Breaking: Binance Brings Back Zero-Fee Trading For Bitcoin, SHIB, PEPE, Other Crypto

The world’s largest crypto exchange Binance on Thursday said it will relaunch its most popular zero-fee trading for a limited period from today onwards. Users will be able to enjoy zero trading fees when purchasing cryptocurrencies from May 18-June 18, 2023. However, the limited period zero trading fee is only applicable on Auto-Invest.

The move comes as Bloomberg reported that Binance continues to lose its dominance in the crypto market due to heightened scrutiny and regulatory action by US regulators. Also, Binance is witnessing low liquidity as compared to earlier quarters as Jump Crypto and Jane Street are pulling back their market-making activity from the US.

Also Read: Do Kwon and Terraform Labs Withdraw Millions A Year After Terra-LUNA Crisis

Binance Announces Zero Trading Fees After Losing Market Share

Crypto exchange Binance introduces zero-fee crypto trading for Auto Invest investors, according to an official announcement on May 18. The zero trading fees will be available only for a month, May 18-June 18.

Users will be able to buy over 210 cryptocurrencies including Binance, Ethereum, Shiba Inu, PEPE, and others on Auto Invest. It has more than 15 fiat currencies and stablecoins via the Single-Token, Portfolio, and Index-Linked plans.

Auto-Invest is a dollar-cost averaging (DCA) investment strategy allowing users to automate their crypto investment and earn passive income at the same time.

Also Read: Binance Making These Efforts To Increase Bitcoin and Ethereum Liquidity

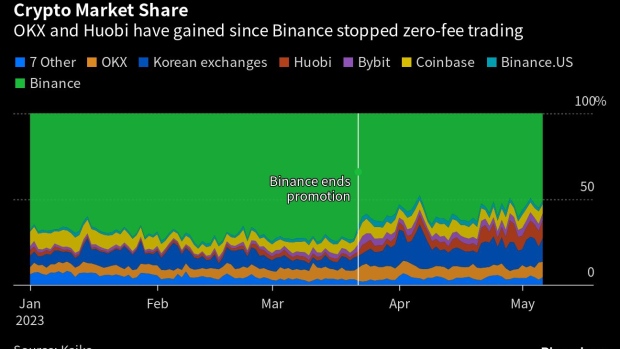

On March 15, Binance ended its zero-fee Bitcoin trading and BUSD zero-maker fee programs, shifting the zero-fee Bitcoin trading facility to TUSD only due to a crackdown against Binance USD (BUSD). Since then, trading volume on the exchange has decreased significantly as most volumes came from BTC/USDT pair. The CFTC lawsuit against Binance and CEO “CZ” added more challenges.

According to Kaiko, Binance’s spot-trading volumes share fell to 51% in May, earlier in March it was 73%. The market share of Huobi increased from 2% to 10% and OKX from 5% to 9%. Also, South Korean exchanges’ market shares increased to 14% from 8%.

The US SEC is also close to bringing an enforcement action against Binance. In response, Binance CEO is planning to reduce his shareholding in the Binance.US crypto exchange to reduce the impact on its US arm.

Also Read: FTX Sues Sam-Bankman Fried, Michael Giles, And Silicon Valley VCs

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

Buy $GGs

Buy $GGs