Binance Launches Ethereum and XRP Options Contracts, More Volatility in Prices?

World’s largest cryptocurrency exchange, Binance, announces addition of options contracts for Ethereum and XRP. It becomes the first exchange to add support XRP options.

Options are financial derivatives with leverage which allows the buyer of the contracts to buy (call option) or sell (put option) the underlying asset at a specified price on expiry.

#Binance Options Lists @ethereum $ETH and $XRP Contractshttps://t.co/jH2dC51XwD pic.twitter.com/V3IXYhhYtY

— Binance (@binance) May 25, 2020

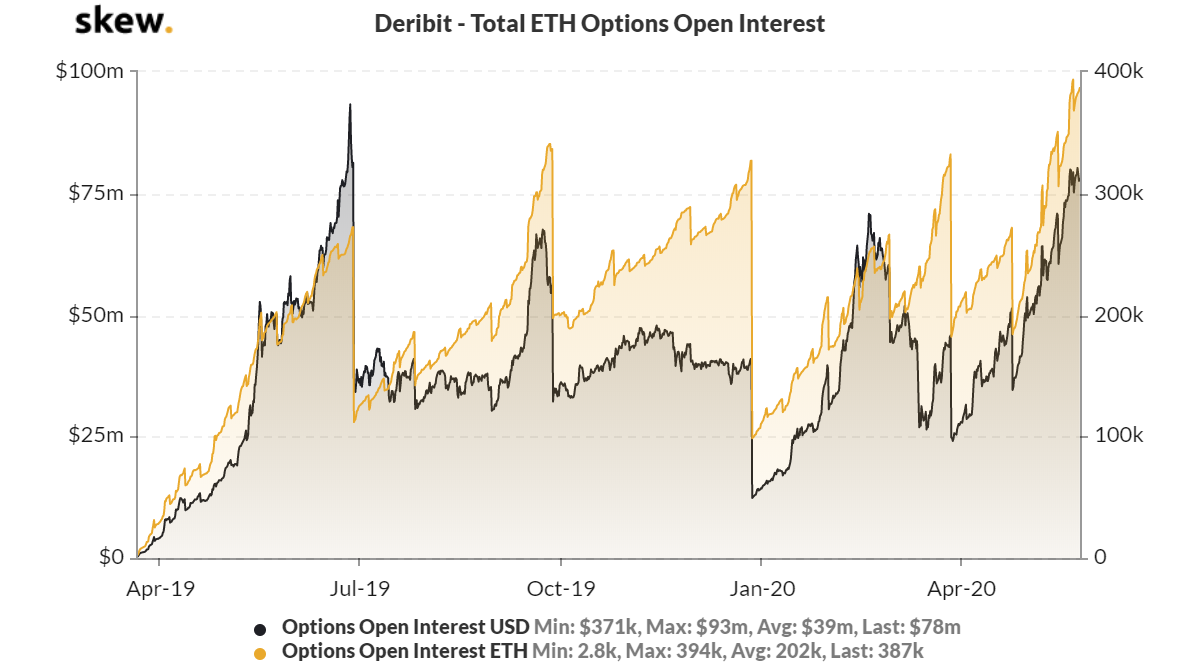

Until now, Deribit exchange has been the leading platform for Ethereum options and also leading the space for Bitcoin options with over 75% market share. The average Open Interest for Ethereum options on Deribit since launch in May last year is around $39 million. It is currently at at an All-Time High with respect to number of ETH. Nevertheless, Binance aims to dominate that market as well.

Moreover, the addition of XRP options is likely to up the ante on altcoin speculations as well. BitMEX was the one of the first major derivatives exchange to offer XRP futures in February this year, besides Binance, Okex, Poloniex and a select few exchanges. Binance is one of the few exchanges which offers futures contracts for a variety of cryptocurrenices.

While the risk is reduced with options contracts, the choice of trading futures or options depends on the preference of traders. Furthermore, the premium around the price of options can act as a robust indicator of market sentiments. However, it also stands to add more volatility in prices.

Do you think the addition of trading products is good or bad for long-term adoption of cryptocurrencies? Please share your views with us.

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k