Ad

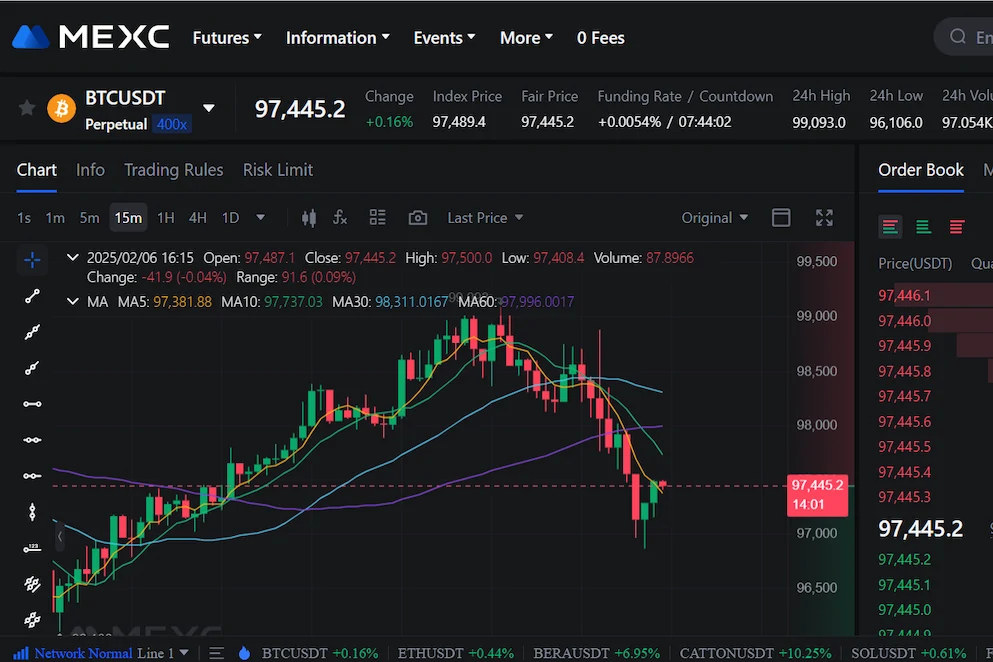

Sign Up on MEXC

- Start trading without hidden costs Zero Fees on Trades

- Catch the next big altcoin before the crowd Early Access to Tokens

- News

- Markets

- Top

- Guides

- Podcast

- Block of Fame

- Awards

- About

Ad

FY Energy

- Renewable Powered Digital Infrastructure Complete the registration and get $20

- Sustainable Passive Income Growth Sign in daily to get $0.8