Bitcoin (BTC) Is Decoupling From Stocks, But Not How You’d Expect

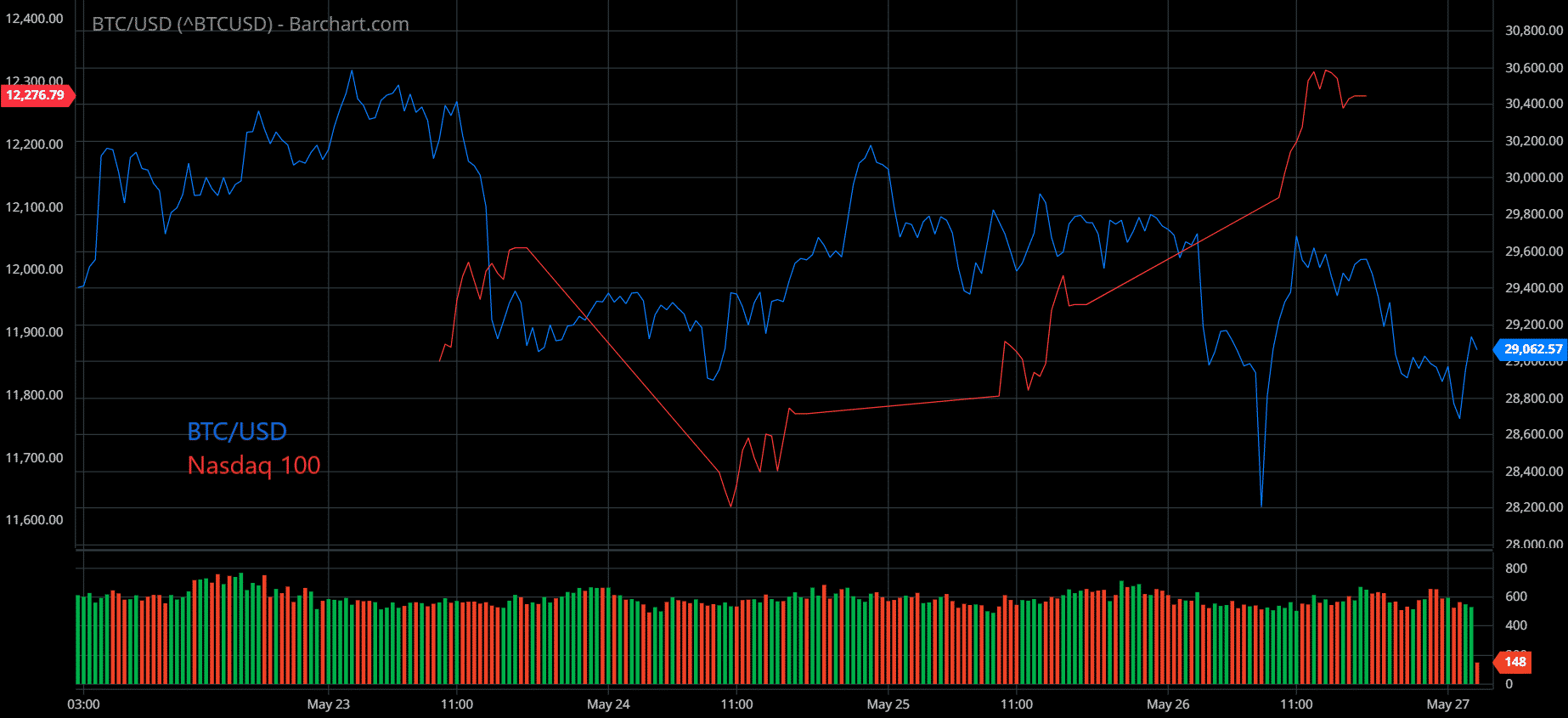

Bitcoin’s (BTC) recent losses have seen it somewhat diverge in performance from major U.S. equities this week.

The world’s largest cryptocurrency is down 4.5% in the past seven days at around $28,000. In comparison, the Nasdaq 100- BTC’s closest parallel in the stock market- is set for a 2% gain this week.

The divergence with the S&P 500 is even more. The benchmark index is up 3.3% this week.

While U.S. stocks have recovered somewhat in the past few days, BTC has lagged. This was also evident in the token’s Thursday session. Wall Street rallied past weak U.S. GDP data while BTC sank further below $29,000.

BTC is now holding around $28,000- its last major support level, after which it could see even deeper losses. The token has already fallen as low as $25,000 earlier this month.

Bitcoin performing much worse than stocks

With this week’s losses, the gap between BTC and the Nasdaq 100’s performance this year has widened substantially.

BTC is now down nearly 40%, while the Nasdaq has pared some of its losses, and is now trading down about 25%. While the Nasdaq has taken some support from positive corporate earnings, BTC has had no such positive factors.

The token is now headed for its ninth straight week in red- its worst weekly run ever. The mass expiry of BTC options on Friday may also spell more losses for the token.

U.S. stock futures are also trending slightly lower on Friday.

No respite for markets

BTC has fallen sharply this year, consolidating most of its gains made through 2021. Concerns over rising inflation and interest rates have largely driven these losses.

Those factors are still in play, severely dampening appetite for cryptocurrencies. While BTC has fallen, altcoins have suffered even sharper losses.

The Terra crash has also contributed to this crypto aversion, with investors now expecting a swathe of new regulations in the space.

Recent data also showed that sentiment towards the crypto market is at its worst since the COVID crash of 2020.

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?