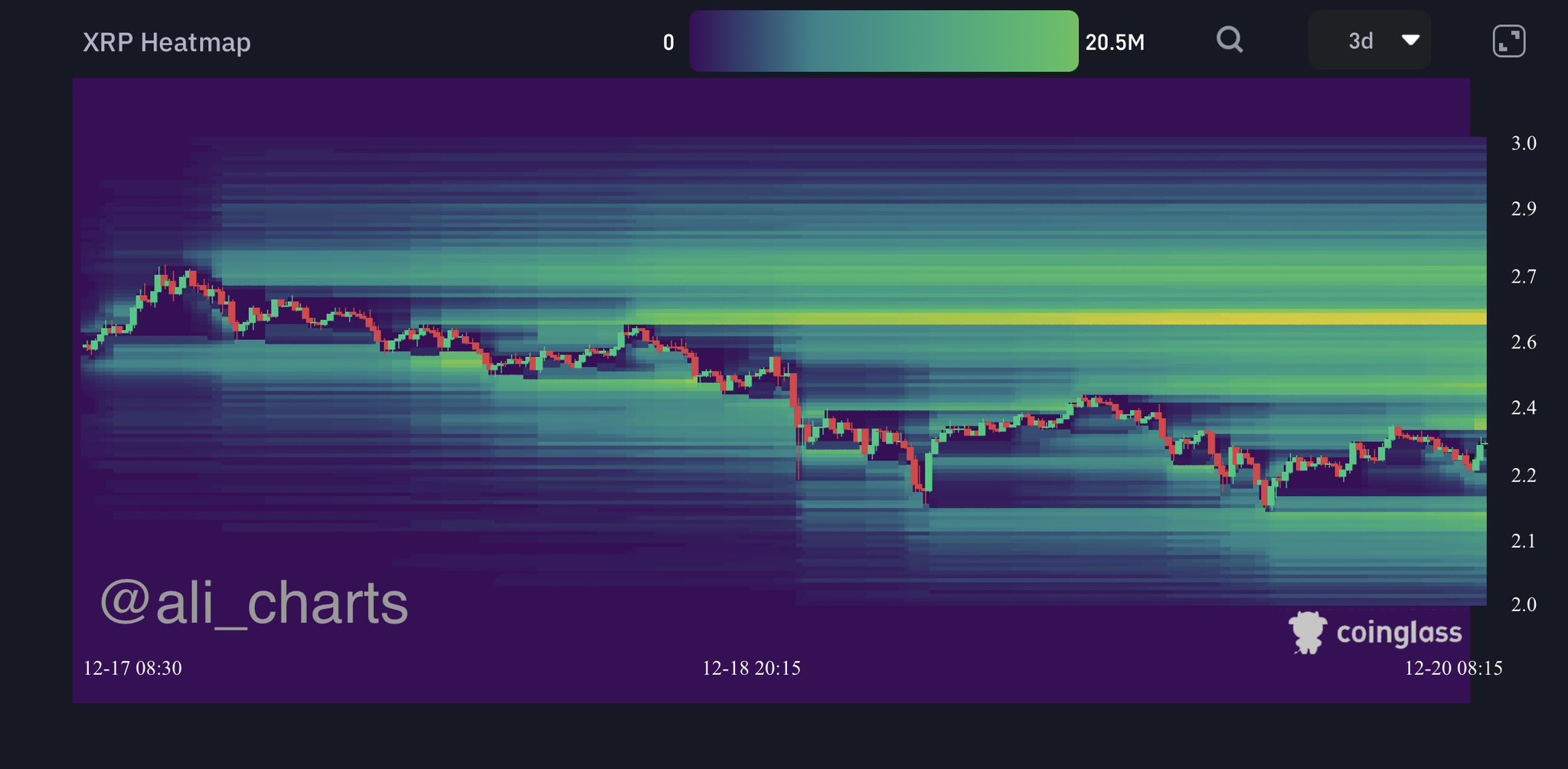

However, it’s worth noting that another market expert Ali Martinez has predicted a potential volatility ahead. In a recent X post, Martinez said that $20.5 million in “short positions will be liquidated” once XRP hits $2.62.

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k