Bitcoin (BTC) Slips Under $50,000, Here’s What Investors Should be Doing

After a solid show over the last weekend, the world’s largest cryptocurrency Bitcoin (BTC) has slipped under $50,000 once again. As of press time, BTC is trading 1.5% down at $49,331 and a market cap of $927.2 billion.

On the monthly charts, Bitcoin (BTC) is still trading at over 45% gains. However, just as Bitcoin (BTC) flirts around $50,000 levels, here’s what analysts think investors should be doing.

Speaking to CNBC’s “Trading Nation” on Monday, August 23, Bill Baruch, president of Blue Line Capital said that he would be cautious and making any fresh entry right now. “I think it needs to be in your portfolio, but is $50,000 the place to be buying it? I wouldn’t chase it,” he added.

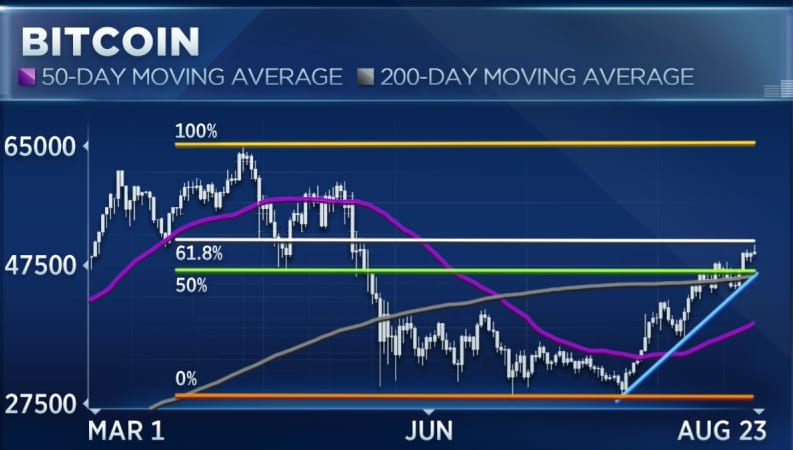

Baruch further acknowledged that he continues to hold Bitcoin (BTC) but has started to trim his stake as the BTC price bounced back to $45,000 levels. He explains that the $45K benchmark serves as a retracement from the June low of $29K and the April highs of $64K. Thus, this level also serves as the 200-day moving average for the world’s largest crypto. Baruch said:

“Again, I think it’s a great space to be in, but don’t chase it just because you see $50,000 in the headlines. Pick your spots and stick to your game plan”.

Bitcoin (BTC) On-Chain Data

As Baruch suggests, we need to be careful at this point in time. As the BTC price was soaring over the last week, nearly 30K Bitcoins moved on to exchanges.

29,696 BTC moved onto exchanges in the last week.

Not a trend we want to see continue. pic.twitter.com/mzkiGOxZZU

— Will Clemente (@WClementeIII) August 24, 2021

However, just as the BTC price crosses $50,000 levels this time, the trends of accumulation have changed when it surpassed $50K back in February. Earlier in Feb, when BTC moved past the $50K benchmark, fewer and fewer people were accumulating. But this time, the accumulation is strong.

1/ Good news. Compared to February, when #Bitcoin crossed $50k for the first time, the on-chain dynamic has changed:

🔵February, less and less people were accumulating.

🟠Now, more and more people are accumulating. pic.twitter.com/HEc2C6mUW0— ecoinometrics (@ecoinometrics) August 23, 2021

Another positive data is that the BTC hashrate has been recovering. This hashrate recovery usually follows the surge in price and surge in demand. Addressing his long-term view, John Petrides, portfolio manager at Tocqueville Asset Management, said:

“If you put your long-term investment hat on, there are two ways to look at this space — one is cryptocurrency the asset class and then the second one is an investment in the blockchain. For our team specifically, from a long-term theme perspective, we think that blockchain has a lot of value to it”.

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand