Binance: Despite Regulatory Crackdown By 6 Countries, Binance’s Bitcoin (BTC) Holdings Remain Intact

Binance, the world’s largest crypto exchange by trading volumes, has been facing a slew of regulatory hurdles recently. Over the last week, regulators from more than 6 countries have started investigations in Binance citing the exchange doesn’t meet regulatory requirements.

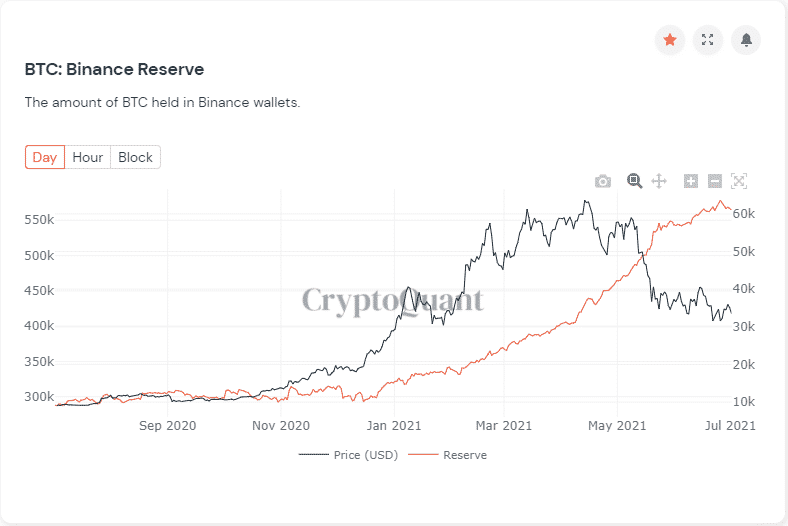

Interestingly, this has had little impact on Bitcoin deposits at the exchange. The Binance Bitcoin reserves still remain above 560K and largely range-bound.

This goes to show that amid the global regulatory crackdown on Binance, investors have yet not panicked, unlike the Chinese crackdown that led to major inflows at Bitcoin exchanges. This shows that confidence among Bitcoin investors hasn’t dropped despite the major crackdown.

On the other hand, institutional players have continued accumulation over the past few weeks. Amid the recent price correction, Canada’s Purpose Bitcoin ETF has continued accumulation. As per the data, the Purpose Bitcoin ETF now holds 22,300 Bitcoins worth $789 million.

Bitcoin On-chain Indicators

The Bitcoin hashrate and mining activity has seen a major overturn in recent times amid the rout of miners from China. As reported by Glassnode, the bitcoin mining difficulty registered its biggest-ever downward adjustment of 28%.

#Bitcoin mining difficulty just saw its largest downward adjustment in history: -28%https://t.co/dREzQkzRBk pic.twitter.com/HO5DhzESY9

— glassnode (@glassnode) July 3, 2021

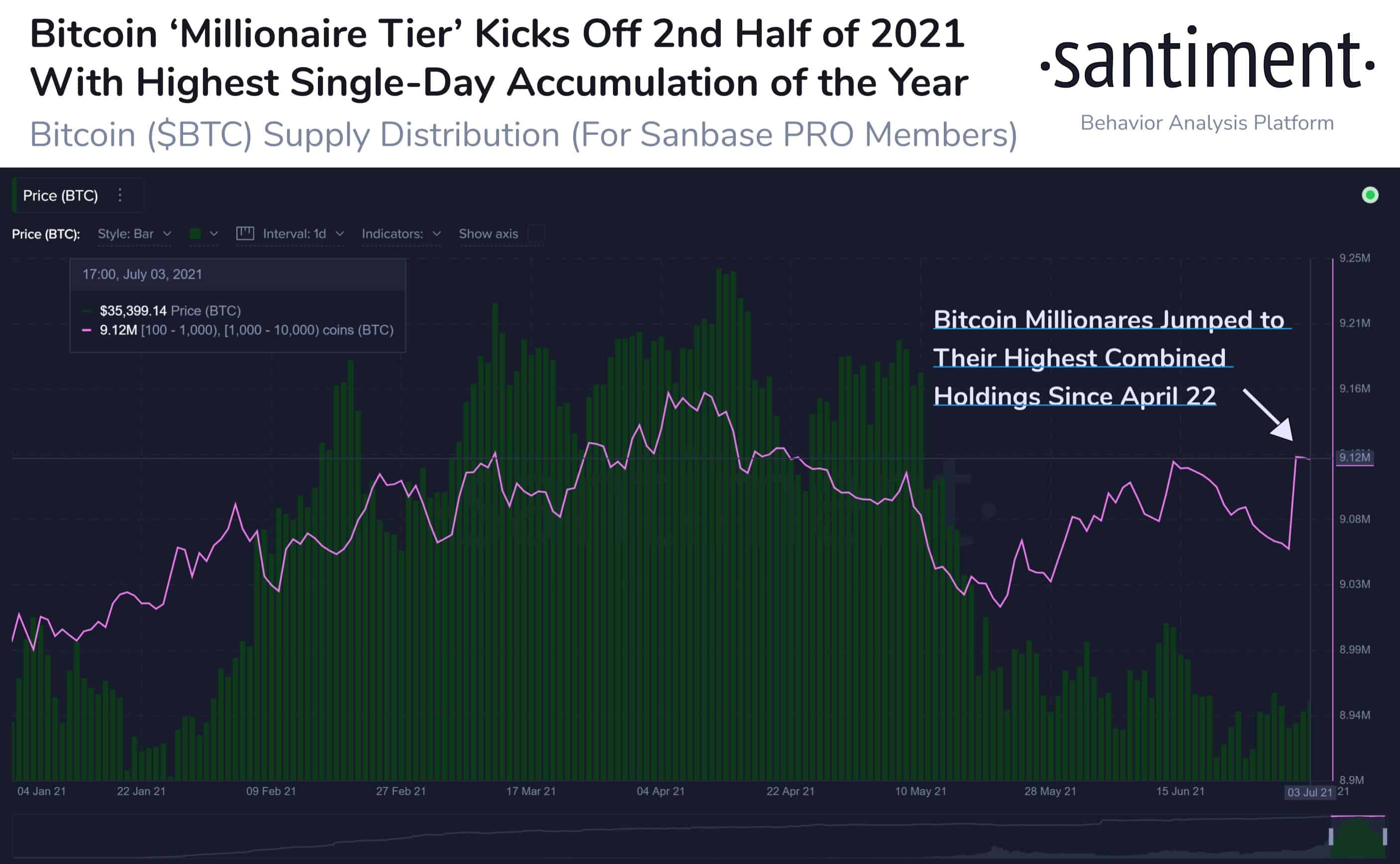

The Bitcoin hashrate has come dropping down significantly over the last few weeks correcting by more than 50% from its May 2021 high. However, Bitcoin whale action is catching up once again in the month of July. On-chain data provider Santiment reports:

“Bitcoin’s whale addresses holding between 100 to 10k $BTC kicked off July with a 60k $BTC accumulation spike, the highest daily spike of 2021. These addresses hold 9.12M coins combined after holding 100k less $BTC just 6 weeks ago”.

Last week, Bitcoin (BTC) made an attempt at a northward rally breaking past $35,000 levels. However, it has remained above these levels for a very short time and has been once again under pressure since then. At press time, Bitcoin is trading 2.88% down at a price of $34,187 with a market cap of $641 billion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs