Bitcoin ETF: BlackRock Triumphs With $260 Mln Inflow As Grayscale’s Total Outflow Exceeds $3 Bln

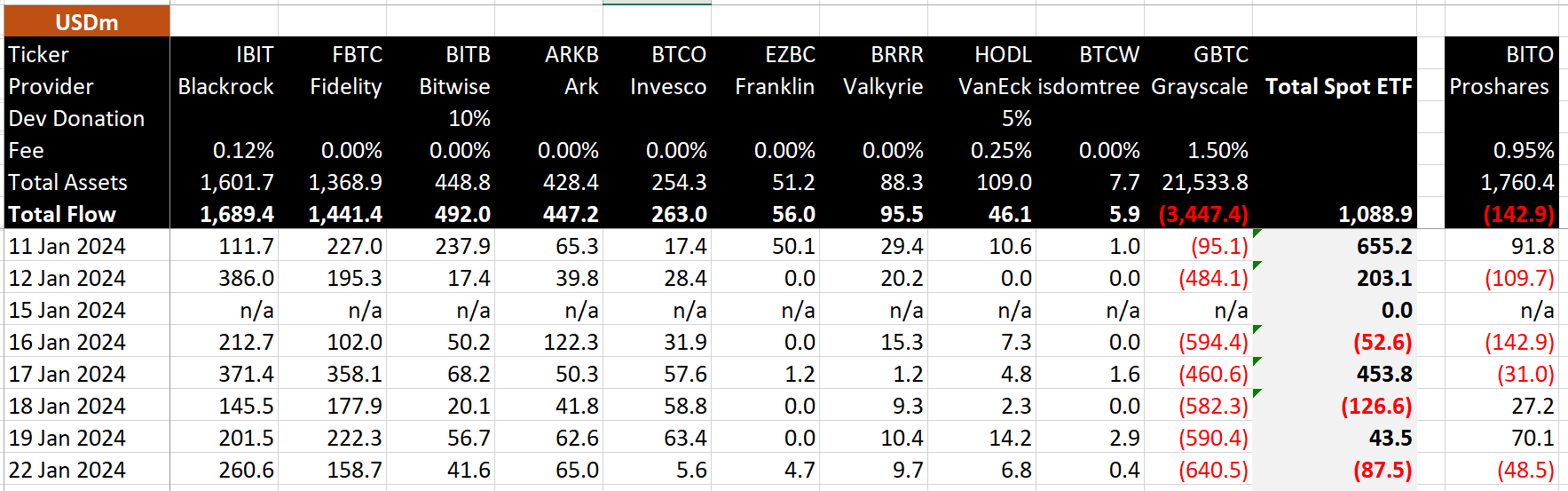

The immense hype around Spot Bitcoin ETFs hasn’t helped much with their performance since inception. All Bitcoin ETFs have witnessed massive outflows and substantial declines in NAV lately. On Monday, January 22, these ETFs recorded a net outflow for the third time after launch. However, BlackRock‘s IBIT has emerged as a winner in the inflow race with $260 million in inflows while Grayscale’s GBTC has again led the net outflows this time.

How did BlackRock and Grayscale fare?

BitMEX Research data reveals a significant net inflow of $260.60 million for BlackRock’s IBIT on the seventh day of trading. Whilst, the BlackRock Bitcoin ETF holds an AUM of $1.6 billion. On the other hand, a substantial net outflow of $640.50 million from Grayscale Bitcoin ETF was recorded on Monday. This pushes its total net outflow to a staggering $3.4 billion.

Meanwhile, the seventh day of trading witnessed a total net outflow of $87.20 million from all 12 Spot Bitcoin ETFs. To date, the total inflows of these ETFs amount to $1.09 billion. However, GBTC’s massive $3.4 billion outflow has greatly affected the inflow metric. Currently, Grayscale’s GBTC holds an AUM of $21.53 billion.

Also Read: Grayscale Brings New Twist to Spot Bitcoin ETF Marketing War

Data for other Bitcoin ETFs

Following BlackRock closely, Fidelity Wise’s FBTC experienced a net inflow of $158.70 million, contributing to an overall positive flow since its launch. Moreover, it’s worth noting that BlackRock and Fidelity’s combined inflow to date is $3.13 billion, which offsets more than 90% of GBTC’s total outflows.

Whilst, ARK 21 Shares (ARKB) attracted an inflow of $65 million, and Bitwise’s BITB saw a net inflow of $41.60 million. Conversely, Franklin Templeton‘s EZBC, the BTC ETF with the lowest fee, didn’t register a significant inflow. EZBC recorded a $4.7 million inflow on Monday.

Meanwhile, Valkyrie’s BRRR recorded an inflow of $9.7 million and VanEck’s HODL reported a $6.8 million inflow. In addition, the Invesco Galaxy Bitcoin ETF (BTCO) experienced a lower net inflow of $5.6 million. Moreover, the WisdomTree ETF, BTCW, witnessed the lowest inflow of $0.4 million.

Also Read: Jim Cramer Doubts Bitcoin Recovery After ETF Introduction

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% to $83 on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

Buy Presale

Buy Presale