Bitcoin (BTC) Tops $56,300, Here Are Bullish and Bearish Cases for Its Next Journey to $65,000

The world’s largest cryptocurrency Bitcoin (BTC) continues its surge to hit its new all-time high above $56,300 levels. At press time, Bitcoin (BTC) is trading 8.9% up at a price of $55,701 with a market cap of $1038 trillion.

The recent price has helped Bitcoin (BTC) to become the first cryptocurrency trillion-dollar asset in the world and the sixth most valuable global asset by market cap. Interestingly, the recent price surge in Bitcoin (BTC) comes along with subdued volatility as the BTC price trades confidently above $50K levels for the third consecutive day.

The latest BTC price surge comes as MicroStrategy announced another $1 billion offerings of convertible notes, which shall be invested into Bitcoin. MicroStrategy already holds over 71,000 Bitcoins valued at $4 billion, and now it’s planning to add another $1 billion in holdings.

MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at 0% Coupon and 50% Conversion Premium with #Bitcoin Use of Fundshttps://t.co/KHIyrhR8Nz

— Michael Saylor (@michael_saylor) February 19, 2021

Also, despite trading at all-time highs, Bitcoin continues to attract institutional funds. As per data on Bybt, Grayscale has added nearly 2000 Bitcoins over the last two days. The world’s largest digital asset manager has bought nearly 50K Bitcoins so far in 2021 taking its holdings above 655K. With this, the net assets under management (AUM) of the Grayscale Bitcoin Trust (GBTC) have also crossed $35 billion.

While Bitcoin continues to surge ahead as an indomitable force, let’s take a look at some of the bullish and bearish signals to Bitcoin’s next leg of the journey to $65,000.

Bitcoin Price Target $65,000! Some Bullish and Bearish Indicators

Onchain data provider Santiment has shared some of the bullish and bearish price movement that can determine Bitcoin price action from here on-wards. Let’s take a look at some of the bullish signals first. The mean dollar invested age of Bitcoin (BTC) continues to drop as dormant coins move. Since the age of invested dollars gets younger, it’s likely that they will be staying here for a long time.

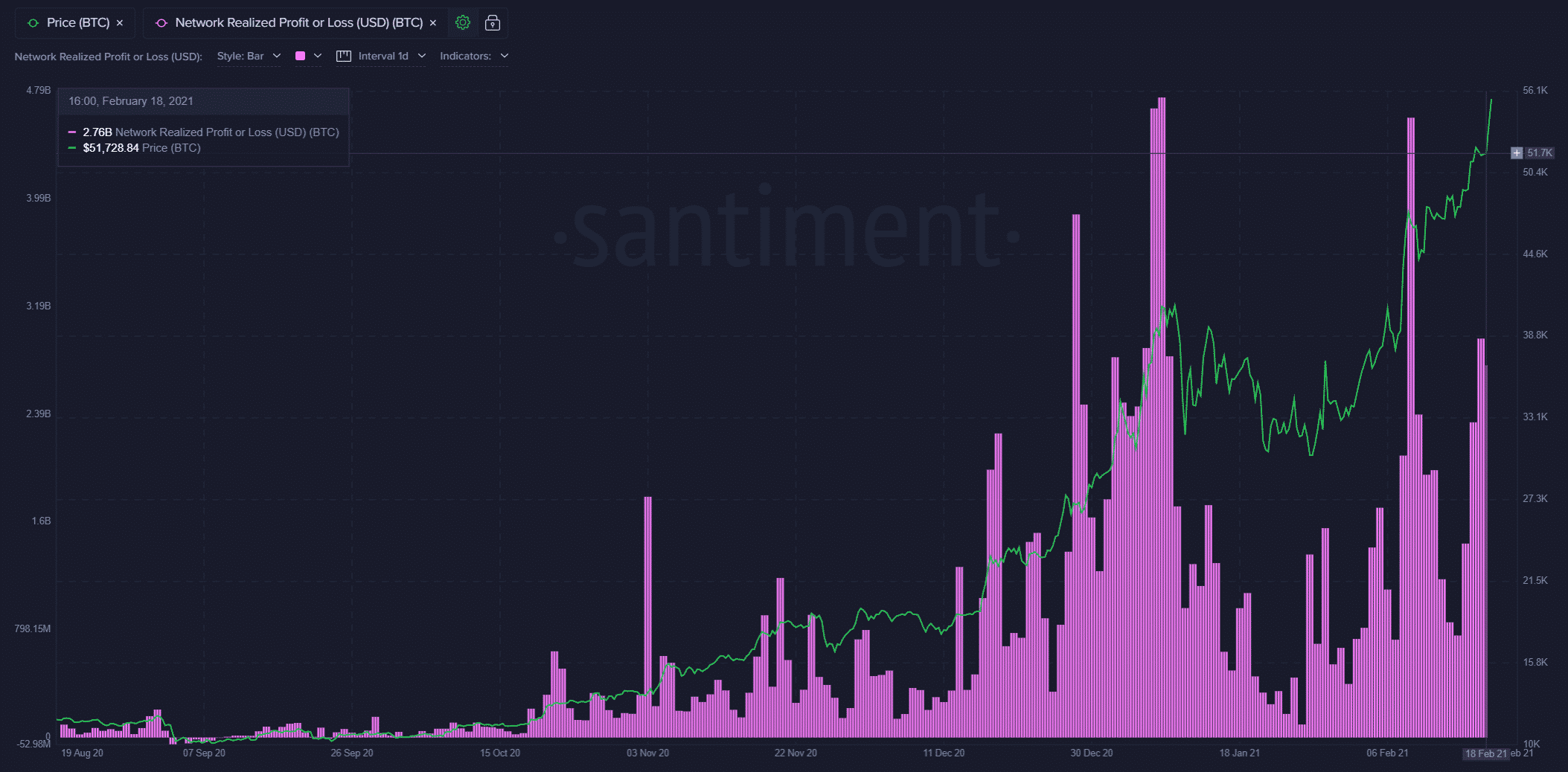

The network realized profit/loss for Bitcoin (BTC) it lower than its peak a week back. It shows fewer investors are interested in profit-booking than earlier.

Also, Bitcoin continues to face a liquidity crunch as the coin supply on exchanges has been dropping since the beginning of 2021, as a lot of supplies have been moved to cold storage.

Well, if these bullish indicators help Bitcoin (BTC) further, it can surge past $60,000 and even to $65,000 as suggest by Bitcoin evangelist Max Keiser. Interestingly, Keiser has now topped his short-term BTC price prediction from $65K to now at $77K.

I’m raising my short term #BTC price target from $65K to $77K based on growing supply-shock issues – as coins are removed from exchanges

My 2021 target of $220,000 remains pic.twitter.com/y1SKIYQW53

— Max Keiser (@maxkeiser) February 17, 2021

Let’s take a look at some of the bearish on-chain indicators ahead. As Santiment reports, the BitMex findings rate (ratio of longs vs. shorts) stays at a very high percentage of longs. It means”long traders are paying a premium to short traders” to keep the prices higher.

On the other hand, the Bitcoin whale addresses have been on a decline since BTC crossed $45,000 levels on February 7. It means whales have resolved to some profit-booking with every surge. However, data from Glassnode shows that there’s are still over 100,000 addresses holdings more than $1 million worth of Bitcoins.

There are currently over 100’000 $BTC and $ETH Addresses that hold more than $1M.#Bitcoin is the largest wealth creation event in human history.https://t.co/MNesoUJc7m pic.twitter.com/YpdjBsdUjO

— Yann & Jan (@Negentropic_) February 19, 2021

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

Buy $GGs

Buy $GGs