Beware of the Litecoin (LTC) Price Rally, Here’s Why 30-40% Correction Is Possible

Litecoin(LTC) has been leading all of the top ten cryptocurrencies with over 25% gains last week. On Monday, July 3, the LTC price touched its new 2023 high of $114 with its market cap crossing $8 billion.

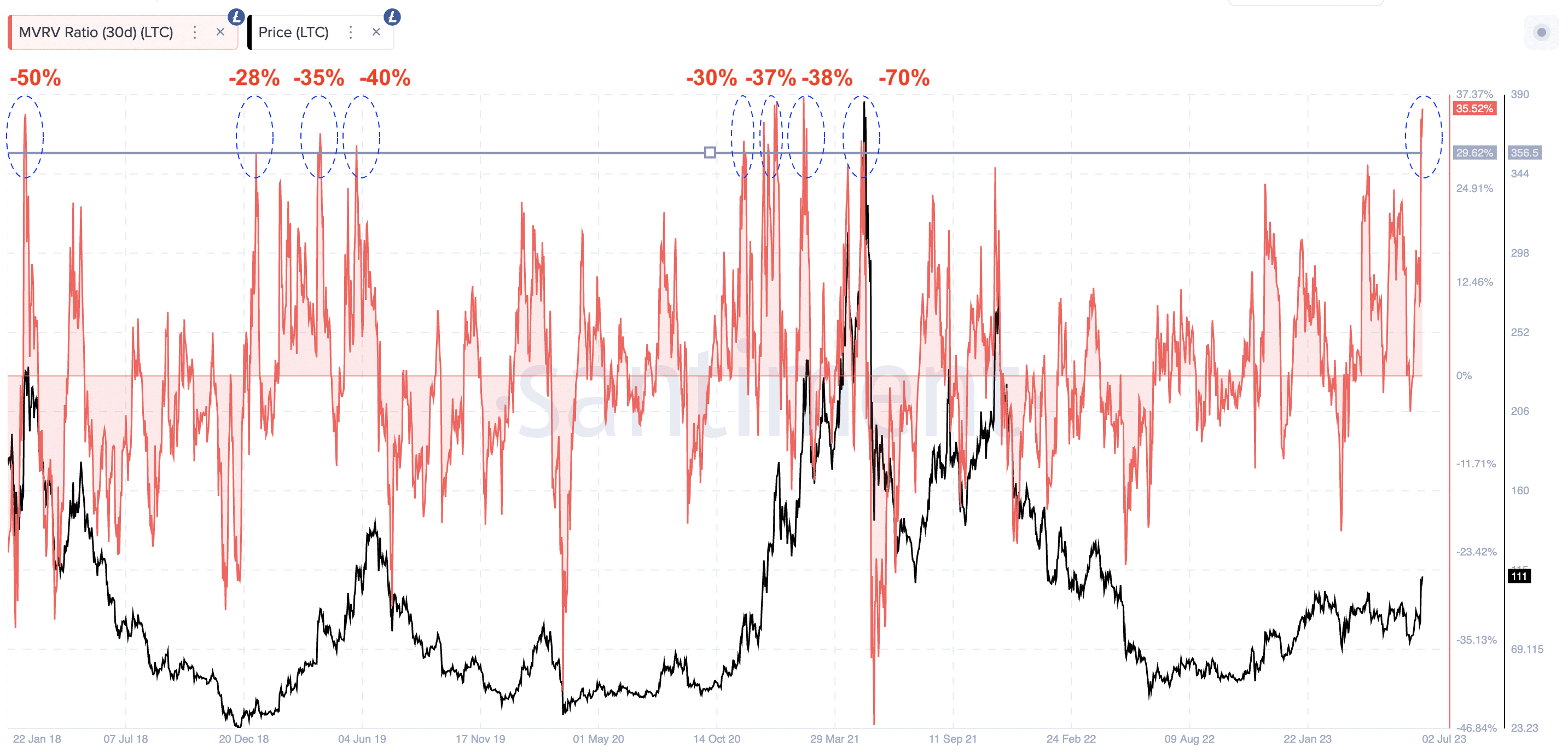

With the Litecoin halving event just around 40 days from now, there’s a strong bullish sentiment around the cryptocurrency. While analysts have been giving further bullish price targets for LTC, the on-chain indicator suggests that investors should maintain some caution going ahead. Popular crypto analyst Ali Martinez explained:

Currently, #Litecoin MVRV 30D hovers around 35%. Historically, each time $LTC MVRV 30D exceeds the 30% mark since 2018, a sharp price correction typically follows! This usually translates to a #LTC price drop ranging from 30% to 40%.

Earlier this year in 2023, the Litecoin (LTC) price crossed $100 twice, however, it soon faced strong selling pressure thereafter seeing a fall of nearly 20% before rising back once again.

Litecoin Halving Ahead

As per the schedule, the Litecoin blockchain will undergo the halving event next month around mid-August. Litecoin enthusiasts are getting ready for an important event called the “halving.” This event, happening on August 5, will reduce the amount of new Litecoin coins being created by half. This decrease in new coins entering the market is expected to have an impact on supply and demand, potentially leading to price increases.

Since the beginning of 2023, LTC’s price has risen by approximately 53%, reaching its highest point of $114.50 on July 3. The approaching halving event has sparked excitement and anticipation among investors, as they hope it will further boost the price of Litecoin.

Last week, the Litecoin hashrate reached an all-time high since the network activity spiked ahead of the halving event. In June, the Litecoin hashrate experienced a notable increase. This rise in hashrate was accompanied by a corresponding increase in mining difficulty, making it more challenging to discover new blocks.

Miners have responded to this challenge by adding more machines to their mining operations, aiming to improve their chances of successfully finding blocks. As a result, the overall hashrate has risen.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs