Bitcoin (BTC) Faces A Crash To 2020 Lows, Here’s Why

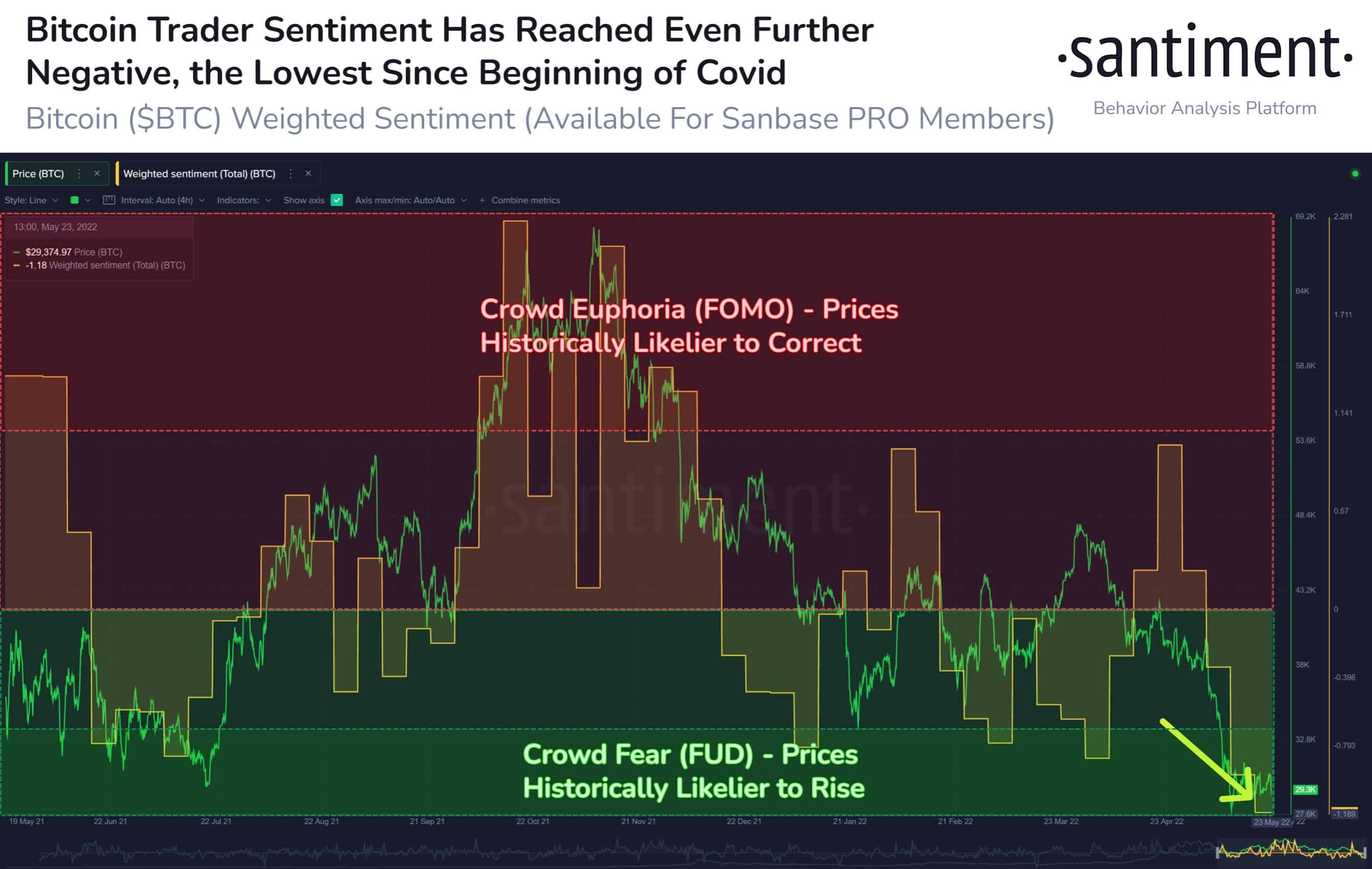

Sentiment towards Bitcoin (BTC) and the broader crypto market is at its lowest level since the COVID-19 crash of 2020, recent data shows.

BTC has slumped nearly 60% from a record high hit in November, and is currently struggling to stay above $30,000. Total crypto market capitalization is also down by over $500 billion this month, at $1.3 trillion.

The recent crash was triggered by two main factors- concerns over rising inflation, and plans by the Federal Reserve to hike interest rates this year.

Considering that both factors are still in play, investor sentiment is extremely low.

BTC sentiment at March 2020 lows

Data from blockchain data firm Santiment shows that sentiment towards BTC and the crypto market has now sunk to its lowest since a sharp sell-off at the beginning of the COVID-19 crisis in 2020.

The 2020 crash had seen BTC slump below $6000, and had raised serious questions over the token’s future. But it had also recovered sharply since, and raced to several consecutive record highs by the year-end.

Santiment believes a similar scenario may be playing out for BTC. The token’s sharp price drop may make it a valuable bargain buy.

Weak hands may continue to present opportunities for the patient.

-Santiment

Timing the bottom still risky

But while BTC has slumped to more attractive valuations, analysts have warned that trying to time a market bottom may be risky. Given that the factors behind its 2022 crash are still in play, the token could be set for more losses.

El Salvador President Nayib Bukele, who bought BTC at a perceived bottom of $30,000, is already holding the token at a loss. So far, there are few factors supporting the token’s price.

BTC marked a record eight straight weeks of losses, and seems likely to notch a ninth. Futures markets suggest the token is also headed for more losses, with funding rates turning negative this week.

- Bitcoin Shows Greater Weakness Than Post-LUNA Crash; Is a Crash Below $60K Next?

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?