Bitcoin ETF: BlackRock & Fidelity Saw Inflows Of $870M

Highlights

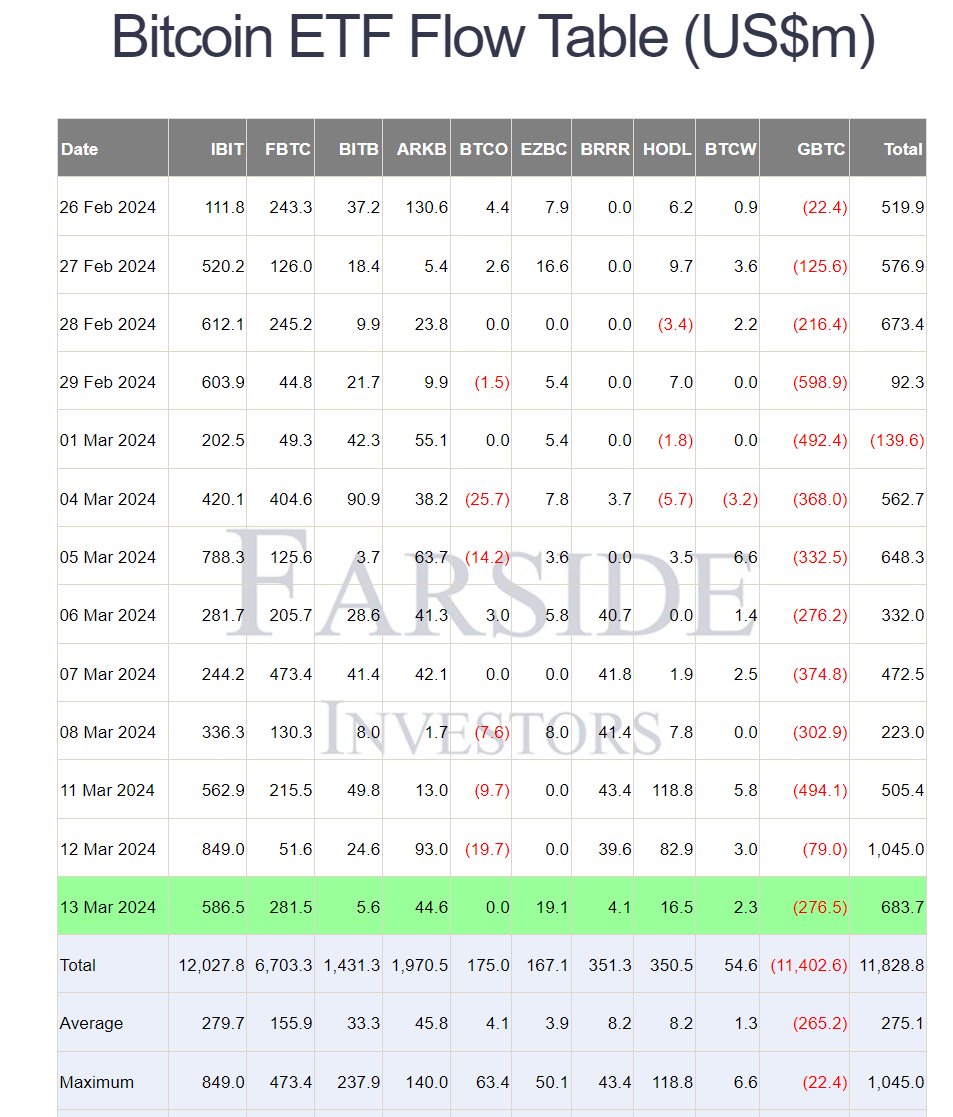

- BlackRock and Fidelity Bitcoin ETFs attracted $870M inflows amid BTC's price rally.

- U.S. Spot Bitcoin ETF recorded a $684.7M inflow, signaling Wall Street's interest.

- Bitcoin ETF inflows coincide with BTC's price hitting new highs, signaling market optimism.

The U.S. Bitcoin ETF market witnessed a significant surge in inflows, with BlackRock’s IBIT and Fidelity’s FBTC leading the charge, attracting a combined total of nearly $870 million on March 13, 2024. Notably, amidst this influx, the broader U.S. Bitcoin ETF saw a substantial inflow of about $700 million, reflecting strong interest from the institutional players.

It’s worth noting that several market pundits have attributed the recent strong inflow into U.S. Spot Bitcoin ETF to the recent rally in Bitcoin price.

BlackRock & Fidelity Bitcoin ETF Dominate Inflows

The U.S. Spot Bitcoin ETF recorded an inflow of $684.7 million on Wednesday, March 13, according to Farside Investors’ report. Notably, the continuing robust inflow this week, especially amid Bitcoin’s unprecedented rally, suggests the strong interest of the Wall Street players toward the flagship crypto.

Meanwhile, BlackRock’s IBIT and Fidelity’s FBTC emerged as frontrunners in the Bitcoin ETF race, with a combined influx nearing $870 million. Specifically, BlackRock’s IBIT received $586.5 million in inflows on Wednesday, while Fidelity’s FBTC recorded an impressive $281.5 million influx.

However, the influx into the VanEck Bitcoin ETF (HODL) witnessed a decline, cooling to $16.5 million from $82.9 million in the prior day. However, VanEck had recorded a substantial inflow of over $200 million in the first two days of the week, following its decision to waive fees, from 0.20% to 0.0%, for the first $1.5 billion in assets until March 2025.

In contrast, the outflow in Grayscale’s Bitcoin ETF (GBTC) surged once again, totaling $276.5 million, following a decline to $79 million in the previous day’s outflow.

Also Read: Bitcoin (BTC) Profits Moving to Large Cap Altcoins Like SOL, BNB, AVAX

Bitcoin Price Rallies Amid Market Optimism

The U.S. Spot Bitcoin ETF also marked a significant milestone, recording its highest single-day net inflow since its launch on March 12. As CoinGape Media reported earlier, the U.S. Spot Bitcoin ETFs witnessed a net inflow of $1.05 billion on March 12, fueled by the second-highest volume day for the 10 Bitcoin ETFs, totaling $8.5 billion.

Meanwhile, these developments coincide with a new high in Bitcoin’s price, further underlining the growing interest of Wall Street players in the cryptocurrency market. Analysts attribute the surge in ETF inflows to the recent rally in BTC price, signaling heightened institutional interest in digital assets.

As of writing, the Bitcoin price was up 1.35% to $73,123.31, with its trading volume from yesterday falling 20.73% to $48.36 billion. Meanwhile, the crypto has touched a new high of $73,641.04 today, while touching a low of $71,720.18 in the last 24 hours.

Notably, over the last 30 days, the BTC price was up nearly 50% during writing, along with a weekly gain of around 11%.

Also Read: Shiba Inu- Shytoshi Kusama Reveals The Shib Magazine’s Latest Edition, Here’s Everything

- Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

- Trump Tariffs: U.S. Supreme Court Sets February 20 for Potential Tariff Ruling

- Brazil Targets 1M BTC Strategic Reserve to Rival U.S. Bitcoin Stockpile

- Breaking: U.S. CPI Inflation Falls To 4-Year Low Of 2.4%, Bitcoin Rises

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15