Bitcoin (BTC) At $34,000, Average Trader Returns At Historic High Levels

Bitcoin (BTC) is hitting new highs almost every few hours! In less than 24 hours of crossing $30,000 levels, the BTC price has surged another 13% to hit a new all-time high of $34,000. Several on-chain indicators are suggesting that Bitcoin (BTC) fundamentals continue to get stronger with every passing day.

Bitcoin’s daily trading volumes have crossed a record $75 billion as of writing this article. Moreover, on-chain data provider Santiment notes that the BTC rally has been extremely painful for BTC pairs over the last 10 months. Interestingly, the average trader returns have never been this high since June 2019.

???? For those expecting a #Bitcoin correction to kick off 2021, the $34,000 #AllTimeHigh achieved 10 mins ago is showing how painful it's been being a $BTC bear the past 10 months. Avg. trader returns haven't been this high across the board since June 2019. https://t.co/NADisu58A0 pic.twitter.com/J9ujHfYisP

— Santiment (@santimentfeed) January 3, 2021

Interestingly, crypto analyst Willy Woo also notes that the recent buying activity has been largely supported by buying calls coming from spot exchanges. Moreover, he adds that the USDC inflows have been massive to support the buying. As CoinGape reported, there have been massive stablecoin deposits at the exchanges in the last two days. “We weren’t even close to being overheated at 29k”, Woo adds.

USDC inflows to support that buying, also off the charts.

We weren't even close to being overheated at 29k.

Charts by @glassnode pic.twitter.com/3d4g1MVT3e

— Willy Woo (@woonomic) January 2, 2021

The Bitcoin (BTC) exchange outflows also continue further at a rapid rate. Meaning the Bitcoin (BTC) supply at the exchanges is also drying up faster than expected. Over the last two days, nearly 50K BTC has left the Coinbase Pro wallets in massive OTC deals with most of them going to cold wallet custody. Just after we reported that 12,000 BTC has been moved out before hitting $30,000 levels, another 35K BTC has been moved out as Bitcoin approaches $35,000 levels.

Over 35k $BTC leave Coinbase. Most likely OTC deals, institutional investors buying #Bitcoin.

chart: @cryptoquant_com pic.twitter.com/awrLJ2rdDu

— unfolded. (@cryptounfolded) January 2, 2021

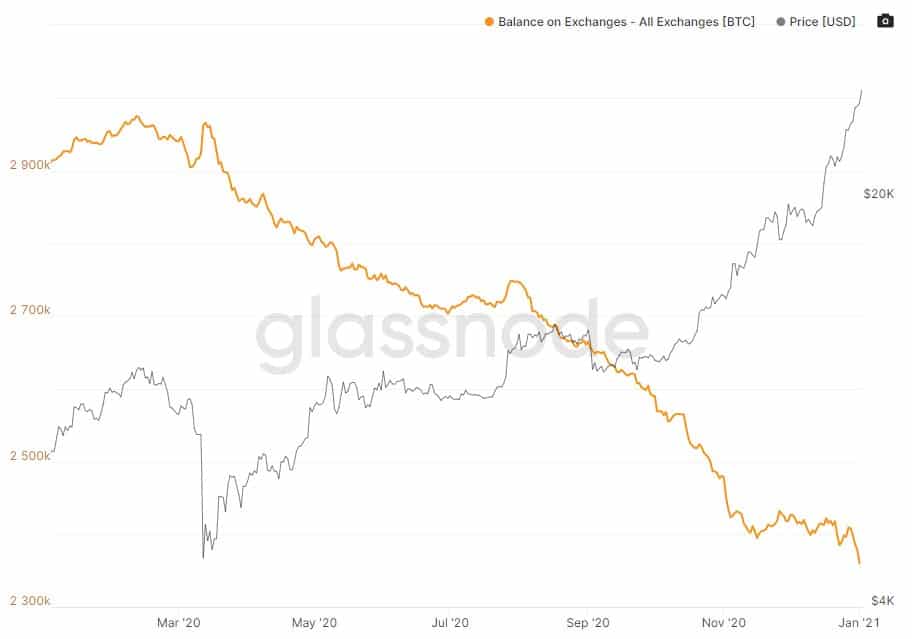

Additionally, the recent institutional buying has also forced the BTC whales to make fewer deposits at the exchanges and reconsider any kind of profit booking at the moment. The below graph from Galssnode clearly shows that the BTC balance on exchanges has been constantly dropping over the last year.

The Bitcoin liquidity crisis is getting real with every passing day. Also, a recent study from Glassnode states that only 22% of the BTC supply i.e. 4.2M is currently under circulation. The remaining 78% of the Bitcoin supply is illiquid.

Apart from just the price and the BTC supply, the cryptocurrency is hitting new milestones on multiple fronts. On Saturday, January 2, Bitcoin network hash-rate hit its new all-time high of 136 exahash/s.

ATH: December's hash rate (136 exahash / s) was the highest in #Bitcoin's history so far ????

Chart: https://t.co/M6ZrAkKGRh pic.twitter.com/QOn5CRtWAR

— glassnode (@glassnode) January 1, 2021

Also, the Bitcoin futures open interest has hit an all-time high as per Skew analytics.

#bitcoin futures open interest new all-time-high pic.twitter.com/2YxG4yjqie

— skew (@skewdotcom) January 2, 2021

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs