Breaking: Binance And Changpeng Zhao Faces FTX Lawsuit To Return $1.8B Fund

Highlights

- FTX sues Binance and its founder Changpeng Zhao for $1.8 billion fraudulently transferred funds.

- The filing claims that Sam Bankman-Fried allegedly transferred FTX funds via a share repurchase agreement.

- FTX claims that Binance's statements destabilized its financial position before the collapse.

FTX has recently filed a lawsuit against Binance and its former CEO Changpeng Zhao, demanding a return of $1.8 billion. According to FTX, the fund was fraudulently transferred by its co-founder, Sam Bankman-Fried, to the leading crypto exchange. This legal development has sparked speculations in the broader crypto market, especially as it comes as FTX works to recover funds following its collapse two years ago.

FTX Seeks $1.8B Clawback From Binance And Changpeng Zhao

According to a recent Bloomberg report, FTX alleges that the exchange and Changpeng Zhao (CZ) received the $1.8 billion as part of a share repurchase agreement in July 2021. In this transaction, Sam Bankman-Fried or SBF reportedly used a combination of the FTT, BNB, and BUSD, to repurchase approximately 20% of the international unit of FTX and 18.4% of the US-based entity.

The report notes that at the time, the total value of these assets was around $1.76 billion. In its filing, the defunct exchange contends that it and its sister firm, Alameda Research, may have been financially unstable from the beginning and were likely already insolvent by early 2021.

Based on this, the FTX estate argues that the share repurchase deal was fraudulent and should be voided to reclaim the transferred funds. Adding to the allegations, it accuses CZ of issuing misleading statements ahead of FTX’s collapse.

In November 2022, Zhao tweeted that the exchange intended to sell its FTT holdings, worth $529 million. This announcement triggered massive withdrawals from the defunct exchange, leading to a liquidity crisis. According to the filing, these statements were designed to destabilize FTX, escalating the company’s financial troubles.

FTX Expands Legal Actions

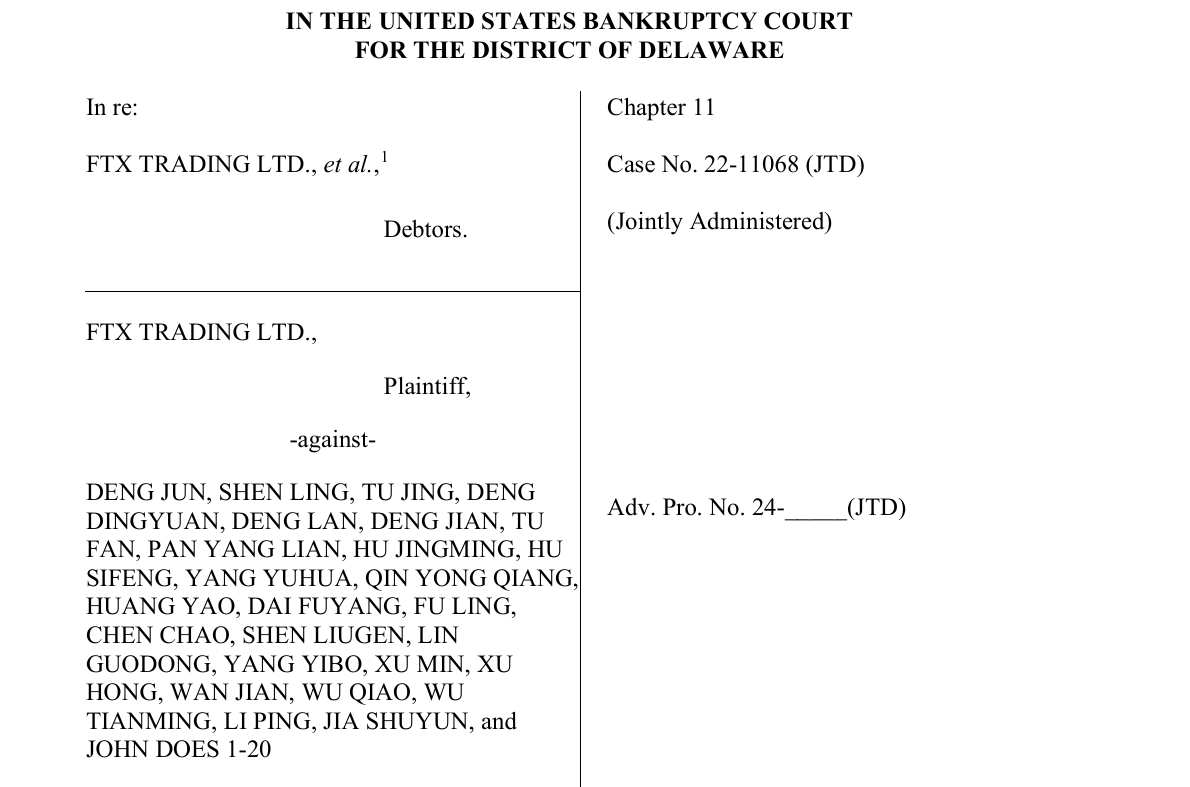

The lawsuit against Binance and Zhao is part of FTX’s broader legal efforts in Delaware’s bankruptcy court. For context, in another latest legal action, the defunct exchange targeted Chinese nationals, alleging their engagement in large-scale money laundering.

According to the report, the exchange claimed that 26 Chinese individuals and 20 unidentified individuals laundered billions through the platform. It added that the individuals have withdrawn $468 million in cash and cryptocurrency within a critical 90-day period.

Meanwhile, the case against CZ has also caught attention as the ex-CEO of the top crypto exchange made a recent comment on FTX. Besides, it also comes just after lawyers filed to dismiss the Binance SEC lawsuit, sparking discussions in the market.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs