CME Bitcoin [BTC] Futures Sees Largest Drop in OI Since Launch: Report

The futures monthly contract on CME saw the strongest declines in its history post-expiration on Friday.

While the price of the monthly contract for August closed ($11,350) around the opening ($11,630) itself. The high and lows of the futures contract on CME were $12,625 and $11,115. Apparently, the massive short position closing towards the end indicates profit-booking from positions.

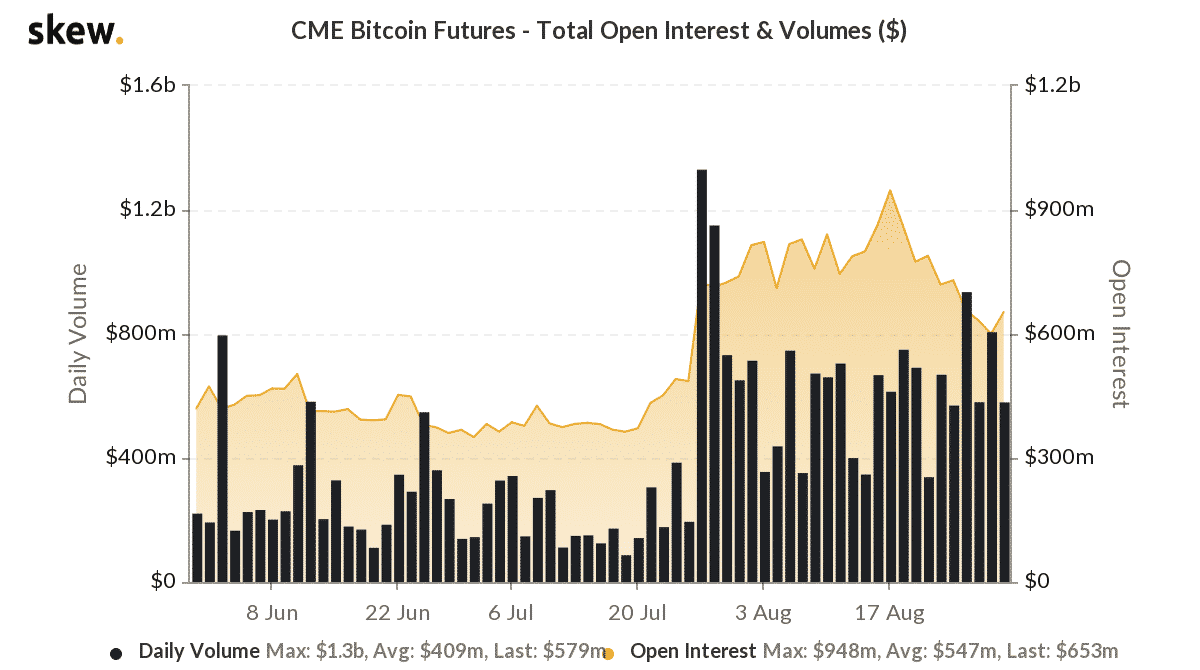

Nevertheless, despite the steep drop in OI, the current Open Interest over $600 million is considerable given its’ historic trend. At the time of the 2019 top around $14,000, the OI was only around $370 million.

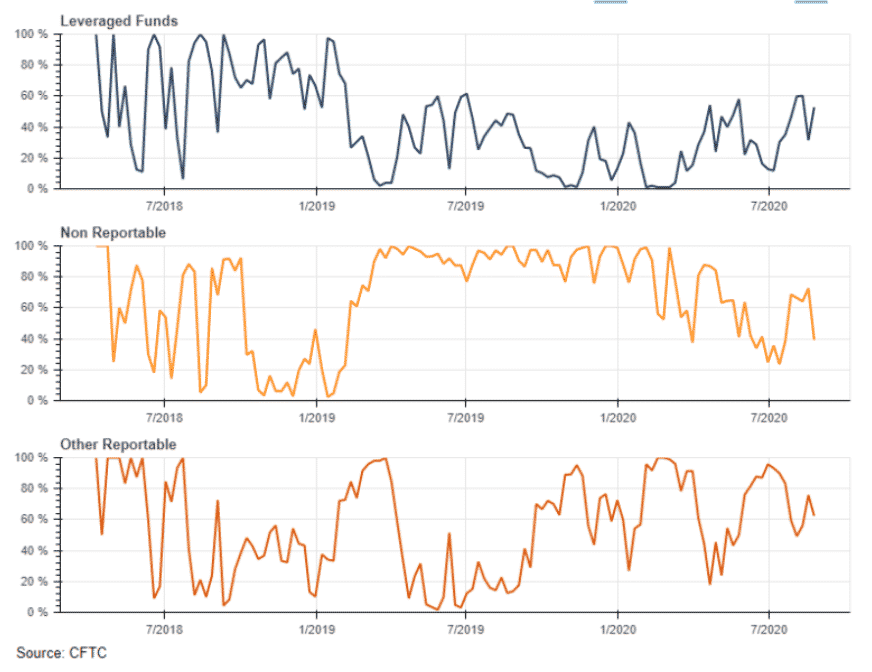

According to the report by Market Science, leveraged funds account for the majority of trades on the platforms leading with a slight short composition. Moreover, non-reportable and other reportable positions fell slightly towards short inclination.

The net positioning of the market can be viewed in the chart below,

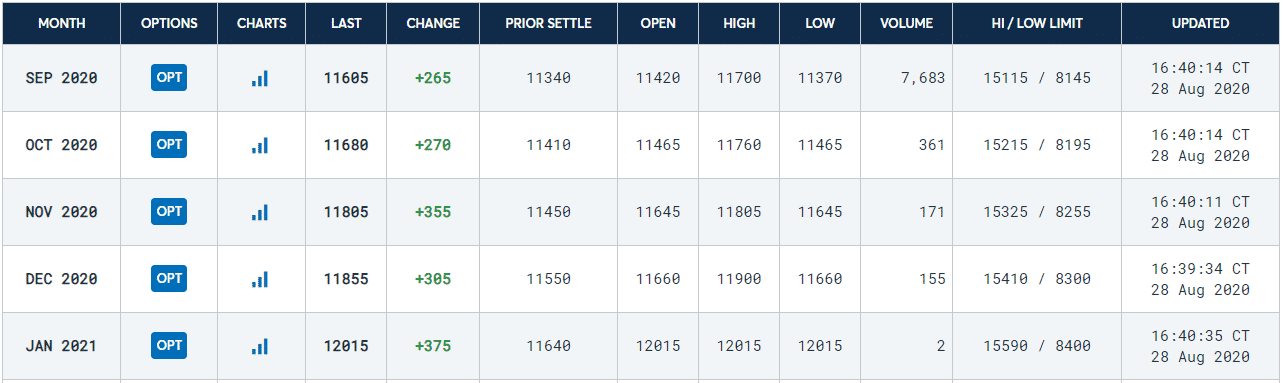

The futures contract is, nonetheless, is still in contango with prices of the successive increasing up to $375 for January 2022 contracts.

On non-regulated exchanges, the OI is surging as well with close to $1 billion each on BitMEX and Okex. The funding rate for the XBT perpetual contracts on Bitmex is 0.03% which gives room for bullish pressure as well.

Do you think the bears are tired or getting ready for another surge? Please share your views with us.

- XRP News: Ripple Taps Zand Bank to Boost RLUSD Stablecoin Use in UAE

- BitMine Keeps Buying Ethereum With New $84M Purchase Despite $8B Paper Losses

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- XRP Price Prediction Ahead of White House Meeting That Could Fuel Clarity Act Hopes

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting