Bitcoin At An “Unstoppable Maturation Stage” Says Bloomberg Analyst

With the U.S equity markets gripped in uncertainty, Bitcoin and the broader crypto market have been showing similar moves. Interestingly, the Bitcoin whale addresses supply has also recently touched a three-year low.

However, Bloomberg’s senior commodity strategist Mike McGlone believes that Bitcoin could be entering an unstoppable maturation stage. Mr. McGlone draws an interesting comparison with the current crude price of $84 per barrel last seen in October 2007. He adds the fact that Bitcoin didn’t exist 15 years back gives it an “appreciation advantage”. Interestingly, the latest Bloomberg report shows:

The fact that the benchmark crypto index hasn’t dropped with the latest round of rate-hike expectations may also signal a Fed end-game on the horizon. A top potential catalyst for central banks to curtail tightening is for markets, notably stocks and commodities, to do it for them, which may favor Bitcoin.

Bitcoin – Declining Supply and Rising Demand

Bloomberg strategist Mike McGlone added that BTC’s diminishing supply could be unprecedented on a global scale. Thus, he believes that the prices should continue to rise over time unless something unusual reverse the demand and BTC adoption rate. Mr. McGlone also said:

Bitcoin may be entering an inexorable phase of its migration into the mainstream, and at a relatively discounted price. FASBA’s recent decision that companies should use fair-value accounting for measuring crypto assets.

On-Chain Metrics

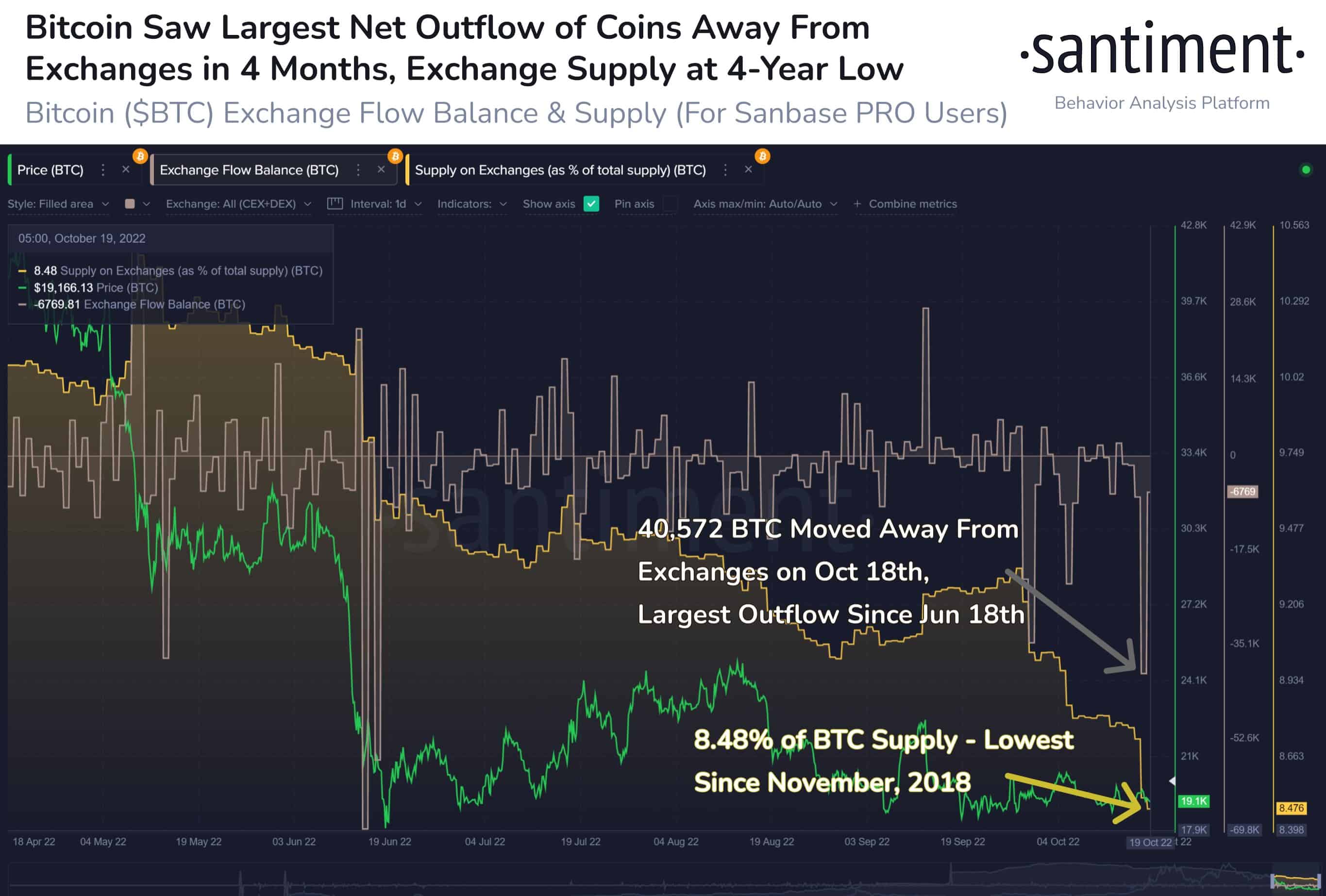

On Tuesday, October 18, BTC witnessed a massive surge in the coins moving off exchanges. At 40,000 Bitcoins, Tuesday marked the largest Bitcoin outflow from exchanges in over four months. On-chain data provider Santiment noted: “The supply of coins on exchanges is down to 8.48%. As exchange supply decreases, it de-risks chances of a future sell-off”.

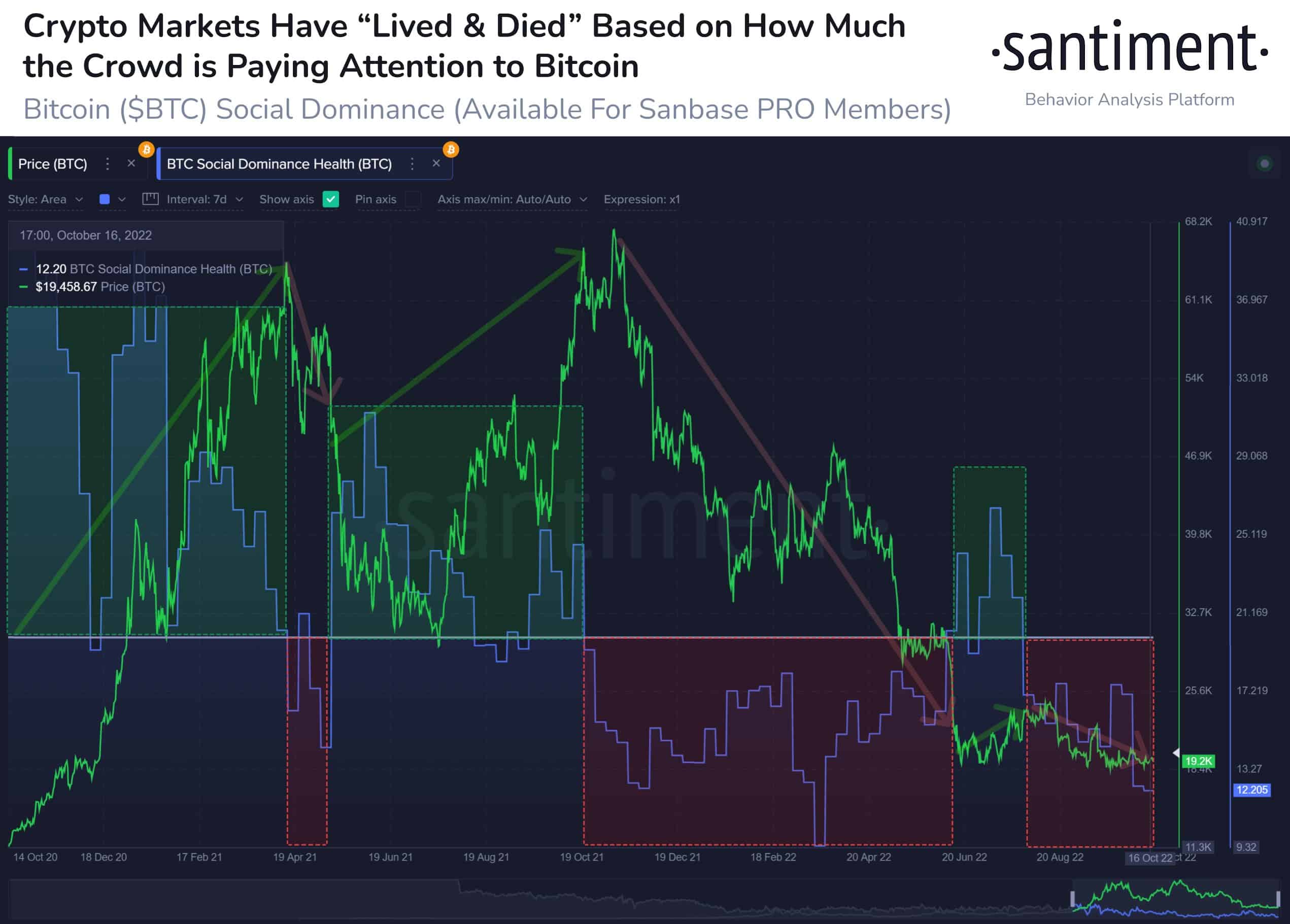

However, BTC’s social dominance has turned in the red which gives a bearish signal for the BTC price. The Santiment report notes:

Bitcoin’s social dominance has factored in for ALL of #crypto, and whether prices move up or down. Green zones show when convos related to $BTC exceed 20% of asset discussions. Prices generally climb. Red zones are below 20%, and prices generally fall.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k