Bitcoin (BTC) Hasn’t Bottomed Yet In This Bear Market Cycle, Here’s Why $20,000 Is Possible

The world’s largest cryptocurrency Bitcoin (BTC) has been showing volatile price swings in the range of $29,000-$31,500. After yesterday’s price crash, Bitcoin has once again reclaimed the $30,000 level. Bitcoin’s price action has been quite in line with what’s happening on Wall Street recently.

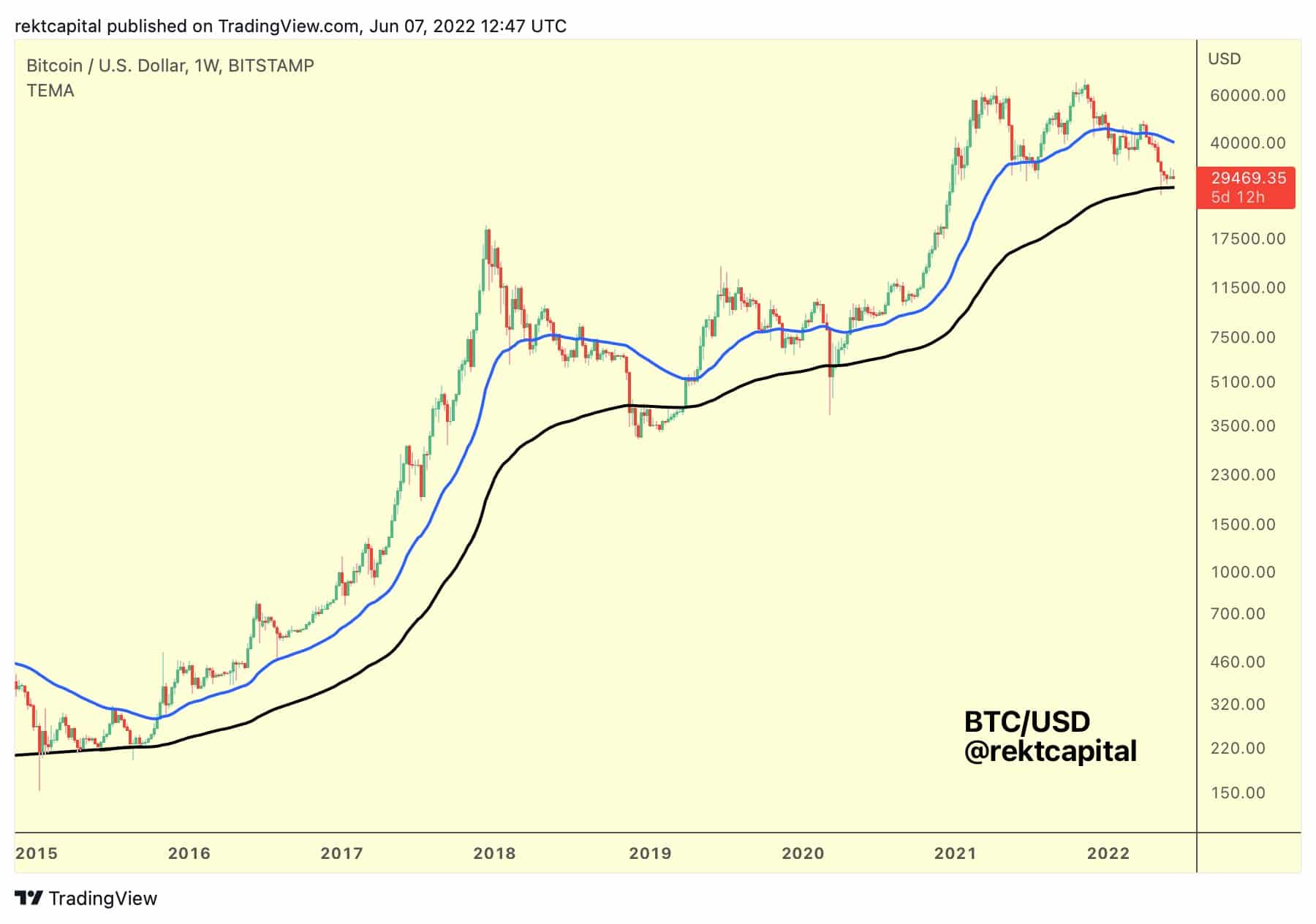

Many think that Bitcoin (BTC) might have formed a bottom at $29,000, however, that might not be the case. Historical chart patterns and a simple understanding of moving averages will help us understand that Bitcoin (BTC) hasn’t yet bottomed in this bear market cycle.

Popular crypto analyst Rekt Capital shares interesting insights into this matter. In one of his recent threads, Rekt Capital explains:

BTC tends to confirm uptrends when it breaks above the (blue) 50-week EMA. $BTC tends to confirm maximum financial opportunity when it reaches & breaks down from the (black) 200-week EMA.

The analyst further explains that the gap between 50 WEMA and 200 WEMA will help us understand whether if the bottom is in. Rekt Capital shares interesting insights from the past three bear market cycles. He writes:

- In 2015, the first bottom was 150% away from the blue 50 WEMA. The final bottom was ~50% away from the blue 50 WEMA.

- In 2018, the first BTC bottom was ~100% away from the blue 50-week EMA. The second $BTC bottom was 70% away from the blue 50-week EMA.

- In March 2020, the first BTC bottom was 110% away from the blue 50-week EMA. No second bottom formed.

Bitcoin $20,000 Is Possible?

Thus, the key takeaway from the past observations is that the first bottom comes at least 100% away from the 50-week EMA. The second bottom, if any, comes as 50-70% from the 50 WEMA. If we go by this trend, Bitcoin hasn’t yet bottomed in this cycle. Rekt Capital explains:

5.

Because the current local #BTC bottom is 66% away from the blue 50-week EMA

Typically the first $BTC bottom is ~100% away and the second bottom 50-70% away from the 50 WEMA

So this current situation resembles "second bottom" behaviour more than "first bottom" price action pic.twitter.com/bSjPHlORa4

— Rekt Capital (@rektcapital) June 7, 2022

If BTC repeats a 100% downside from the 50 WEMA (blue line), it means it will touch $20,000 before reversing the trend. It means BTC will have to form a major wick under the 200 EMA (black line) to form a major bottom. All credits to Rekt Capital for this wonderful analyst.

Previously, the analyst also shared one such insight based on the Bitcoin Death Cross to understand bottom price formations.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand