As Bitcoin Goes Below $20K, Stats Show How Close Is Bottom

Amid much hype of buying the dip at current prices and market reaching its bottom in this cycle, statistics reveal important insights. Key indicators reveal that the current levels are hovering around the late bear market stage.

As of writing, Bitcoin is trading at $19,986, down by 4.40% in the last 24 hours, according to price tracking website CoinMarketCap. As it is BTC is staring at the danger of closing the month below the 200 week moving average for the first time ever. So far this month, Bitcoin failed to close above the 200 week moving average level for the third consecutive time.

Bear Market Entry Signals

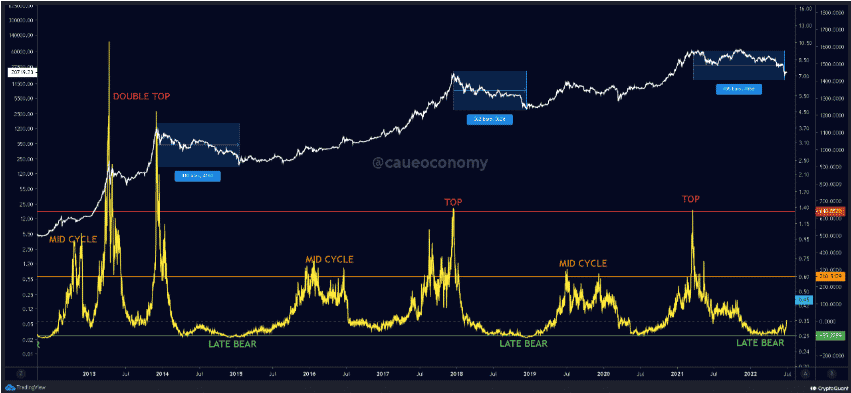

According to caueconomy of CryptoQuant, the rate of change of the Puell Multiple could be utilized to gauge important trends. The Puell Multiple is a valuation tool to assess revenues of Bitcoin miners.

Analysis shows we are likely to be in a late bear market stage. However, chances are the trend could witness a reversal soon.

“We are in a late bear market stage and may soon reverse. By using the rate of change of the Puell Multiple we were able to have an even more optimized view than the indicator itself.”

Three Stages Leading To Bitcoin Bottom

The Bitcoin market cycle is characterized by three cycles, which includes a market top.

The mid-cycle across the orange line indicates early stages of generalized euphoria. Following this is the market reaching its peak across the red line. The regions of euphoric bull market top crossed at the red line with high precision.

In the current stage, the bear market entry and confirmation is shown along the Bitcoin bottom green line. “When the indicator starts to rise again, indicating that it is leaving the bear market region. We can assume that we are already at the end of the bearish cycle, close to a complete reversal. We are at a bear market bottom formation.”

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs