Will Uptrend Continue for XRP Price? Coinbase, Kraken And Other Exchanges Relist XRP Token

XRP price towered across the crypto market on Thursday and Friday bolstered by the landmark ruling from Judge Analisa Torres in the Ripple vs. SEC lawsuit, deeming XRP not a security.

Although the lawsuit did not define what makes up a cryptocurrency and to a large extent, may have complicated regulations in the US, the fourth-largest cryptocurrency was saved from the dreaded security status.

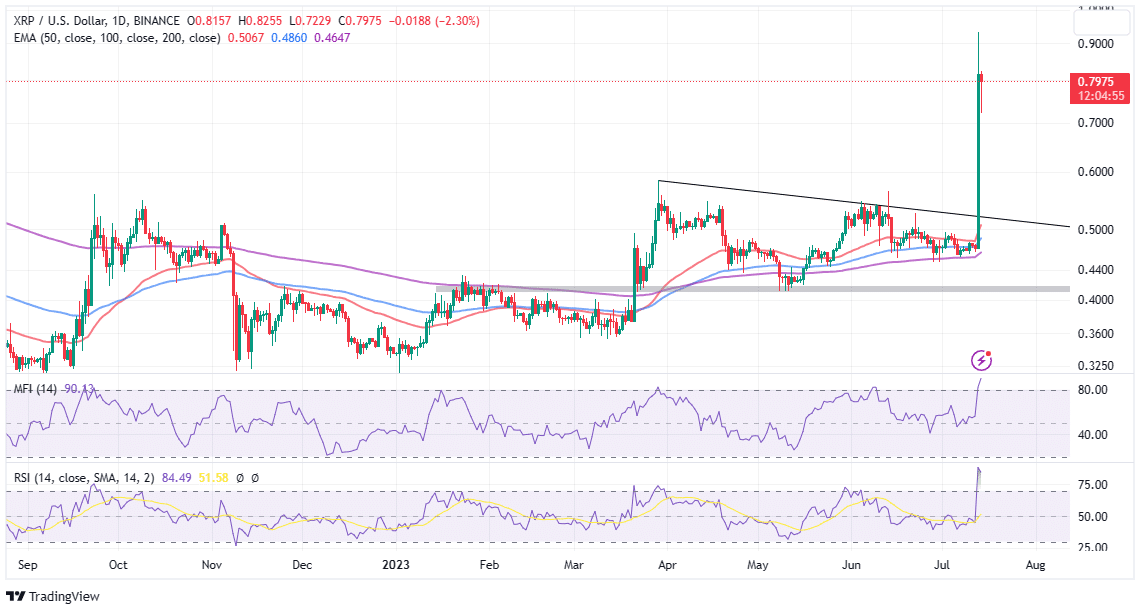

Following the ruling, investor interest in XRP surged, propelling the XRP price to $0.9351. Though, profit taking paused the rally with XRP retracing to trade at $0.7932 during the European session on Friday, higher support at $0.8 might mark the resumption of the uptrend.

XRP Overtakes BNB Becoming Fourth-Largest Crypto

The payments-oriented crypto token XRP exploded both in price and market cap surpassing Binance’s native token BNB to become the world’s fourth-largest digital token.

With $41 billion in market share, XRP now sits behind the largest stablecoin, Tether (USDT) with $83 billion. Meanwhile, BNB has assumed the fifth position with nearly $40 billion in market share.

XRP price could face a sudden correction based on the overbought conditions exhibited by the Relative Strength Index (RSI).

That said traders would be watching the XRP price reaction to resistance at $0.8. If defended, investors would be encouraged to keep buying XRP with the hope of a break above the psychological $1 resistance.

The Money Flow Index (MFI) movement into the overbought area above 80 means that more funds are flowing into XRP markets compared to the outflow volume. What this means is that XRP price is most likely to keep trending north then reverse the trend to retest support at $0.06 and $0.5, respectively.

Coinbase, Kraken Announce XRP Relisting

After facing regulatory pressure for more than two years, XRP holders can now smile after Judge Torres ruled that XRP is not a security in certain instances, particularly when sold on third-party protocols like cryptocurrency exchanges.

Analysts at Bernstein, a crypto broker said that the lawsuit outcome will eliminate the “securities overhang on tokens sold exchanges.” In addition, the landmark ruling is a “major relief for all tokens sold on secondary platforms.”

According to the analysts, the famous Howey test cannot be applied straightforwardly to crypto assets trading on exchanges. They argued that “the context of the transaction matters.”

“This weakens the U.S. Securities and Exchange Commission’s (SEC) stance that the securities law is clear and no separate clarity is required for digital assets, given the contextual interpretation required in every case,” the analysts at Bernstein said in a statement.

Many exchanges and digital asset entities that had delisted XRP citing regulatory scrutiny, including Coinbase, Kraken, and Bitstamp announced on Thursday that they intended to resume support for the token issued by Ripple.

“Following today’s court ruling, we have resumed trading of XRP in the United States effective immediately,” Bobby Zagotta Bitstamp USA CEO said in a written statement. “Bitstamp was one of the earliest exchanges to list XRP, and we are a leading liquidity venue for the asset globally.”

Gemini, another major U.S.-based crypto exchange run by the Facebook-founding Winklevoss twins, said it was also weighing the possibility of bringing back XRP.

Related Articles

- Terra Luna Classic Community Votes To Revise LUNC Gas Fees and Staking Undelegation Period

- Bitcoin Price Pushes Past $31k as US Judge Rules XRP Not A Security – Rally to $38k Impending?

- BinanceUS Ceases Trading For 9 Crypto Including BTC, ADA, MATIC, SOL, LTC

Recent Posts

- Crypto News

BlackRock Bitcoin ETF Ranks Among Top ETFs In 2025 Despite Crypto Downturn

The BlackRock Bitcoin ETF (IBIT) has emerged as one of the top exchange-traded funds (ETF)…

- Crypto News

Stablecoin Adoption Deepens as Klarna Turns to Coinbase for Institutional Liquidity

Klarna has taken a major step into crypto finance by partnering with Coinbase to accept…

- Crypto News

Ripple, Circle Could Gain Fed Access as Board Seeks Feedback on ‘Skinny Master Account’

The U.S. Federal Reserve has requested public feedback on the payment accounts, also known as…

- Crypto News

Fed’s Williams Says No Urgency to Cut Rates Further as Crypto Traders Bet Against January Cut

New York Federal Reserve President John Williams has signaled his support for holding rates steady…

- Crypto News

Trump to Interview BlackRock’s Rick Rieder as Fed Chair Shortlist Narrows to Four

The Fed chair race is heating up with U.S. President Donald Trump set to interview…

- Crypto News

Breaking: VanEck Discloses Fees and Staking Details for its Avalanche ETF

The leading crypto asset manager VanEck amends its Avalanche ETF with the U.S. Securities and…