Here’s Why Bitcoin Price and Altcoins Could Crash After Halving?

Highlights

- Over $2 billion in Bitcoin and Ethereum options are set to expire on Friday and $8 Billion on April 26.

- Bitcoin historical pattern sets Bitcoin price under $60,000 in April end.

- Markus Thielen said the BTC price downside below 60,000 and even 52,000 possible amid rising inflation.

- Tensions between Iran and Israel continue to escalate.

- Bitrcoin ETF inflow slows and possible bank run due to end of BTFP.

Bitcoin price tumbled from an all-time high as it failed to maintain momentum and broke below support levels around $68,300 and $63,400. Experts predicted a fall below $60,000 for consolidation to rally upside after Bitcoin halving and today BTC price fell to a low of $59,768. Can Bitcoin halving trigger a sudden change in sentiment to bring a massive rally in the crypto markets?

1. Bitcoin Options Expiry

Bitcoin halving is estimated on Saturday, April 20. Before that, over $2 billion in Bitcoin and Ethereum options are set to expire on Friday.

Over 21k BTC options of notional value $1.35 billion are set to expire, with a put-call ratio of 0.63. The max pain point is $65,000, as per Deribit data. Moreover, 27,785 ETH options of notional value of almost $0.90 billion are set to expire, with a put-call ratio of 0.42. The max pain point is $3,125. Both BTC and ETH are trading below their max point, causing high volatility in the crypto market.

However, the major test for the market comes during the monthly expiry on April 26. Over 88k BTC options of notional value $5.5 billion are to expire. The put-call ratio is 0.66, which indicates calls are significantly higher than put open interest. The max pain price is $60,000, signaling high odds of BTC price trading below $60,000 after Bitcoin halving.

Moreover, 860k ETH options of notional value $2.6 billion are to expire, with a put-call ratio of 0.51. The max pain point is $3,100. Thus, the market will brace for more than $8 billion in Bitcoin and Ethereum options expiry.

Bitcoin and Ethereum open interests are falling amid the lack of interest ahead halving, with derivatives volumes also declining. Traders are making calls for $100K in September.

Bitcoin’s funding rate has continued to decline into the halving which is now only days away. The decline in the funding rate indicates that traders have taken off bullish positions and that the market is now relatively light-positioned through the derivatives market.

Access the… pic.twitter.com/uvfMgDz5X4

— Matrixport (@realMatrixport) April 18, 2024

2. Bitcoin Historical Pattern

As the Bitcoin halving gets closer, Bitcoin and crypto market saw a pre-halving selloff similar to past Bitcoin halving events. A sudden increase in BTC price to all-time high is not viable as these usually take a few months to settle.

Elja Boom, Forbes 40 Under 40, said Bitcoin tends to have a bearish Q2 and Q3 and believes the trend will continue this year. Also, a rise in the cost of mining BTC will cause miners to sell their holdings as mining reward gets halved to 3.125 BTC. He said, “I’m not bearish on BTC and crypto, but I wouldn’t mind a few months of sideways action after 7 consecutive months.”

However, he still predicts a $150k+ price target for Bitcoin and $12k+ price target for Ethereum. Altcoins will also witness a massive pump amid rising crypto adoption.

3. Fed Rate Cut Delay and Macro Uncertainty

The hotter CPI, PPI, and PCE inflation figures, robust labor market, and the US economy resilience give the Federal Reserve options to consider delaying rate cuts. Fed Chair Jerome Powell and Vice Chair Philip Jefferson recently signaled a delay in rate cuts, with some reports even anticipating only 2 rate cuts this year.

The rallies in stock and crypto markets were triggered by speculation of Fed rate cuts in March, later shifted to May. However, the latest inflation reports caused Fed swaps to shift rate cuts to September. This caused a reversal in stock and crypto markets. 10x Research CEO Markus Thielen claimed CPI data is more crucial than Bitcoin halving. CPI came at 3.5% causing BTC price to slip.

JPMorgan and other Wall Street banks estimated inflation to remain high for months. Analysts now predicts Bitcoin price to fall below $60,000 and even to as low as $52k. In a new 10x Research report, Markus Thielen said “The price rally may not be immediate and downside could open to 60,000—if not 52,000.”

4. Iran-Israel Tensions

The tensions between Iran and Israel caused nearly $500 billion lost in crypto liquidations in the last few days. The global crypto market dropped from $2.64 trillion to a low of $2.21 trillion. The situation has not cooled as the Israeli war cabinet conducted meetings on how to respond after the aerial attack by Iran.

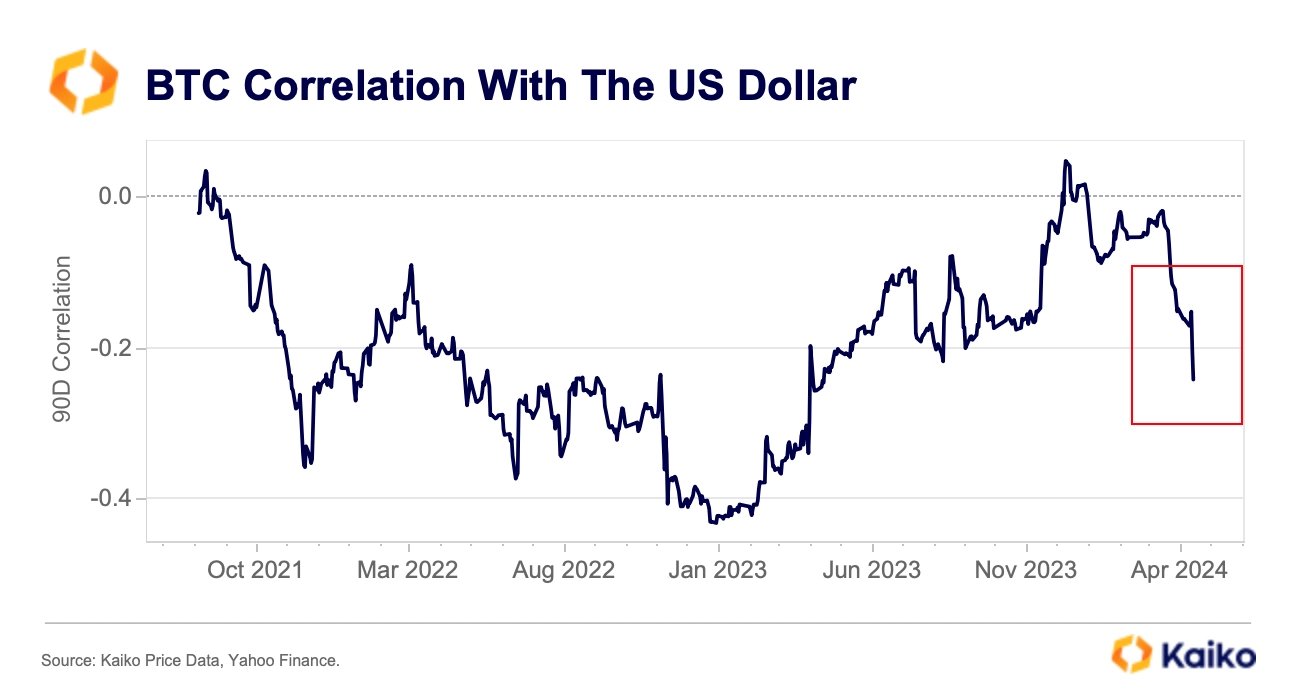

This and other macroeconomic events caused US dollar index (DXY) to climb above 106, the highest level since early November. Also, the US 10-year Treasury yield (US10Y) jumped to a 6-month high of 4.622%, failing to drop lower. As Bitcoin moves opposite to DXY and Treasury yields, a rise in both has caused a downfall in Bitcoin price to $60k.

Kaiko reported that BTC’s 90-day correlation with the US Dollar index dropped to a negative 0.24, lowest level in over a year due to higher-than-expected US inflation data and escalating geopolitics tensions.

5. BTC ETF Outflow

Spot Bitcoin ETFs saw a fourth consecutive outflow this week, with a net outflow of $165 million on Wednesday. The Bitcoin ETF buying activity has dropped significantly in the last few days, likely due to falling institutional interest and tax filing in the United States.

The outflows from Grayscale GBTC have shown signs of slowing down this week. However, on April 17, outflows from GBTC increased to $133.1 million from $79.4 million. Ark 21 Shares Bitcoin ETF (ARKB) also witnessed another day of negative outflows and Bitwise Bitcoin ETF (BITB) saw its first-ever outflow of $7.3 million on Wednesday.

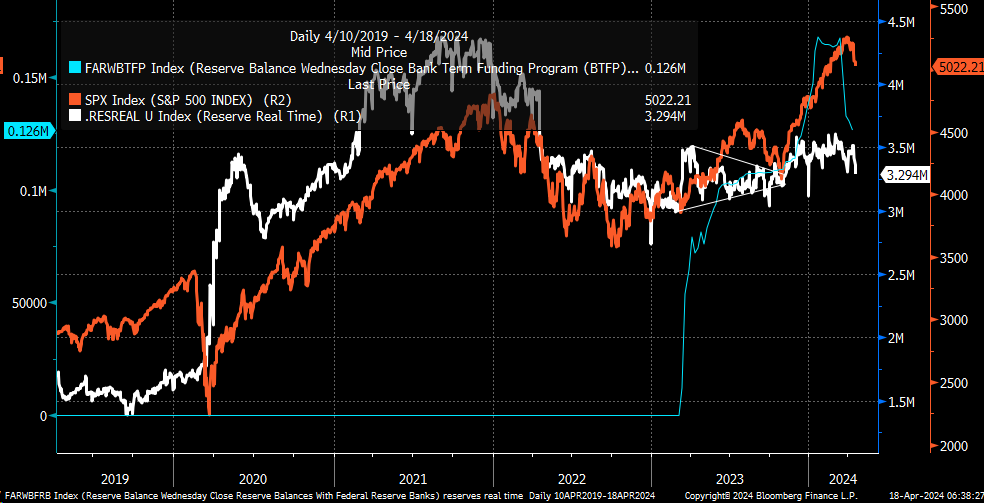

6. Bank Runs Due to BTFP End

The Treasury Reserve balances are falling quickly as the TGA ramps higher and the BTFP drains. Without BFTP, banks are likely to fall again as the Fed delays rate cuts and conditions look grim. Bank Term Funding Program (BFTB) is an emergency lending program created by the Federal Reserve to provide additional funding to banks.

In March 2023, a sudden failure of banks like Silvergate Bank, Signature Bank, and Silicon Valley Bank led the Fed and Treasury Dept to put banks BFTP support amid a massive bank run. Experts said as BTFP has ceased making any new loans, a huge chunk of consistent liquidity has been pulled out. This is short-term bearish for markets.

Also Read:

- Binance Announces Airdrops, Web3 Quest Platform Megadrop

- Toncoin Teases Major Announcement, What’s Next For TON Price?

- Bitcoin Price: Whale Dumps $1B BTC To Binance Ahead Of Halving, What’s Next?

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum