Aave Price Leads Altcoin Recovery, Here’s Possible Reason

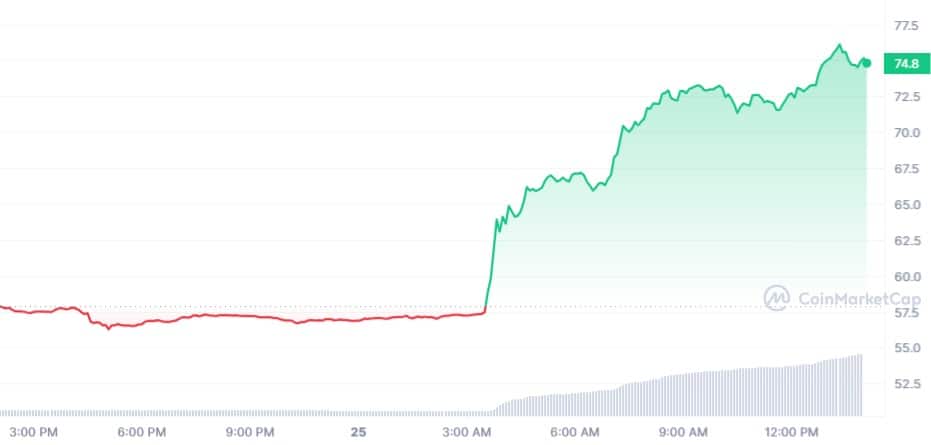

The digital currency ecosystem is seeing a mixed reaction today and while the combined crypto market cap is down by 0.10%, decentralized lending protocol Aave is currently leading altcoin momentum.

Aave Price Jump and Possible Triggers

At the time of writing, Aave is changing hands at a spot price of $74.46 after printing a parabolic 29.04% growth in the past 24 hours. The coin has now extended its gains in the past month where it has increased its value by more than 45%. As it stands, Aave is one of the biggest beneficiaries of the recent price rally and is now trying to pare off the losses it has accrued in the past year.

The trigger for this growth is not far-fetched as the protocol has doubled down on its innovation with respect to its V3 engine. Over the course of the past week, Aave has expanded the number of assets that users can inject cash into or provide liquidity for to multiply their productivity.

Aave has also recorded a number of upgrades that now makes the usage of the platform more seamless for users.

The decentralized lending offering that Aave is known for has seen limited competition in the broader industry when compared to other niches like exchanges and memecoins.

First Mover Advantage

Aave is one of the first lending platforms in the Decentralized Finance (DeFi) space and its consistency and first mover advantage has positioned it as a protocol under many user’s radar.

The platform has stood the test of time, transitioned alongside Ethereum from the Proof-of-Work (PoW) system to the Proof-of-Stake (PoS) and has remained innovative with the launch of its stablecoin – GHO – and new versions of its lending outfit over the years.

The deep ties to Ethereum has also made it one of the lenders with the most reliable and robust liquidity, giving it the upper hand against other lending startups hosted on other chains across the board.

Thus far this year, Aave has gained more than 43% in the Year-to-Date (YTD) period.

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs