Bitcoin Crash: Why Is BTC Price Dropping Today?

Highlights

- The recent Bitcoin crash has sparked discussions in the crypto market.

- The Bitcoin price was down nearly 7% during writing.

- Top analyst unveils key levels to watch for BTC's future performance.

The recent Bitcoin crash has rocked the crypto market, igniting conversations about its root causes. Notably, the BTC price has nosedived by approximately 4% today, dropping to as low as $61,000 today. Notably, the drop has sparked speculations and leaving investors grappling with uncertainty amid the turbulent fluctuations.

So, let’s look at the potential reasons that might have triggered the sell-off and contributed to the current state of the crypto landscape.

Key Reasons Behind Bitcoin Crash

There could be a flurry of factors that may have triggered the Bitcoin crash today, dampening the investors’ sentiment. Some of the prominent reasons are-

Muted Trading Ahead Of FOMC

The market seems to have remained subdued ahead of the Federal Open Market Committee (FOMC) decision, with investors exercising caution. The recent higher-than-expected inflation data, including the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI), has dampened sentiment.

Meanwhile, investors were previously anticipating five rate cuts in 2024, but the recent inflation data has forced investors to change their bets to only three. The CME FedWatch Tool indicates a 99% likelihood of unchanged interest rates tomorrow.

Now, the investors seem to be trading cautiously, awaiting further indications of the Federal Reserve’s future policy decisions. This cautious approach underscores the market’s sensitivity to central bank actions and the potential impact on asset prices, including Bitcoin.

Bitcoin ETF Outflow Sparks Concerns

Following a period of bullish momentum fueled by robust inflows into U.S. Spot Bitcoin ETFs, Monday marked a significant shift as outflows were noted for the first time this month. Notably, on March 18, Grayscale’s GBTC saw its highest outflux of $642.4 million since inception, outpacing an influx from BlackRock’s IBIT, which observed an inflow of $451.5 million.

Meanwhile, the overall U.S. Spot Bitcoin ETF noted an outflow of $154.3 million yesterday, dampening the market participants’ sentiment. Notably, several analysts cite this trend as a contributing factor to the recent Bitcoin crash, signaling potential challenges amid ongoing market volatility.

Similarly, the outflow continued on March 19 as well, with the overall U.S. Spot Bitcoin Outflux totaling $326.2 million. Grayscale contributed the most with an outflow of $443.5 million.

Also Read: Is Meme Coin Hype Coming To An End?

Whale Selloff Triggers FUD

In a recent development, a significant Bitcoin whale made waves on the BitMEX exchange by offloading over 400 BTC, causing a temporary plummet in prices to $8,900. However, the market swiftly rebounded to normal levels soon.

Meanwhile, this whale selloff has reignited concerns about profit-taking strategies amid the ongoing bull run, with investors seizing the chance to cash in on Bitcoin’s recent rally. In other words, the incident underscores the volatility of cryptocurrency markets and the cautious stance adopted by some investors amid price fluctuations.

Analyst Warns Of Pre-Halving Retracement

As reported by CoinGape Media earlier, popular crypto analyst Rekt Capital warns of an imminent pre-halving retracement for Bitcoin, likely occurring 28 to 14 days before the anticipated halving event. Historical trends reveal a similar pattern, with previous halvings experiencing significant plunges, such as a 38% drop in 2016 and a 20% decline in 2020.

Although past performance doesn’t ensure future results, investors are cautioned to brace for potential market turbulence ahead of the upcoming halving. Meanwhile, despite the recent downturn, numerous analysts view it as a chance to buy before an anticipated rally fueled by Halving optimism.

Crypto Market Liquidation

According to CoinGlass data, a staggering 152,049 traders faced liquidation within 24 hours in the crypto market, totaling $570.83 million. Notably, OKX saw the largest single liquidation order at $12.25 million on BTC-USDT-SWAP.

Meanwhile, Bitcoin took a hit with liquidations reaching $208 million, predominantly from long traders at $126 million, and short traders at $82 million. This massive liquidation wave contributes to the recent Bitcoin crash, reflecting heightened volatility and uncertainty in the crypto sphere.

Bitcoin Futures OI & RSI

Bitcoin Futures Open Interest (OI) experienced a slight decline, dropping by 0.76% in the last 24 hours to 532.75K BTC or $34.12 billion, according to CoinGlass data. Specifically, the CME Exchange observed a 4.53% decrease to 168.79K BTC or $10.78 billion, and Binance witnessed a 3.39% drop to 114.88K BTC or $7.36 billion.

However, despite the drop in the Bitcoin OI, Bitcoin’s Relative Strength Index (RSI) stood at 50, indicating a neutral market sentiment.

Bottom Line

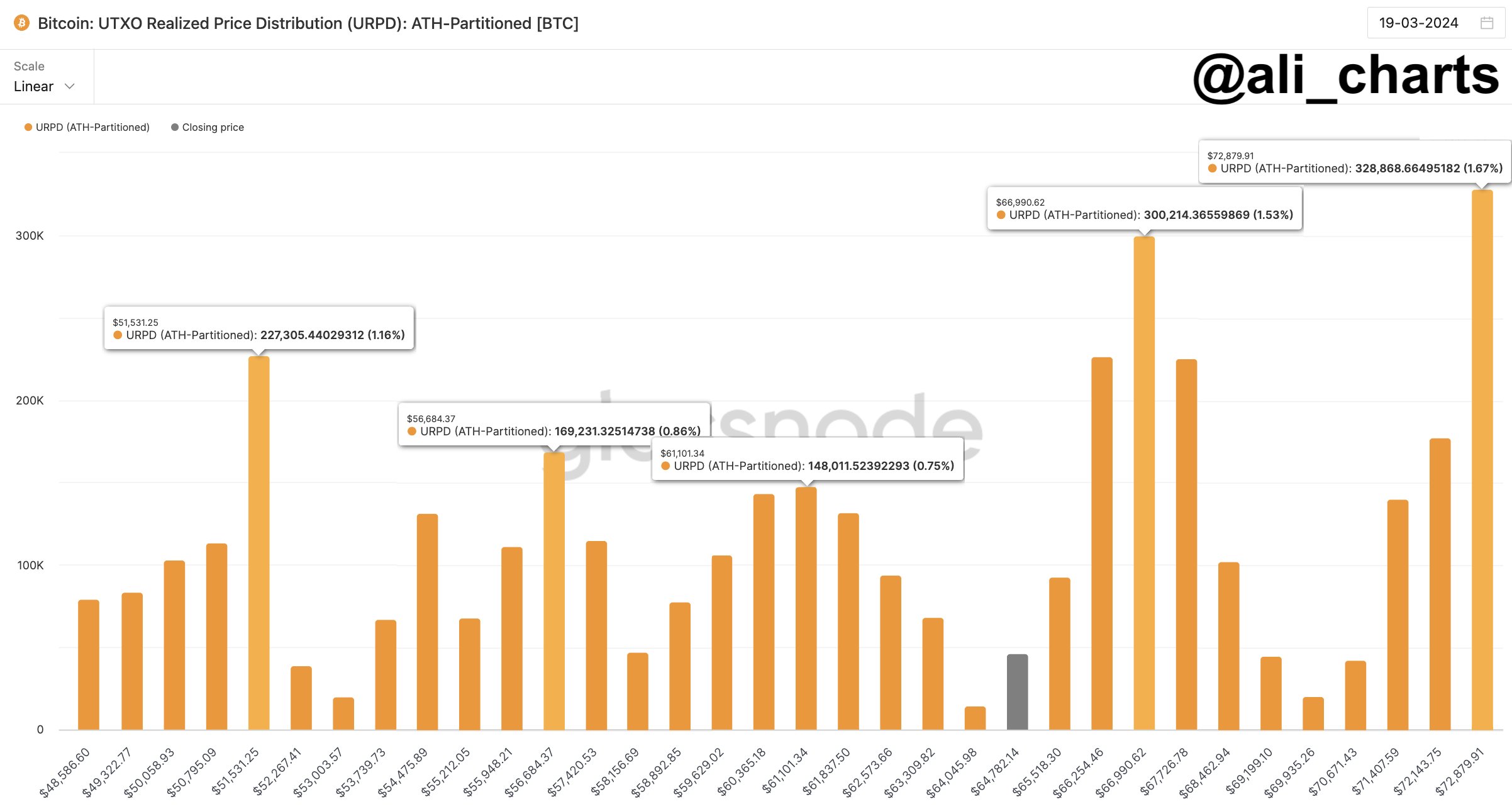

Amid the recent Bitcoin crash, prominent crypto market analyst Ali Martinez offers insights into the key levels for BTC price. In a recent X post, analyst Ali Martinez highlights key support and resistance levels.

According to Martinez’s analysis, crucial support thresholds for Bitcoin lie at $61,100, $56,685, and $51,530. Conversely, critical resistance points are identified at $66,990 and $72,880. These insights provide valuable guidance for investors navigating the volatile crypto market landscape.

Meanwhile, as of writing, the Bitcoin price traded at $63,228.23, down 6.82% from yesterday, and its trading volume rose 48% to $60.92 billion. Over the last 24 hours, the BTC price has touched a high of $68,552.94, while currently trading at its lowest level in the same time frame.

Also Read: Arbitrum (ARB) Price Tanks 25% But Market Cap Hits New ATH, Here’s Why

- Michael Saylor Says Strategy Can Cover Debt Even If Bitcoin Crashes to $8,000

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs