Nearly 300,000 Ethereum Transferred to Coinbase By Two Whales, ETH Price Dump soon?

The world’s second-largest cryptocurrency Ethereum (ETH) could witness a massive price dump amid massive online transfers recently. As per the on-chain data, a staggering 300,000 ETH worth nearly $500 million has been transferred from two different wallets to the crypto exchange Coinbase.

The two wallet addresses in question belong to Coinbase and are cold wallets. After the funds were moved from these cold wallets to Coinbase’s hot wallet, they were subsequently dispersed among multiple addresses, with each transaction involving the transfer of 4282 ETH.

On-chain data provider Santiment explains: “Among the largest of 2023, this is the highest onchain transaction spike since June 13. The reasons for these moves are unknown, and may not necessarily impact price”.

As of press time, the ETH price has shown much volatility and is down 1.19% trading at $1,619 with a market cap of $194 billion. On the technical chart, Ethereum continues to show major weakness.

Ethereum (ETH) Price Analysis

After a significant decline from the critical $1.8K resistance level, Ethereum’s price slipped below both the crucial 100-day and 200-day moving averages, hovering around the $1.8K mark. However, it managed to find support at a significant level of $1.6K, sparking a rebound.

This support zone is of great importance as it corresponds precisely to the 61.6% Fibonacci retracement level, which aligns with the previous strong upward movement towards the $2.1K mark back in early March. Also, if the price falls below the $1.6K mark, the likelihood of a bearish downturn becomes increasingly plausible.

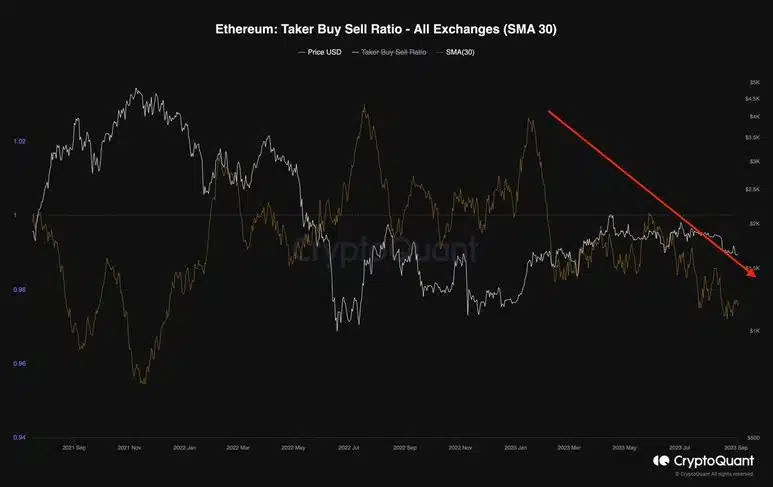

Furthermore, on-chain data also shows a strong bearish sentiment for Ethereum. The 30-day moving average on the chart shows that the buy-sell ratio for Ethereum has been on a downward trajectory over the last few months.

When this metric is above 1, it signifies a bullish sentiment. similarly, as the metric drops under 1, it signifies a bearish sentiment. Any drop under $1,6000 could tailspin into a deeper correction going ahead. Some market analysts also suggest the possibility of Ethereum touching $1,000.

The positive catalyst ahead would be the approval of the Ethereum Futures ETF which looks likely. The US SEC could soon give a nod for the same.

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling