Bitcoin Bulls Build Strong Foothold At $60K Support, BTC Price To Rally?

Highlights

- Bitcoin holds firm above $60K, sparking speculation of a potential bullish rally.

- Analysts note significant accumulation at key support levels, signaling investor confidence.

- Despite recent fluctuations, optimism prevails with strong institutional interest.

Bitcoin, the flagship cryptocurrency, is once again capturing the attention of investors as it holds strong above the $60,000 support level. Notably, analysts are keeping a close watch on this crucial juncture, especially with notable accumulation noted within this price range.

Despite the recent fluctuations in BTC price, Bitcoin’s resilience at this level signals potential bullish momentum ahead.

Bitcoin Bulls’ Firm Support At $60K

Bitcoin’s recent surge above the $60,000 mark has set the stage for potential bullish momentum in the crypto market. Notably, prominent crypto analyst Ali Martinez observes a strong foothold at this critical support level, indicating robust investor confidence. However, as the rally momentarily pauses, questions arise about the future trajectory of Bitcoin’s price.

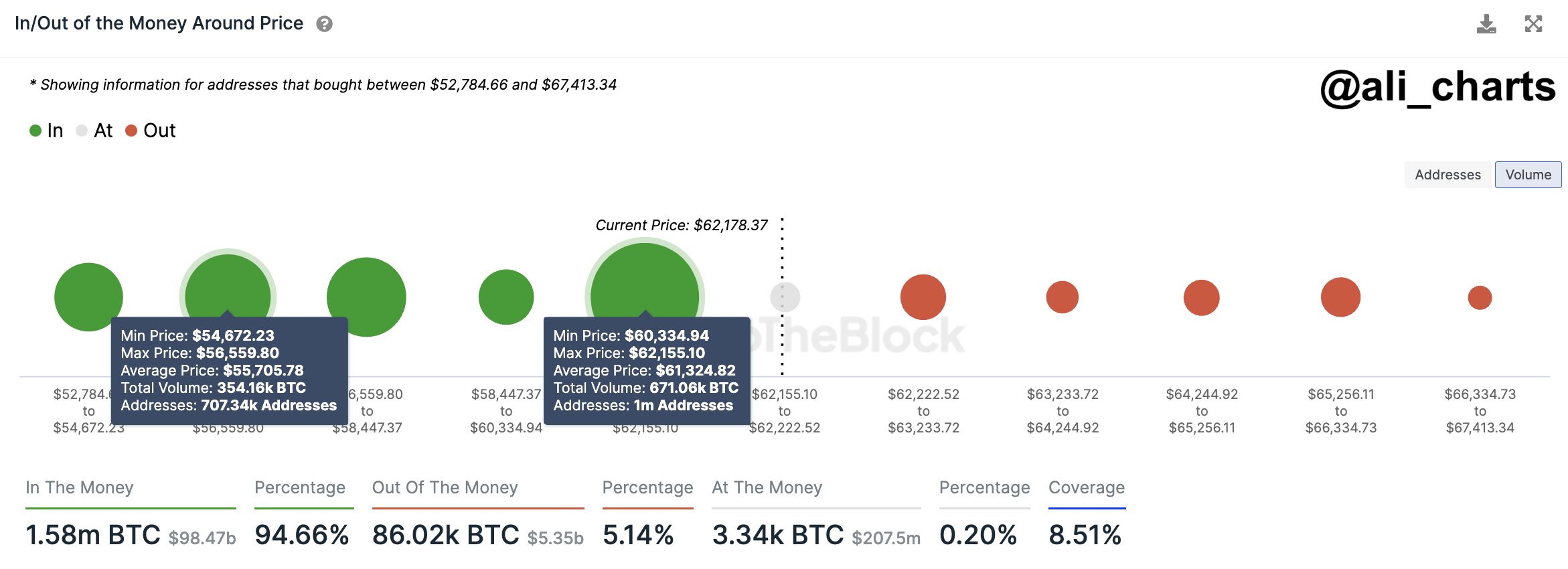

Meanwhile, Ali Martinez highlights a significant accumulation zone for Bitcoin, with over 1 million addresses purchasing substantial amounts of BTC between $60,334 and $62,155. This influx of buying activity underscores a solid foundation of support for BTC, potentially shielding it from further downward pressure.

Besides, Martinez’s chart analysis emphasizes the resilience of Bitcoin’s price, buoyed by widespread investor confidence in the digital asset’s long-term prospects. The accumulation of BTC at key price levels signals a bullish sentiment, suggesting that market participants view current prices as attractive for investment.

Also Read: Binance Faces $10B Fine Amid Nigeria’s Crypto Crackdown

Price & Performance Amid Recent Flux

Bitcoin experienced a meteoric surge earlier in the week, crossing the $60K threshold for the first time since November 2021, and rallying to $64K. However, the momentum has soon cooled off, with the crypto witnessing a reversal track. Despite this, the cryptocurrency remains resilient, trading near the $62K mark at the time of writing.

The recent BTC crash has sparked speculation and uncertainty among market participants. However, many analysts remain optimistic about BTC’s long-term trajectory, citing strong fundamentals and institutional interest as key drivers of its continued growth.

For instance, the ongoing strong inflows into Bitcoin ETF and the upcoming Bitcoin halving have fuelled the confidence of the investors. Despite legal uncertainties and other hovering concerns in the market, the bulls seem to have remained optimistic about the crypto’s future trajectory.

Now, the market participants are closely monitoring Bitcoin’s behavior around the $60K support level, viewing it as a critical indicator of market sentiment. A sustained hold above this level could pave the way for further upside potential, potentially propelling Bitcoin towards new all-time highs in the near future.

Notably, as of writing, the Bitcoin price was down 1.55% over the last 24 hours and traded at $61,967.54, while its trading volume also dipped 42.45% to $52.74 billion. Notably, Bitcoin has hit a high of $63,913.13 and a low of around $50K this week, reflecting this week’s meteoric surge.

Also Read: Crypto Hackers Drain $105 Mln With Over 20 Attacks In February

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs