Binance Futures Suffers Attack on Liquidity of ETH Perpetual Futures, Price Spike Over $550

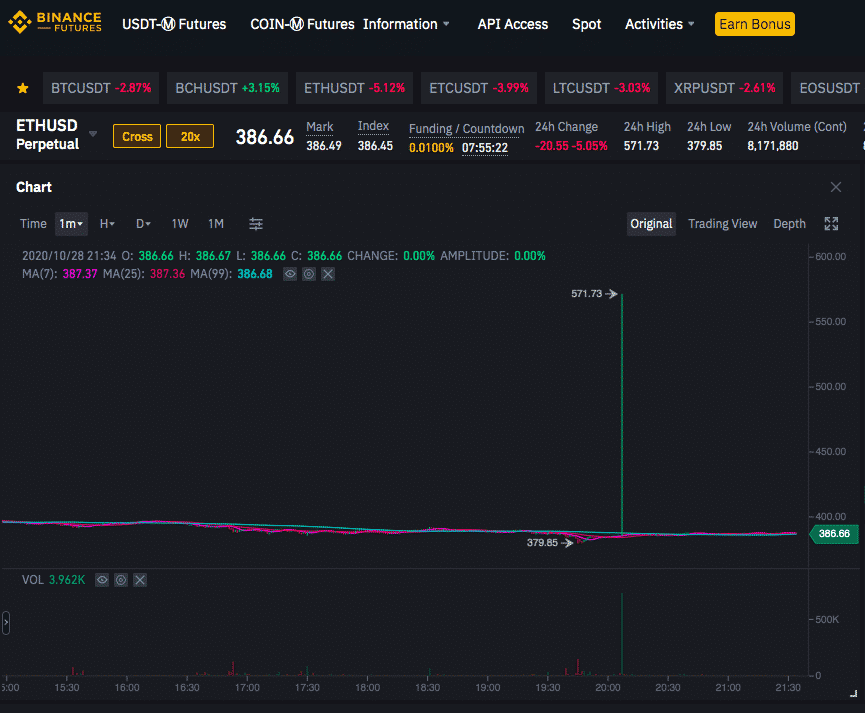

Another day, another attack. This time it was on ETHUSD Perpetual Futures on Binance’s platform. Addressed by Aaron Gong, who happens to be the Vice President [VP] of Futures at Binance, stated that the user involved in the apparent attack not only caused losses to his rival but also lost of money himself. It is important to note that prior to this incident, ETH futures price on Binance saw an abrupt spike all the way to $560 then down to $200 on the 28th of October.

His tweet read,

“This happened on ETHUSD Perp futures. It was caused by one trader, both ways. We believe this may be intentional sabotage from a competitor. The trader lost lots of money himself. But also caused other stop orders to trigger. We will make a few changes to reduce in the future.”

Taking into consideration the state of the order book, many in the community were doubtful whether one single trader could, in fact, scam the entire liquidity despite the fact that Gong asserted that the Binance Futures team would make several changes to ensure this situation does not arise again in the future. Elaborating on the changes to be implemented on the platform, the VP stated,

“We will change the stop order to default to Mark (index) price, not Last price. Many novice users don’t know the difference, and used Last Price. Using Mark price would avoid this problem. We will turn on Price Protection for all stop orders, including existing one. This way, if the Last Price and Mark price differs significantly, the stop orders will not trigger.”

He further went on to add that the team would invite and incentivize more market makers to provide more liquidity and order book depth, in the hopes to reduce the likelihood of the attack happening in the future.

The Spike

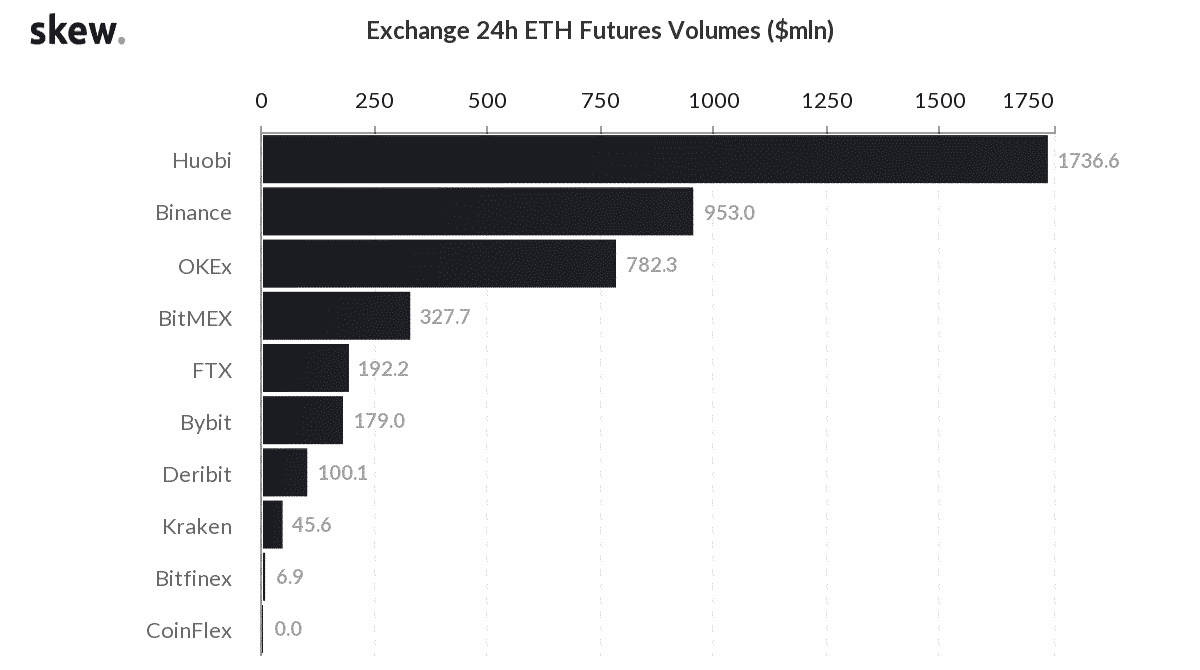

According to the chart compiled by the crypto-analytic platform Skew, Binance rose to the second position in terms of Exchanges 24-hour ETH Futures Volumes due to the episode. At press time, Binance recorded $953 million in ETH futures volume trailing behind Huobi at $1736.6 million.

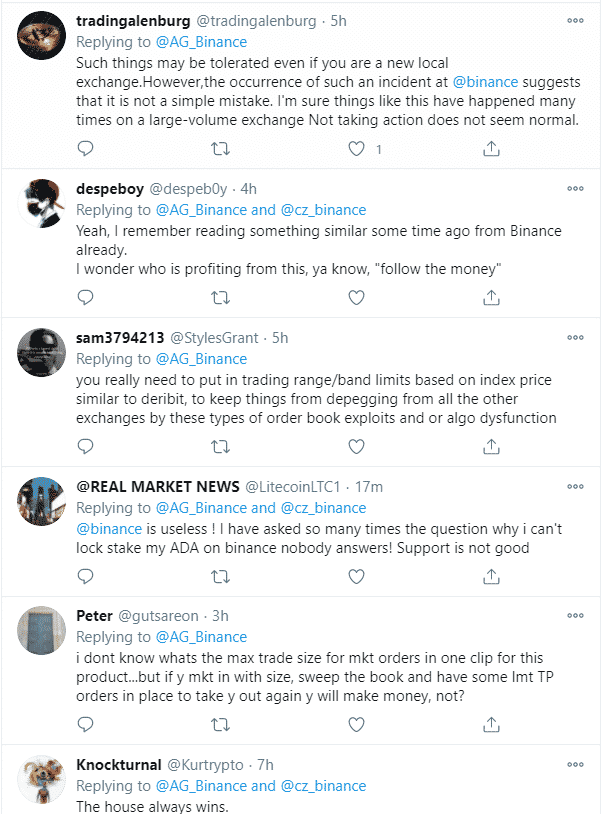

Community Reaction

Despite Gong’s clarification on the issue, many users claimed that the potential cause of the abrupt spike was something else. Here are some of the comments on his original thread:

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs