Bitcoin (BTC) Dominance Retreats As Altcoins Rally, Another Dip?

Bitcoin (BTC) saw its market dominance fall sharply over the past two days, as the latest crypto rally became more skewed towards altcoins. A mix of institutional buying and interest in staking appeared to have triggered the rally.

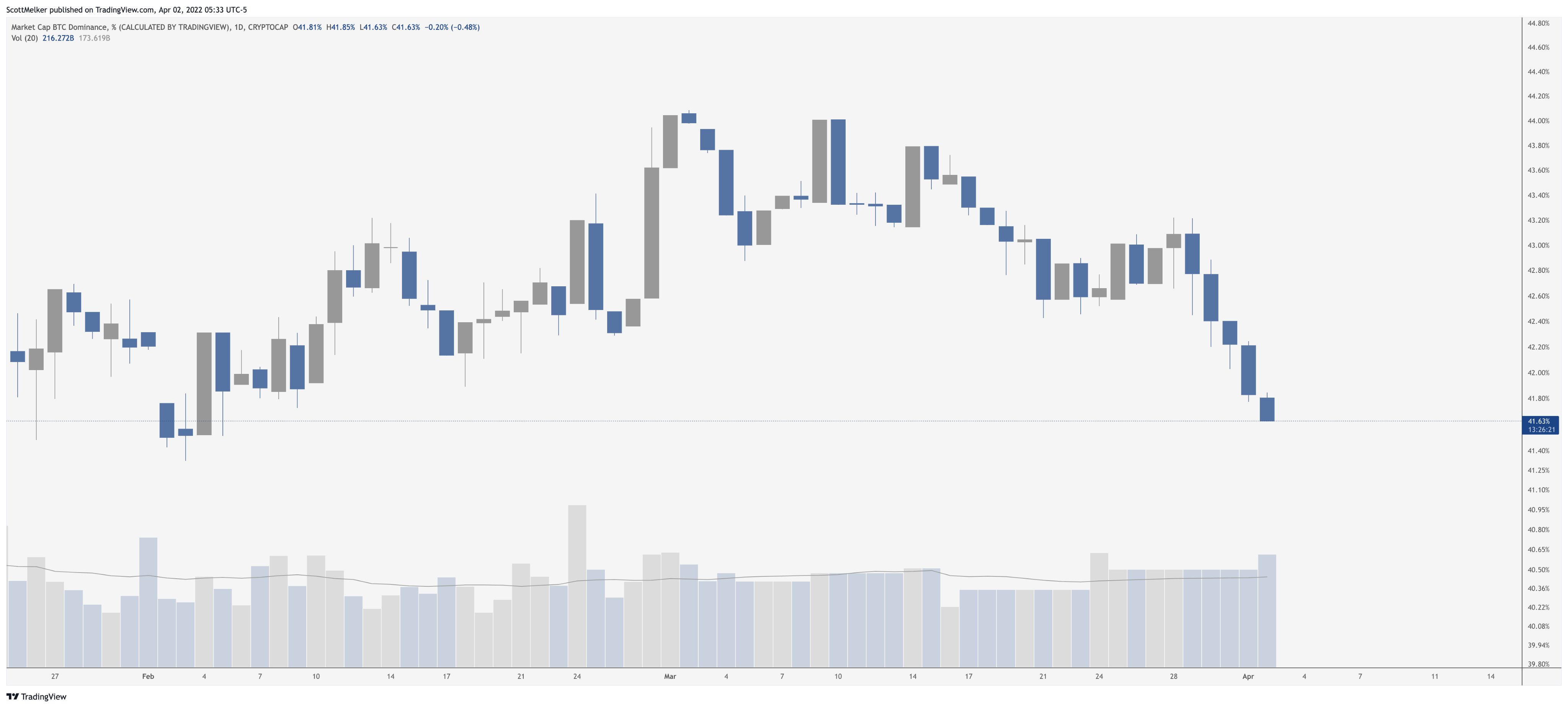

BTC market dominance stood at 40.9% on Saturday, retreating sharply from the 42% seen on Thursday. While the token is trading up 5% for the week, it has been vastly outpaced by smaller coins this week.

Still, BTC was the highlight of a crypto rally in March. Market sentiment was boosted as the world’s largest token jumped to its highest level since December, at $48,000.

Altcoins blaze past BTC

Ethereum (ETH), Solana (SOL), Terra (LUNA) and Avalance (AVAX) were standout performers over the past seven days, rising between 11% to 38%. While ETH gains were at the lower end of this range, its impending shift to a proof-of-stake (PoS) model was credited with raising interest in several other altcoins.

Increased institutional interest- a major factor in BTC’s 2021 rally, also appeared to be helping altcoins. Fund managers such as Coinshares and Grayscale recently included SOL, ARD and other altcoins in new products geared towards professional investors.

PoS token SOL led gains among its peers for the week, also crossing $40 billion in market capitalization and becoming the sixth-largest cryptocurrency.

LUNA jumped 25% to a record high of $112, as large BTC buying by its community, coupled with a steady burn rate supported the token. The LUNA community has been buying BTC to use as a reserve for its stablecoin, TerraUSD, as part of an aggressive push to make it the largest stablecoin.

Broad rallies tend to dent BTC dominance

The lowest BTC dominance has ever been is at about 37%, observed in 2017 during the initial launch of several altcoins. While the token’s dominance had since recovered sharply to over 70%, the massive rally in 2021 saw BTC weightage come back to around 42%, where it has hovered since.

The token’s dominance tends to fall whenever the market sees an extended rally, with the latest bull run showing similar results. Whether this trend will continue remains to be seen.

- Will Bitcoin & Gold Fall Today as Trump Issues Warning to Iran Before Key Nuclear Talks?

- Epstein File Reveals Crypto Controversy: 2018 Emails Reference Gary Gensler Talks

- Wintermute Expands Into Tokenized Gold Trading, Forecasts $15B Market in 2026

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?