After Tesla (TSLA), Binance to List Coinbase Stock Token (COIN/BUSD) Next

Just as crypto exchange Coinbase (COIN) is all set to go public ahead today, April 14, on Nasdaq, Binance announced that it will release the Coinbase Stock Token on the same day. As per the official announcement, the COIN/BUSD trading pair will be open for trading from Wednesday, April 14.

#Binance Will List the @Coinbase Stock Token $COIN

➡️ https://t.co/8WCWLvJI9a pic.twitter.com/x6XvADlp52

— Binance (@binance) April 14, 2021

Just two days back on Monday, Binance announced its zero-commission tradable stock tokens in the market. As per the official announcement:

“Binance Stock Tokens are zero-commission digital tokens fully backed by a depository portfolio of underlying securities that represents the outstanding tokens. Holders of stock tokens qualify for economic returns on the underlying shares, including potential dividends.”

The Binance Stock tokens feature allows investors to own fractional stocks instead of buying the who quantity. This allows small retail players to invest in companies that could be potentially very expensive to own and out of their reach. On a large front, it bridges the gap between the crypto world and the traditional stock market.

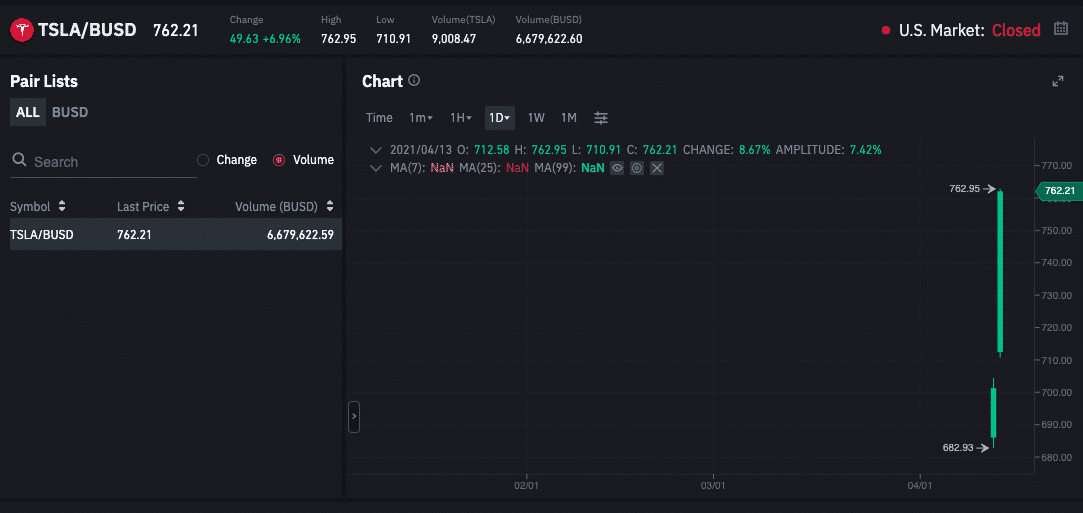

Good Market Response for the TSLA/BUSD Trading Pair

There’s been a strong market response after the Tesla/BUSD i.e. TSLA/BUSD trading pair went live on Monday. The TSLA/BUSD trading pair represents 1/100th of the TSLA stock’s market price. As per the official Binance data, the TSLA/BUSD trading pair has clocked 6.6 million in volume.

Commenting on the new Binance Stock Tokes feature, Binance CEO ChangPeng Zhao said that it will further broader retail investors’ access to the liquidity market while creating a more “inclusive financial future”. The Binance Stock tokens trading feature is available for investors worldwide except for some restricted jurisdictions like Turkey, China, and the U.S.

To bring this feature to the market, Binance has collaborated with regulated German firm CM-Equity AG and Switzerland-based asset tokenization platform Digital Assets AG. Earlier on Monday, Binance announced its Q1 2021 results with 260% growth in traded volume and a 346% surge in users.

The native Binance Coin (BNB) price has also skyrocketed above $600 earlier this week followed by a massive DeFi activity on the Binance Smart Chain (BSC).

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs