Analyst Warns Bitcoin Price Could Drop Below $60k Amid Trump’s Reciprocal Tariffs

Highlights

- Titan of Crypto has warned that the Bitcoin price could drop below $60,000 if it fails to hold above $81,872.

- Donald Trump's reciprocal tariffs could trigger this price crash.

- The analyst raised the possibility of Bitcoin bouncing back by May.

Crypto analyst Titan of Crypto has provided a bearish outlook for the Bitcoin price, predicting it could drop below $60,000. This comes amid Donald Trump’s announcement of reciprocal tariffs, which could trigger this price crash.

Bitcoin Price Could Drop Below $60,000 If It Fails To Hold This Level

In an X post, Titan of Crypto warned that the Bitcoin price could drop below $60,000 if it fails to hold above $81,872. He remarked that BTC must hold within this range, stay above the 50-week Exponential Moving Average (EMA), and keep the weekly RSI above key support.

He warned that the flagship crypto could witness a deeper correction if it fails to hold above those levels. His accompanying chart showed that a drop below $60,000 could occur as part of this correction, with Bitcoin touching $58,500.

This bearish outlook for Bitcoin follows US President Donald Trump’s announcement of reciprocal tariffs on all countries. This move could spark this downtrend for BTC, especially as a global trade war heats up. The flagship crypto has already dropped from as high as $88,000 following this announcement and could soon lose the $80,000 range.

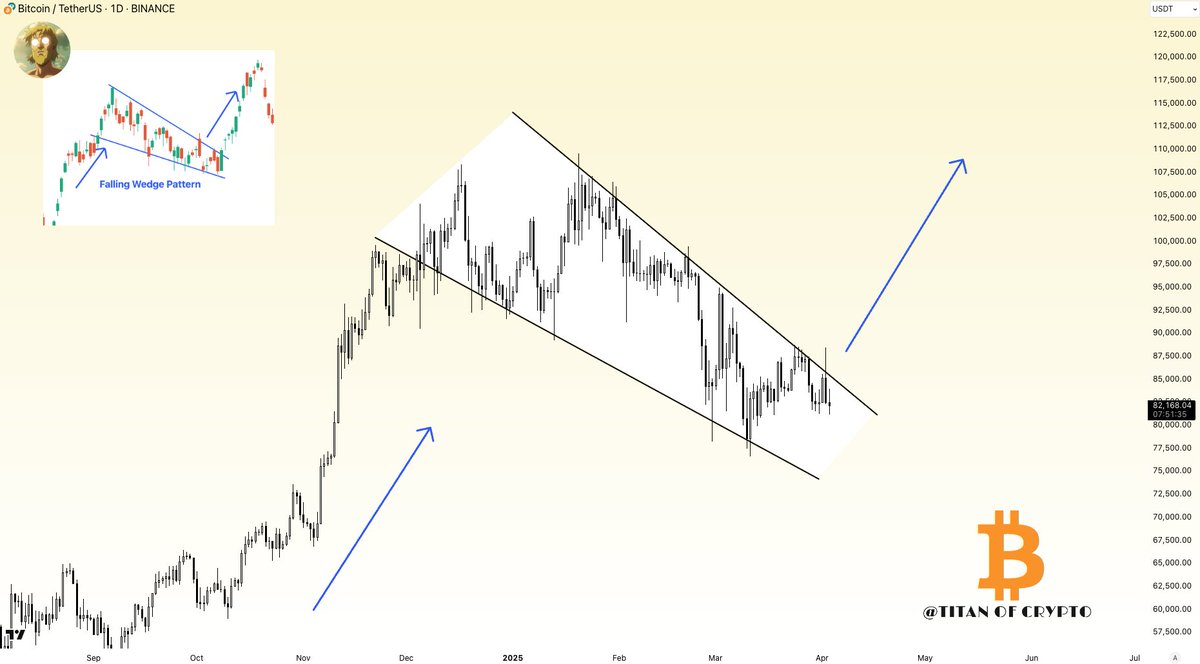

In the long term, Titan of Crypto believes the Bitcoin price could still rebound. He highlighted a Falling Wedge pattern, which was forming for the flagship crypto. The analyst remarked that over the next couple of months, the CPI and Core PCE will likely improve as Trueflation data shows inflation cooling off significantly. He then raised the possibility of this setting the stage for a “strong” BTC bounce by May.

Macro fundamentals continue to heavily impact Bitcoin’s price and the broader crypto market. A CoinGape market analysis highlighted the Nonfarm Payrolls (NFP) report and Fed Chair Jerome Powell’s speech as two key macroeconomic events to watch this week.

Bullish Scenario For BTC

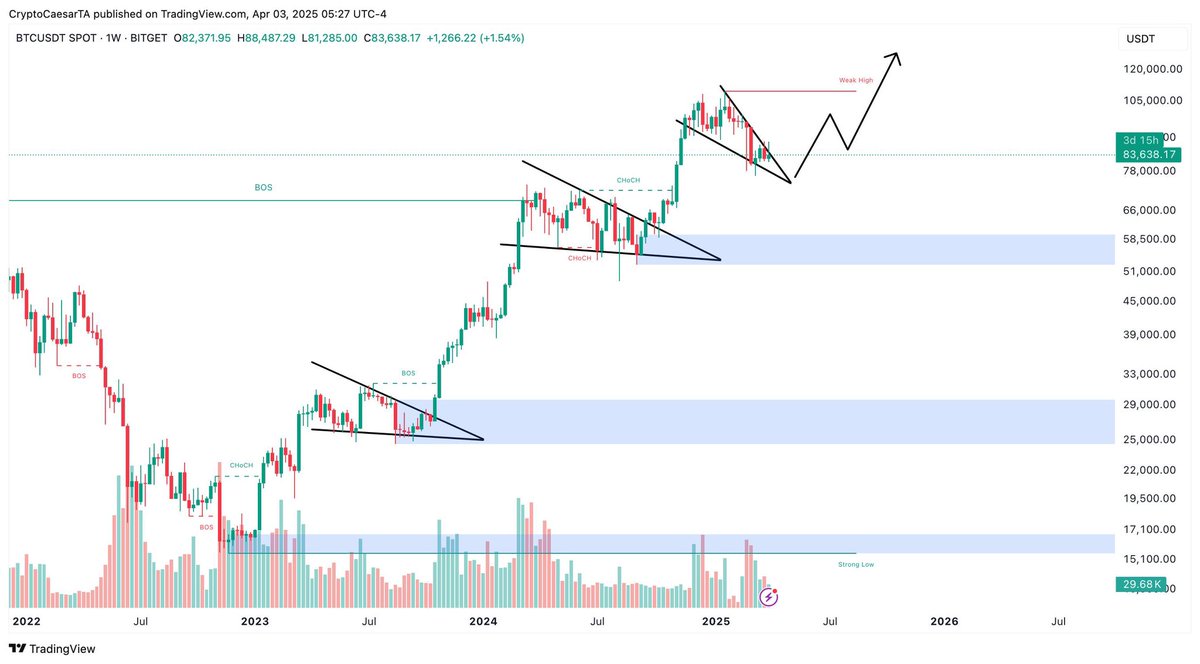

Amid this persistent downtrend for the Bitcoin price, analysts are still providing bullish predictions for BTC. Crypto analyst Crypto Caesar stated that his bullish scenario for the BTC price is a rally to $120,000, which will mark a new all-time high (ATH) for the flagship crypto. He suggested that this price level would mark the top for BTC in this cycle.

Meanwhile, crypto analyst Trader Tradigrade asserted that the Bitcoin price is poised for the final surge. He remarked that a surge begins whenever BTC’s RSI breaks the ascending triangle. Interestingly, his accompanying chart showed that Bitcoin could reach as high as $650,000 on this final surge, although this looks likely to happen next year.

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- CLARITY Act: Crypto Group Challenges Banks Proposal With Its Own Bill Suggestions

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?