Breaking: United States Denies Plans Of Stalling Payments As Debt Default Looms

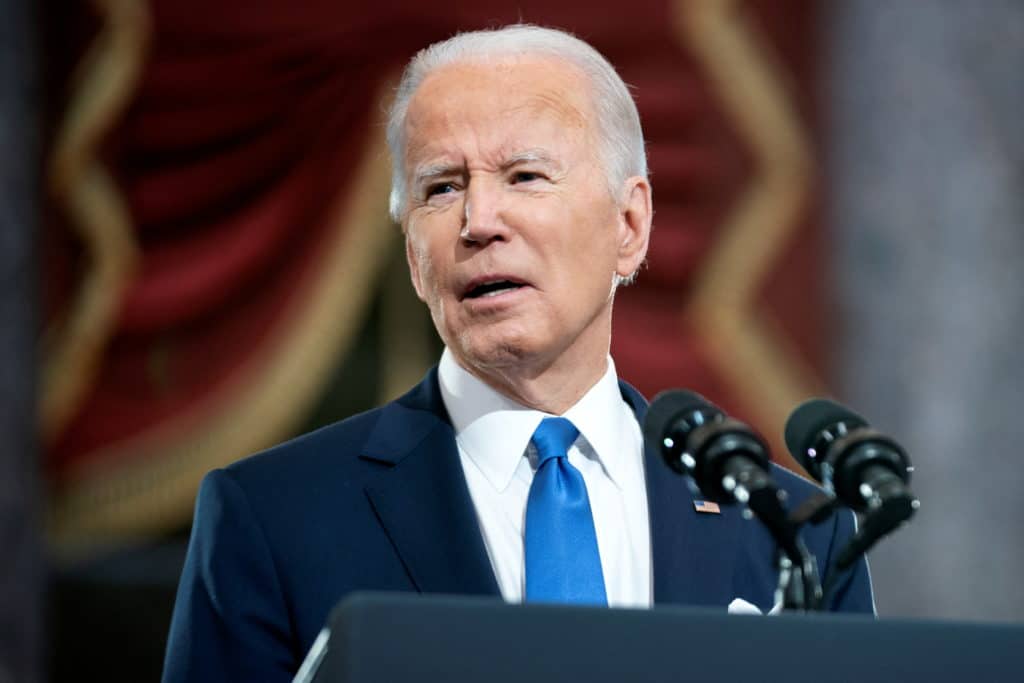

As the United States edges closer to a potential default on its debt, the Treasury Department had reportedly been inquiring government agencies about the possibility of delaying upcoming payments in order to avoid a catastrophic default. However, those rumors of a contingency plan have been discarded by the Biden administration on Thursday.

US Denies Contingency Plan

According to a report by WSJ, Treasury officials had quietly been preparing for the possibility of delaying certain payments after June 1. With the deadline fast approaching and Congress yet to raise the debt limit, the Treasury was seeking flexibility by considering payment delays until it had sufficient funds to cover the full day’s bills. While discussions surrounding this plan had taken place across the government, no instructions were given to agencies to alter their payment procedures.

Read More: McCarthy Stays Optimistic, Claims “We Could Get Debt Ceiling Deal Any Time”

Earlier reports had revealed that the Treasury reached out to counterparts in federal agencies to explore the option of delaying payments due before early June. By postponing payments until June 15, the expected influx of quarterly tax payments could potentially provide additional funding, thereby extending the default deadline into July. This strategy would have offered temporary relief and allowed for further accounting measures to prevent an immediate default.

Mounting Debt Ceiling Pressure

Federal officials are bracing for the possibility that Congress will fail to raise the borrowing cap of approximately $31.4 trillion in time. Treasury Secretary Janet Yellen has consistently emphasized the need for prompt action from Congress to avert financial calamity. In a letter addressed to lawmakers on Monday, Yellen warned that the U.S. could face an inability to meet all its financial obligations as early as June 1 if decisive measures were not taken.

In conjunction with the contingency planning, Treasury officials have been collaborating with agencies to assess their payment requirements. David Lebryk, Treasury’s fiscal assistant secretary, issued a memo earlier this month requesting agencies to notify the Treasury of any large impending payments, which could magnify the agency’s coffers ahead of the due date.

Economists and market experts have repeatedly cautioned that failure to reach a deal by June 1 could have severe consequences, potentially leading to a market crash and a burgeoning recession. Moreover, extending the deadline itself could introduce volatility in both the US stock market and the crypto market, as investors grapple with uncertainty stemming from the potential default scenario.

As the clock ticks, the financial stability of the United States hangs in the balance and therefore demands swift resolution from the ongoing debt ceiling talks between the Biden administration and the Republicans.

Also Read: Binance Launches NFT Lending Feature To Rival Blur’s Blend Protocol

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- USDT And USAT Get Adoption Boost as Tether Invests in Whop for Faster Settlements

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

Buy Presale

Buy Presale