Bitcoin and Ethereum Monthly Options Expiry, PCE Inflation Looms, Brace For Price Impact

Highlights

- Crypto market braces for PCE inflation data and crypto options expiry, probably the last headwinds.

- Wall Street expects annual and core PCE inflation to come in lower than estimates.

- Bitcoin and Ethereum's massive options expiry to shake crypto prices.

- Traders are tracking US dollar index and treasury yields for confirmation of rally.

- BTC price teases breaking above $70,000 as market nerve is being tested.

The crypto market saw a slight recovery, but prices remain under pressure as market participants brace for inflation data and crypto options expiry on Friday, May 31. Altcoins are mainly facing the heat as they weaken against Bitcoin price, with Bitcoin dominance rising again above 53%.

Markets Focus on Fed’s Preferred Gauge PCE Inflation

Traders are now focusing on the PCE and core PCE inflation figures, the U.S. Federal Reserve’s preferred gauge to measure inflation. The U.S. Bureau of Economic Analysis to release key inflation data as that could determine market direction for weeks.

Wall Street expects PCE inflation to come in lower than expected figures. The market estimates annual PCE inflation to come at the same level of 2.7% as last month. Meanwhile, the month-over-month PCE inflation is also expected at 0.3%, similar to the previous month.

On the other hand, annual and monthly core PCE inflation to remain at the same level of 2.8% and 0.3%, as per market estimates. While stagnant actual PCE inflation figures will be positive for the markets, hinting at cooling inflation, Wall Street banks predict an inflation pivot for market rally.

Also Read: FIT21 Unlikely to Pass Senate Before November Election — Report

Bitcoin and Ethereum 8.2 Billion Options Expiry

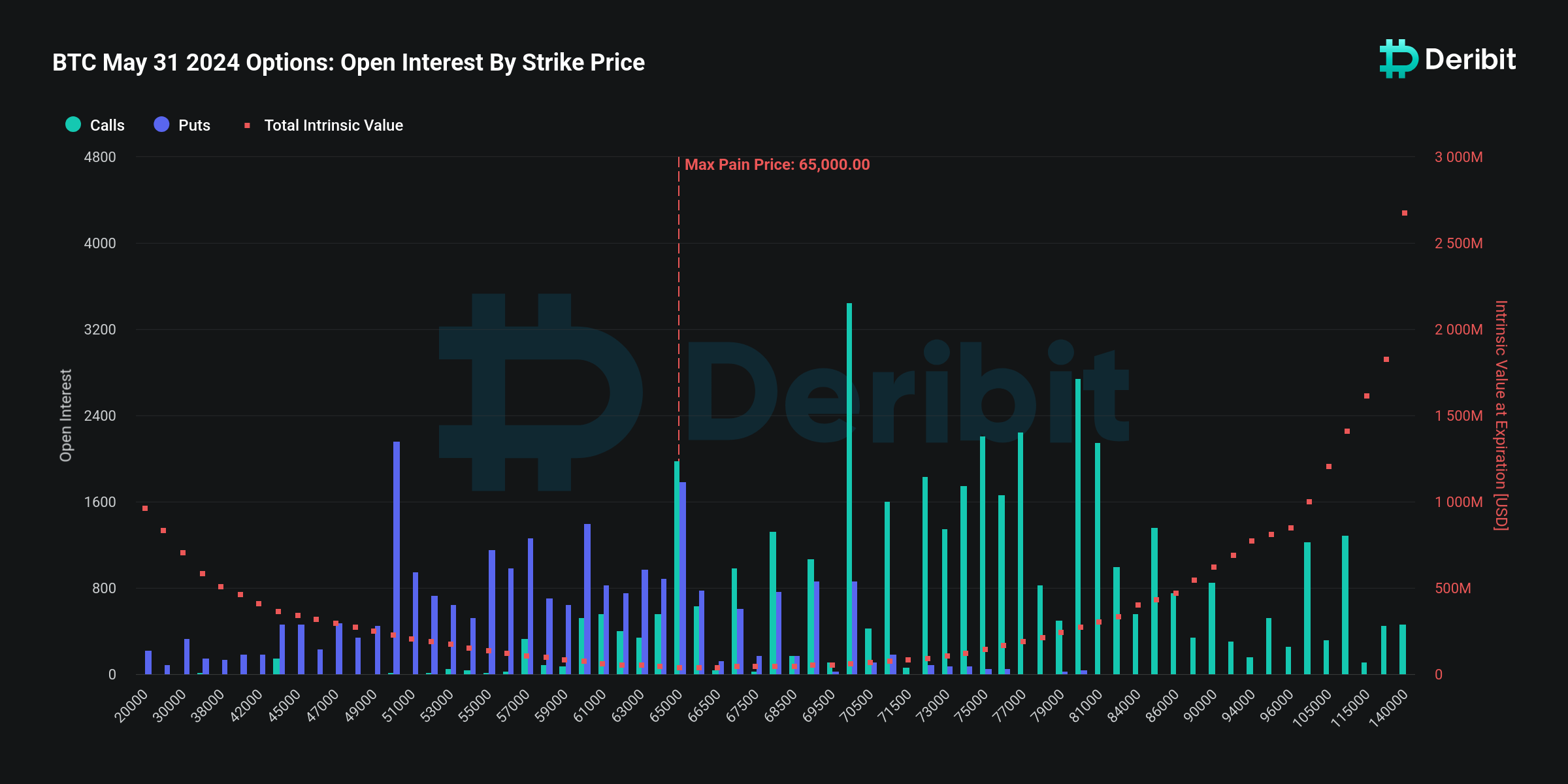

Over 69k Bitcoin options of $4.7 billion in notional value are set to expire on Deribit on May 31. The put-call ratio is 0.61, indicating a rise in call open interest recently as monthly expiry approaches. The max pain point is $66,000, which is below the current price. Thus, the market can expect huge volatility with a pullback in price on the expiry day.

Moreover, 909k Ethereum options of notional value $3.4 billion are set to expire, with a put-call ratio of 0.60. The max pain point is $3,300. ETH price is currently trading above the max pain point and gives more room for traders to book profits.

Adam from Greekslive revealed that the volatility caused by the price surge fell back quickly. BTC’s short-term option IV fell to 40%, whereas ETH’s decline is slightly smaller and is relatively stable at around 60%. Market attention is on spot Ethereum ETFs as any announcement can bring upside move in the markets.

Also Read: Will Ripple XRP Secrets Get Revealed? SEC’s Win in Remedies Imminent?

BTC Price Eyes New ATH

The US dollar index (DXY) fell near 104.70 after consecutive rises in the last few days. The GDP growth for the US was revised lower to 1.3% in Q1, in line with expectations, mainly due to slower consumer spending.

Meanwhile, the US 10-year Treasury yield fell toward 4.55%, easing from the four-week high of 4.61% touched yesterday as markets continued to assess the latest data for hints on the Federal Reserve’s policy outlook. Notably, Minneapolis Federal Reserve President Neel Kashkari stated that the current policy stance is restrictive but emphasized that officials haven’t entirely ruled out additional rate hikes.

Any further drop in DXY and treasury yields could bring a recovery in BTC price as inflationary pressures ease. The CPI reported provided much-need bullish momentum for Bitcoin and the overall market, with traders expecting similar results after PCE data.

BTC price jumped 2% in the past 24 hours, with the price currently trading near $68,500. The 24-hour low and high are $67,118 and $69,500, respectively. Furthermore, the trading volume has increased by 10% in the last 24 hours, indicating interest among traders.

Also Read: LUNC & USTC Open Interest Soars Over 20%, Terra Luna Classic Price Set For 60% Rally

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card